Spectris takeover approach

Embedded value in UK-listed quality (part 1)

This Monday (9 June), the Evenlode Income holding Spectris announced a takeover approach from US private equity firm Advent. After a number of earlier approaches, Advent is proposing a £37.63 offer which represents a premium of +85% above the undisturbed share price at the end of last week – and values the company at £3.7bn. The Spectris board are minded to recommend a firm offer at this level, if it is forthcoming from Advent. Advent has a history in the UK engineering market, having bought other engineering assets such as Ultra Electronics and Cobham in the past. There is the possibility that trade buyers could also be interested in a counter-offer. The Scientific division in particular, would offer clear attractions to a number of larger US-based test and instrumentation peers.

Spectris shares rose +64% on Monday on the news. Spectris’s position size in the fund, prior to the bid, was approximately 1.5% – this stake represents approximately 2% of the company’s outstanding shares.

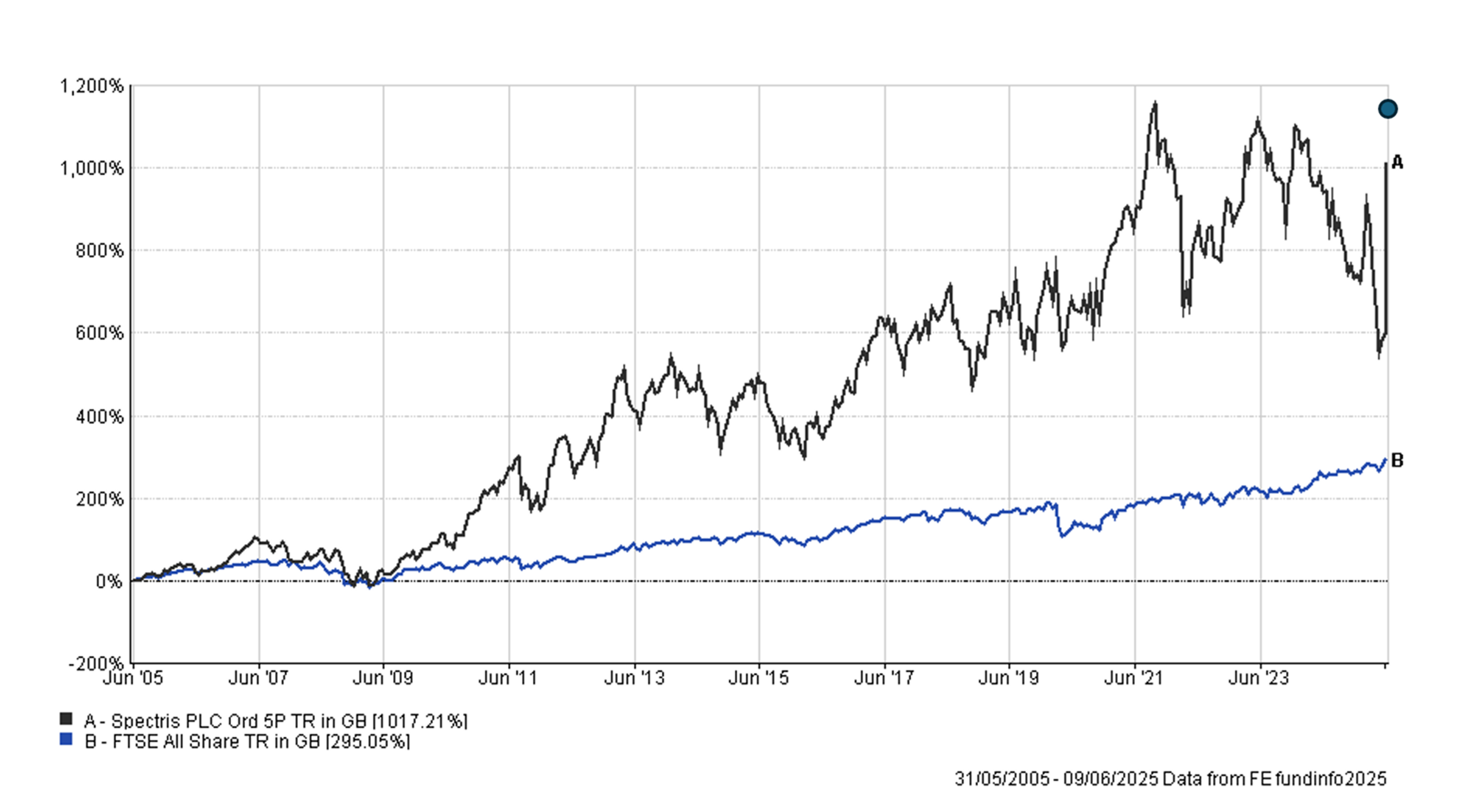

Spectris has been a holding in the Evenlode Income fund for more than a decade. As the below chart shows, the company has compounded at a good rate over time – with a total return of more than 1000% over the last twenty years (approximately +12.8% per annum). The dot in the top-right corner highlights the offer level (approximately +15% higher than the close price on Monday).

Spectris is a leading supplier of precision measurement and instrumentation equipment, with market leading positions in global niches across its two divisions of Scientific (approximately two thirds of revenue) and Dynamics (approximately one third of revenue). The end markets it sells into include life sciences, aerospace and defence, machine manufacturing, semi-conductors, automotive and academic. The group has a reputation for quality, innovation, reliability, and high service levels – all of which lead to strong relationships with customers and high barriers to entry. The company’s Cash Return on Tangible Assets has been stable and consistently high over the long-term, and the company’s pricing power is demonstrated by gross margins of nearly 60%.

The company has, though, faced challenging markets over the last two years, with some end demand weakness in areas such as automotive and semiconductors, and a post-Covid demand hangover in its life science end markets. Though the company’s medium-term organic revenue growth aspiration is +6-7%, these headwinds led to an organic sales decline of -7% in 2024. Analysts currently expect roughly flat organic sales for 2025. The company also took on some debt last summer to make three acquisitions in its Scientific division – an unfortunately timed move in hindsight. Though the company is confident that the direct impact of tariffs will be minimal, ‘Liberation Day’ uncertainty has also not helped sentiment, and may have delayed some customer orders in the second quarter. As a result, prior to the bid emerging, Spectris shares were trading on an unusually depressed Price-to-Earnings (PE) multiple of 13x for 2025, compared to an average PE multiple of 17x over the last decade. The bid values the company at a PE multiple of 24x.

We are in contact with the company via their advisers, and will continue to engage, if and when a firm bid materialises.

Whatever happens in relation to this Spectris offer, it is a reminder of the embedded value that we see in a diverse range of UK-listed quality businesses. Many have been out of fashion over the last year (and particularly those with multinational exposure), but we’ve been reassured by the aggregate fundamental performance of the portfolio and think the opportunity for the patient investor is compelling. To add some colour to this point, the posts below continue the theme of high-quality industrial franchises, highlighting three additional engineering businesses held in the fund: Smiths Group, Spirax-Sarco and Rotork.