As the Christmas break is upon us, we have entered the customary sale season where unshifted stock gets marked down and bargain hunters head out (or get online) hopeful of buying quality goods at knock down prices. For our corner of the equity market, it feels like the Christmas sales have been on continuously for well over a year. Whilst not making predictions about the coming year (another tradition of the season), we do see some companies trade at ever-better valuations, which bodes well for longer term returns. One company that has reached a stock price level cheap enough to tempt us with a new position is animal medicine maker Zoetis, on which more below.

Like all stock being sold at promotional prices it’s important to check that the goods are indeed of the promised quality, and that as buyers we understand why it has been unloved by other shoppers. That’s how we approach our analysis of companies. Providing we’re satisfied quality is intact we continue the ongoing, usually incremental process of nudging the portfolio toward those companies where value is emerging and away from those where the qualities of the business are being more fully recognised with a price tag to match.

At the top of the additions list in the second half of 2025 are the new positions of financial data firm LSE Group and insurance brokerage Marsh & McLennan. Wolters Kluwer also features; a professional information services company where the valuation has round-tripped from cheap to fully valued and back to cheap. For perspective, the share price is now below the level of three years ago. Our position size moved downward accordingly against the strength, and we are now meaningfully rebuilding the position. In the case of LSE Group and Wolters Kluwer the lack of love for the companies indicated by the stock price is reflective of the potential for disruption by new AI-enabled services. Our analysis suggests that whilst there is evolution in how information tools are being delivered, as owners of proprietary data and domain-specific capabilities both businesses will more than likely benefit from delivering new AI tools rather than be replaced.

Other businesses have been added to at the margin, all of this funded by reducing companies that have become more fully valued. Microsoft, lab services firm Quest Diagnostics, and networking equipment and software company Cisco top the list of largest reductions. All remain positions, but at smaller sizes, particularly Cisco which now stands at a little over our minimum position size of 1%.

These portfolio moves have done little to aid recent performance as momentum trends in the market persist in both the positive and negative directions. It is these trends that, in part, create the opportunities to pick up excellent businesses at better valuations, as market concern overshoots the risks posed. Excitement can equally overshoot opportunity in the other direction. Because the market has been particularly polarised in recent times, as we have followed the process of portfolio evolution, the performance profile of the portfolio has become less and less like that of the market. At times the short-term performance has almost been the inverse of the broader market. In a strong market this presents a short-term cost of picking up the bargains on offer, in the form of underperformance. Our strong suspicion is that in the longer term it will ultimately be well worth having shopped for quality while these businesses are on sale.

Some companies where near-term business performance had observably been slow seem to have found stability. The IT consultancies and outsourcers Accenture and Capgemini have returned to revenue growth after a hiatus in discretionary corporate spending as companies digested the impact of the Trump administration’s trade policies. Whilst their share prices have not regained all recent losses, they have stabilised. The aforementioned Cisco has seen sales increase after a Covid-era binge on networking equipment was digested, although the current excitement around the stock is more to do with AI infrastructure spend. The average organic revenue growth[i] of +5% for portfolio companies reporting in the third quarter of 2025 is solid in absolute terms and good relative to the market, particularly when considered relative to the share prices on offer and the economic value these businesses create. Whilst we would rather have had a little more recognition of the solid fundamentals in terms of positive market price movements, we get some Christmas cheer and a good feeling about the future from the combination of fundamental performance and valuation of the portfolio.

New position – Zoetis

Zoetis is the world's largest animal drugs company. We first met Zoetis in New Jersey in 2022 and have followed the firm since and its market valuation has recently become materially more attractive. Here we’ll briefly highlight why the stock seems to represent more of a bargain now.

Zoetis leads the animal drug market with strength in US pet medicines (70% of sales, higher profit share). They excel in organic R&D and sales execution. None of their three main competitors match Zoetis' scale and breadth, giving them a bundling advantage with vets, reinforced by consistently superior new drug launches.

