The portfolio ended the year with a net asset value (NAV) per share almost exactly where it was on 31 December 2024. This is a very disappointing result given the 12.8% increase (GBP terms) in the MSCI World Index, our comparator benchmark, and we are dissatisfied with where we are. But rather than despairing, we think this is an exceptionally promising period for investment. We have spent the past year closely checking company health metrics and these continue to be good; we trust investors will excuse us for continuing to refer to them, on the analogy that a map needs more frequent checking in foggy weather.

Active equity management depends on market valuations being more volatile than company fundamentals. In a rational world the price of companies would track their long-term cashflow outlook, but this would leave little or no gain to be had in investing away from the market core. Shares are unusual assets; people want them less when prices are low[i]. We would prefer that the dislocations be smaller than the one we experienced in 2024-2025, but we also recognise that the launch of AI technology is a once-in-a-generation event. Evenlode has always focused on controlling the controllables, by designing a business and an investment process that accommodates the natural volatility of equity markets, while attracting like-minded investor base which understands the unevenness of equity returns.

It is unequivocally negative that NAV per share of the fund is flat over the last year. It is positive, on the other hand, that on our calculations the underlying portfolio company revenues have increased by +8%, adjusted operating profit by +12.7%, and Earnings per Share (EPS)[ii] by +23% over the last 12 months (as companies have not yet reported their results for the quarter ended 31 December 2025, we are referring to the period 1 October 2024 to 1 October 2025; Quoted figures are averages based on portfolio weightings). This is comfortably greater growth than the MSCI World Index which, on Barclays estimates, produced +4% revenue growth and +8% EPS growth in the same period. Free cash flow[iii] growth has also been solid and increasingly superior to the index, where the growing bill for AI capital investment is beginning to stress the balance sheets of the largest index constituents.

