A modest market sell-off in December has been reversed this week thanks to the US Federal Reserve’s December statement, which (despite the announcement of a ‘tapering’ in the rate of quantitative easing from January) was at pains to stress that current rock bottom interest rates are here to stay for the foreseeable future.Treading Carefully

A modest market sell-off in December has been reversed this week thanks to the US Federal Reserve’s December statement, which (despite the announcement of a ‘tapering’ in the rate of quantitative easing from January) was at pains to stress that current rock bottom interest rates are here to stay for the foreseeable future.

Equity markets have been in something of a sweet spot for the last couple of years and there are two clear factors that have been providing fuel for this bull market (both of which may well continue into next year). First, with central bank interest rates still very low, cash and bonds offer miniscule returns and stocks therefore continue to appeal to investors as the ‘best house in a bad neighbourhood’. Second, the effect of a slowdown in China and other emerging markets is beginning to act as a big positive for consumer confidence in the West thanks to falling inflationary pressures (and this has been the big ‘new’ news this year for financial markets). So we have the closest thing to a ‘goldilocks’ economy we’ve seen in developed markets for some years (i.e. easy monetary policy combined with non-inflationary growth).

Treading Carefully

As we said last month however, rising markets mean higher valuations. The better things feel in financial markets (i.e. the more prices have gone up), the worse the long-term potential for future returns (regardless of the prevailing economic conditions at the time). This is a fact we are very cogniscant of at the moment, and we are therefore treading carefully.

One trend in particular that we have talked about several times this year is the very strong performance of small and mid cap stocks which have become the ‘must have’ asset class for investors. Increasingly, with the slowdown in emerging markets, it is those small and medium sized businesses with exposure to the domestic economy that have been rising in price the most. Several domestically focused Evenlode holdings such as WS Atkins, Hays, Daily Mail, Halfords and Britvic have been strong beneficiaries of this trend. On average, these five stocks have more than doubled in price since the start of 2012 and have performed particularly well since the summer. Their dividend yields and our estimates of forward cash returns have begun to look less appealing as a result. In the last few weeks we have significantly reduced our aggregate exposure to the stocks mentioned above, including an exit from our position in Daily Mail.

There’s Always Something To Do

Of more interest to us at the moment are ‘dull’, ‘boring’, ‘bond-like’ larger companies such as Unilever and Glaxosmithkline. Compared to the doubling of price for the five names mentioned above, Unilever and Glaxosmithkline’s progress has been much more pedestrian since the start of 2012, rising +16% and +17% respectively. As a result, these two stocks are currently languishing on dividend yields of 4% and 5.4% (dividends which have been growing by +9% and +7% per annum over the last five years and remain well covered by free cash flow).

As with many other stocks, Unilever’s 55% exposure to emerging markets has flipped quite quickly in Mr Market’s eyes from an asset to a liability. Paul Polman, the always quotable chief executive of Unilever, is not a fan of the investment community’s relentless focus on the short-term. One of the first things he did when taking the helm at Unilever was to get rid of Unilever’s quarterly reporting cycle – the company now only reports results twice a year. This month, he took the opportunity to gently tease a room full of investment analysts about their relentless short-termism at Unilever’s annual investor day:

I’ve heard everything from you guys in the last five years. In 2009, “it’s a disadvantage that you’re in emerging markets”, then in 2010 “it’s a great advantage”, then in 2011 “I’m not sure you should be in emerging markets”, then in 2012 “I’m so glad that you guys are in emerging markets”, and now “it’s so bad to be in the emerging markets”. I show your reports to my wife to give her a feel for the lack of sanity in the investment world.

And he went on to say:

If you want to live your life over one week or one month timescales then fine, you’ll keep yourself busy writing a lot of reports. But if you live your life a little bit longer term just think about this – 80% of the population of the world will be outside of the US and Europe in 30 years time. Ask yourself, do you want to invest in a company that is well represented in the part of the world where 80% of the population will be, or not?

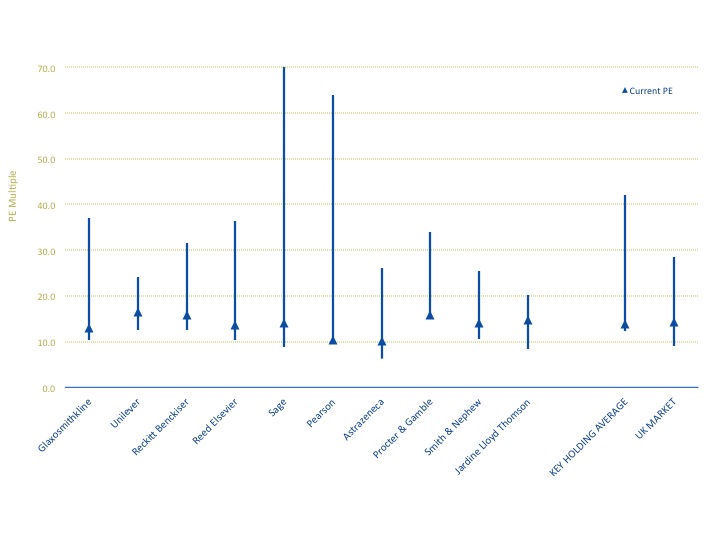

I am positive on Unilever’s long-term potential to compound its cash-flows, and as I discussed in my October Investment View (Mr Market’s Myopia) I am very comfortable with the current valuation. We have been adding to Unilever over the last month and it is back to being our largest holding at nearly 8.5% of the fund. More generally, our ten largest holdings continue to trade on valuations that compare favourably to their longer-term histories. To give a rough and ready sense of this, below is a chart that shows the current price to earnings (PE) ratio of each of our top ten holdings compared with their PE range over the last 15 years* :

PE Multiples

As well as adding to existing holdings where we still see value, we are also seeing a few new opportunities emerging. This month, for instance, we have initiated small positions in energy consultant Amec and technology consultant IBM. Both stocks have fallen out of fashion recently due to a slowdown in their respective industries. However, they both possess excellent micro-economic characteristics including high returns on capital, strong cash generation and recurring revenues. For us, these considerations (along with their attractive valuations) are far more important than the fact that industry prospects look muted. We would not be surprised if both companies continue to under-perform in the short-term, but if they do it will give us a chance to build more meaningful positions at increasingly high forward cash returns.

Onwards to 2014

"The best thing about the future is that it comes one day at a time"

Abraham Lincoln

Looking back on 2013, it has been another year of incremental progress for Evenlode. The underlying companies in the portfolio have in aggregate made steady progress, and dividend growth has been good. We have changed a few stocks and resized others to help inject value back into the portfolio as shares have risen, but as usual it has been evolution rather than revolution for the fund.

I’d like to finish by wishing you all a very restful Christmas break, and I look forward to keeping you updated as next year progresses.