The animal medicines industry differs from human pharmaceuticals in two key ways:

1) No large intermediaries like governments/ insurers means improved pricing power for the drugmakers.

2) There is less generic pressure after the loss of patent protection. About half of Zoetis' sales come from off-patent drugs, yet they maintain strong in terms of growth, margins and returns, taking 2-4% annual price increases across their portfolio.

Generic pressure is lower because animal pharma opportunities are too small for economies of scale that generics makers need to drive down prices; blockbusters are $100m of revenue versus $1bn in human pharma. Vets are incentivised to stock branded drugs at higher margins. As generalists with limited shelf space, they prefer fewer suppliers, and pet owners tend to accept their recommendations without switching.

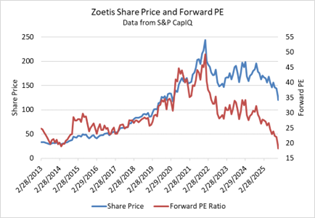

Zoetis typically trades at a premium in the market, but its valuation has halved since late 2021, with the share price fall accelerating after recent results. Lockdown pet adoptions initially boosted growth through vaccinations, then slowed as these pets reached healthy adulthood. However, this cohort will become a tailwind again as they age and will require more treatment.

Forward PE Ratio – A measure of how expensive a stock is compared to future profitability. Calculated as current share price divided by expected earnings per share for the next 12 months.

Recent weakness also reflects new therapy Librela's rare side effects, and weak US consumer spending. We think the issues with Librela are mainly down to communication and consumer perceptions. The drug is mostly given to old dogs that likely have co-morbidities where the options for owners are often treatment or euthanasia. The incidence rate of severe side effects is rare and Librela is demonstrably better than the standard of care. Litigation risk is low as pets are legally property, even if owners consider them family, and a lawsuit was recently dismissed.

Despite surveys showing pet owners consider pets as family and would pay for their care, therapeutic vet visits have declined recently. We suspect corporate vet consolidators have driven up prices, which may need to normalise, though Zoetis' own price increases remain modest.

Customer (i.e. vet) consolidation does present some risks, which we feel are mitigated by the following factors:

1) Consolidation is coming from a very low base.

2) Zoetis’ margin with corporate accounts is higher due to the lack of distributors.

3) Corporate accounts drive higher volumes than independents.

Another structural concern may be the increased penetration and consolidation of pet insurance coverage. We think the risk here is low. Pet insurance penetration is only 4% in the US and growing slowly. Even in highly insured markets like the UK, Zoetis grows well and passes through price increases.

In conclusion we believe the long-term opportunity for Zoetis is substantial. Pet ownership is growing, and increased medicalisation will continue through aging populations, better diagnostics, and new treatments. Zoetis has a strong pipeline including format extensions and treatments for kidney disease, cancer, cardiology, and obesity. These are huge opportunities and Zoetis are expecting to address them with launches over the next few years.

The end of the sales?

Zoetis is a good example of a company where a positive short term demand driver, in this case the coronavirus pandemic, got reflected in a very high stock price, with the price/earnings multiple nearing 50x at its peak. The opportunity presented got overshot by the price, and now the opposite has happened as that driver has abated. The company has remained high quality throughout the process in terms of margin, cash flow, return on capital and the longer-term growth drivers.

The Zoetis example also demonstrates that in the stock market one doesn’t ever quite know when full-price season will end and when the sales will begin. The traditional Christmas sales have been extended in recent years by the Black Friday and Single’s Day phenomena, but they do tend to end some time in the new year. The current bargain season in certain parts of the market may continue for longer than that, but we are finding more items of interest as it persists. Long-term stock market history suggests that even if market conditions persist for a protracted period of time, they do eventually end too.

We’d like to take this opportunity to thank all of our clients, colleagues and partner companies for your continued support in 2025 and your interest in the strategies that we manage at Evenlode.

We wish you all the best for 2026.

Ben Peters and Rob Strachan

23 December 2025