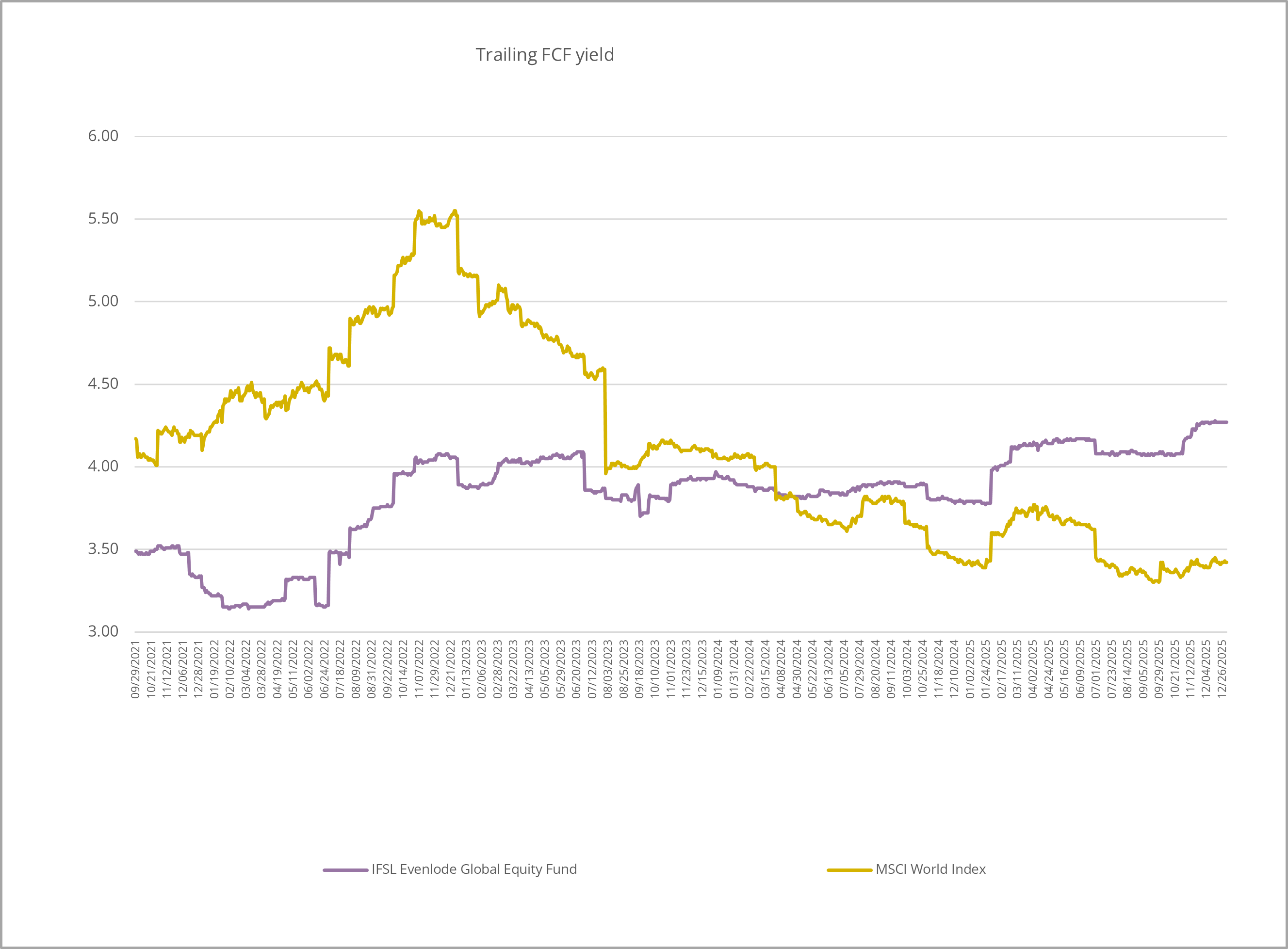

This combination of superior fundamental growth, flat share prices, and a +13% increase in the benchmark index means that the portfolio is now dramatically cheap compared to the broader index on the simple metric of price to free cash flow.

Source: Bloomberg.[iv]

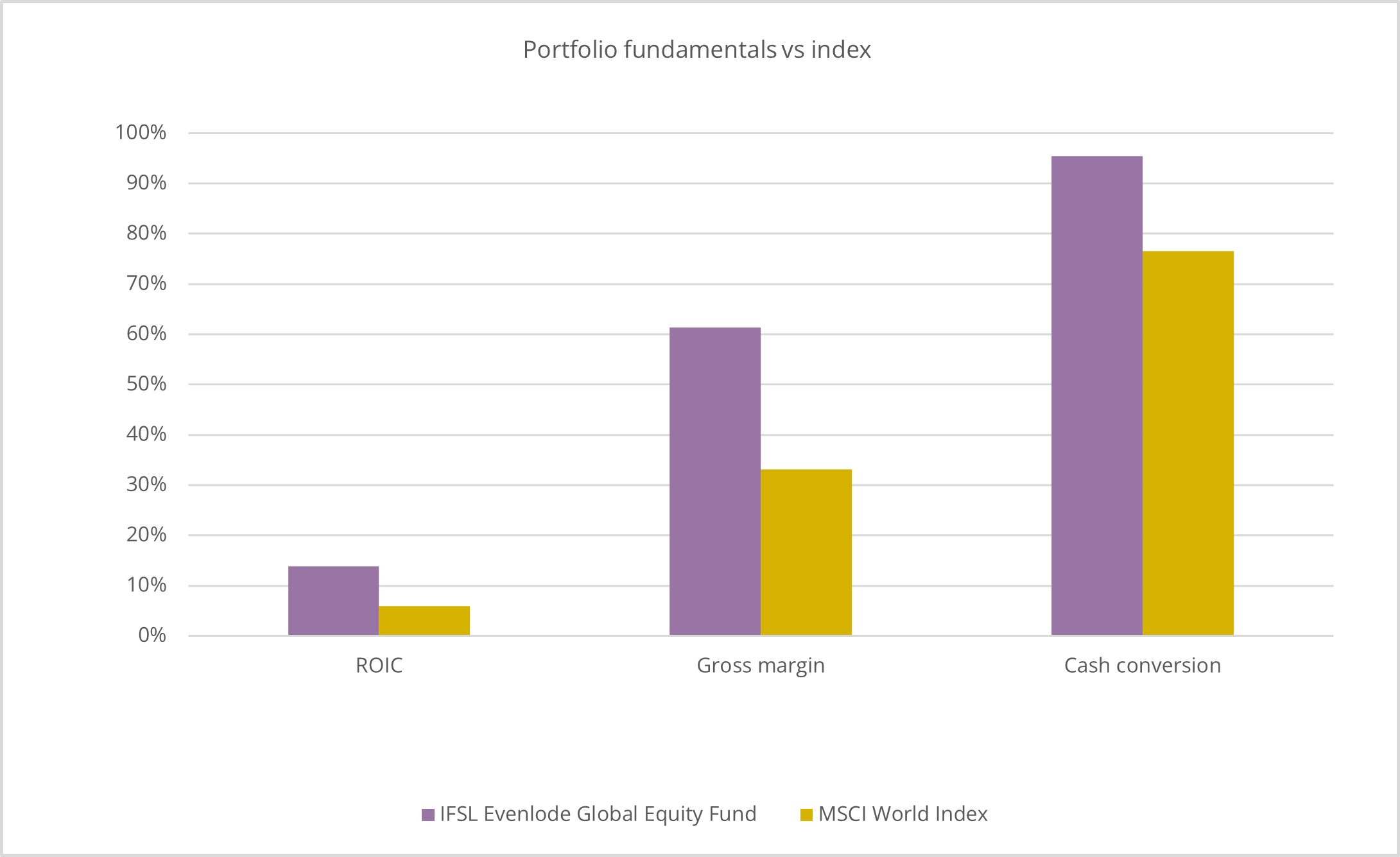

This discount widens if you want to give the portfolio credit for its superior financial characteristics, as below. Evenlode’s investment process is built on the thesis that fundamentals cannot remain divorced from prices indefinitely, and the longer the period of underperformance the bigger the ‘giveback’ will be when prices start to reflect these fundamentals.

