Cheap Protection

There are times when the market is giving you a deal on protection; the IFSL Evenlode Global Equity fund is now trading at a meaningful discount to the MSCI World Index on an FCF yield basis for much superior margin, ROIC, leverage, and growth characteristics. Right now, the market doesn’t appear to favour free cashflow or counter-cyclicality - companies with deteriorating cashflow like Oracle or non-existent cashflow like CoreWeave and OpenAI (on the private markets side) are in hot demand. The concentration in that end of the market is extreme again and the bar for what success from AI looks like keeps moving up with the amount of capital committed. For the index to yield an attractive return from here, ex ante AI simply must hit the high end of expectations as so much of the index is linked to that; even a middling good outcome for AI (some enterprise adoption over the next 3-5 years and decent margins in consumer at maturity) probably won’t be enough based on current valuations. The table below shows the year-to-date revisions to earnings and cashflow for the big 5 AI capex names (Microsoft, Meta, Oracle, Alphabet, Amazon) - earnings are basically flat ex-currency, but cashflow is weakening, having lurched downwards in particular after the recently concluded second quarter earnings.

2025 | 2026 | 2027 | 2028 | 2029 | |

Earnings | 2.6% | -1.9% | -1.3% | -1.4% | -0.9% |

FCF | -31.5% | -31.3% | -24.2% | -18.6% | -14.8% |

Source – Evenlode, Visible Alpha, company earnings announcements

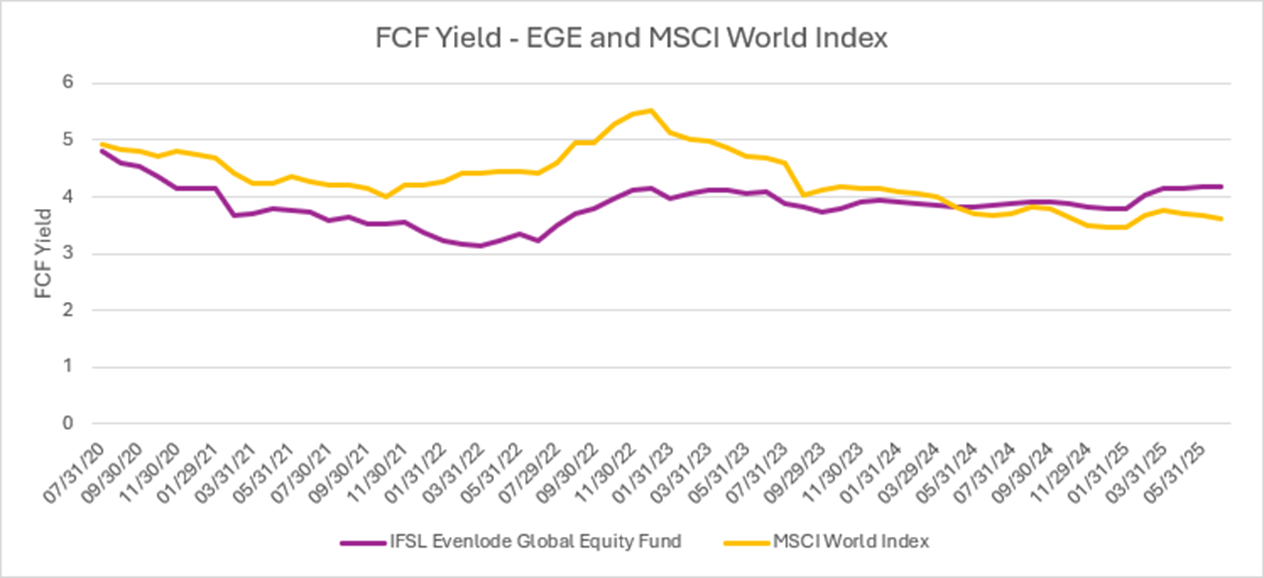

It could of course be that cashflow is pointless and you are best off ploughing every penny you have into AI servers. But the way the market is priced now you are not getting a great return for your risk capital if you make this assumption, as the AI trade is being priced as an overwhelming favourite (to use a betting analogy). IFSL Evenlode Global Equity’s more balanced and defensive portfolio is now looking better value relative to the market compared to its long run history:

Source: Evenlode, Bloomberg