Source: Bloomberg, Evenlode.[v]

Recent disappointing fund performance, then, only makes sense if we assume that the near future will bring an abrupt end to this steady progression in portfolio revenues and profits. Thankfully, we believe this scenario is overwhelmingly unlikely.

Our relative performance problems in 2025 had two origins, both related to AI. Firstly, our focus on enduring earnings power with low cyclicality and higher diversification kept us away from the biggest drivers of index returns which skewed towards cyclical[vi] and capital-intensive companies – banks, semiconductors, and other capital goods manufacturers. Secondly, our preference for these qualities meant we had high weights in industries which are being bucketed by the market as ‘AI losers’ like information services. Extensive due diligence in the year both by us and other investors and analysts has demonstrated that the AI threat to existing data assets is largely a phantom menace. A probabilistic approximate retrieval system which is inherently unstable iteration to iteration is perfect for drafting marketing emails and okay at summarising conference calls, but a literal liability in sensitive, highly regulated deployments like credit and insurance underwriting and legal citation retrieval. As long as the state-of-the-art AI architecture is the large language model (LLM), this is likely to persist. We are in a strange moment in that the AI disruption thesis is widely discounted, but investors remain reluctant to buy companies in the ‘penalty box’ for reasons of career risk rather than on fundamental objections.

We need to stress that we are not negative on AI as a technology; it has considerable potential in many areas, although we believe it has been oversold as a universal panacea. Numerous companies we are invested in will benefit if AI can show more general returns on investment. Some are already clearly benefiting, most spectacularly Alphabet which has generated attractive returns from incorporating machine learning models into Search and other properties. If the resolution to the trade is widespread demonstration of returns on AI investment, we think this is paradoxically great for the wider stock market and less great for the AI complex of semiconductors and capital goods companies. The stock prices of these companies are already pricing in a ‘forever bull market’ in data centre construction, but the rest of the market is pricing in little to no returns from this construction. We expect this dissonance to resolve itself one way or the other, and the rapidly increasing weight of bets on outcomes, and the increasingly high cost of placing these bets consequent to leverage, continually shortens the time the bets can be left open.

There is now widespread recognition that AI is very unlikely to revolutionise the worlds of enterprise data and software. Three years of determined effort and lavish spending have produced dismayingly modest results outside of software coding. The market conversation on AI has moved on from discussions of what it could achieve to trying to identify which year of the late 1990s we are in in terms of the stock market cycle. If we are in 1996 or 1997, the logic runs, there is every reason to stay invested for one more year before bailing out. For us, this liquidity-driven rather than solvency-driven approach to investing means that the underlying assets are irrelevant to the decision so long as their owner is confident an even more enthusiastic buyer will be around for them in the future. In a market which has deprioritised fundamentals, securities are more likely to trade at prices which are disconnected from their economic future, and investors have good opportunities to bake in very attractive future returns.

This takes us to a common and sensible point investors have made to us – when do things change? It is much easier to be confident about the next five years than the next five months. Timing market rotations is notoriously one of the hardest things to do in financial markets, far harder in our experience than identifying resilient business models. That said, the AI trade is materially different as we start 2026 to what it was way back when it kicked off in 2023. Firstly, the numbers are vastly bigger. The key AI infrastructure clients had $167bn in capex in 2023 but are expected by sellside analysts to spend $623bn in 2026 (buyside expectations are certainly higher)[vii]. Secondly, as the likelihood of profitable business models built on current AI recedes, the necessity of more punitively expensive model training to secure a breakthrough just grows and grows, the opposite of the usual dynamic where efficient scaling makes innovation progressively self-funding. Thirdly, the sources of money have shifted. The oft-repeated point that hyperscaler cashflow was funding the trade was completely true in 2023, but this is increasingly not the case, as the size of the tickets being written necessitated a shift to equity and debt markets to fund them. Both increases and decreases in valuations can amplify themselves meaning the trade is intrinsically more fragile and volatile.

The portfolio enters 2026 in great shape. There are pockets of cyclical weakness particularly in the consumer sector where the K-shaped economy is weighing on almost all companies, but in aggregate revenue, profit, and cashflow growth are all solid, leverage is modest, and margins are gently expanding while reinvestment in competitive advantage continues to expand. While earnings delivery keeps up, further derating gets progressively harder. In particular, the opportunity for these companies to exploit their modest leverage and underpriced shares by repurchasing their own stock is getting more and more compelling.

We acknowledge that the last year and a half has been disappointing, and we thank our investors for their patience and understanding. We remain confident that the path ahead for our portfolio companies is extremely attractive, and that there is a silver lining to the rough patch of the last year and a half in the form of a rare opportunity to buy superior companies at a wide discount to the broader equity index.

Chris E, James, Cristina, Gurinder, and the Evenlode Team

7 January 2026