Make the best use of what is in your power, and take the rest as it happens

Epictetus

A Stoic's disposition was required during 2018 as investors faced both higher volatility and lower returns compared to the previous two years, and with quite erratic stock-by-stock and sector-by-sector trends traced out during the year. When all was said and done most global financial asset classes, including the UK stock market, posted a negative return.

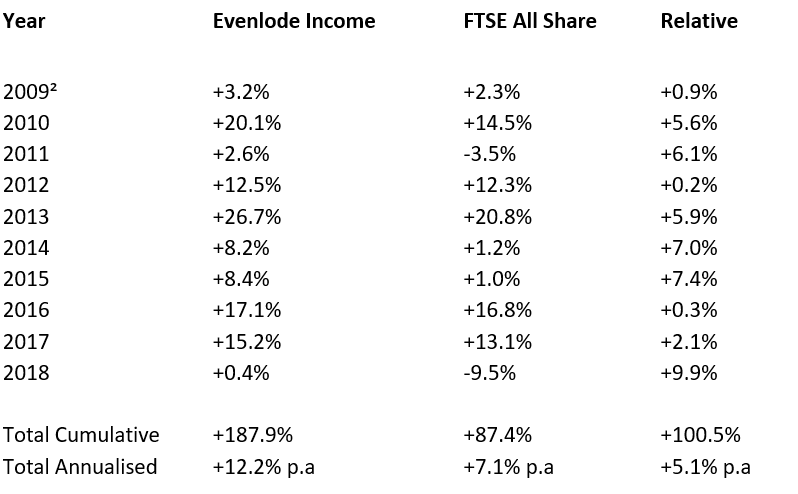

Evenlode Income held up relatively well, delivering a total return of +0-4%, compared to -9.5% for the FTSE All Share and -11.2% for the IA UK All Companies sector. With another calendar year added to Evenlode Income's life, below are both the fund's year-by-year and cumulative total returns versus its benchmark, the FTSE All Share, to 31st December 2018¹:

It is important to stress, as we always do, that there is nothing about Evenlode Income's investment strategy that means it will outperform the UK market, or indeed produce a positive return, each and every year. All the numbers in the second and last columns above happen to be positive, but this will not always be the case, and in fact hasn't been for several twelve-month periods during the fund's life that happened not to coincide with a calendar year.

Our focus on competitively advantaged, asset-light stocks results in a portfolio that looks very different to the UK market. We think this approach is well placed to achieve real dividend growth through a wide range of economic conditions. We also hope it will produce out-performance versus stock market averages over the long-term. But over shorter time periods, there will be certain markets (for instance, when resources and financials shares are sharply outperforming) where this is unlikely to be the case. We, the Evenlode team, are committed to managing the fund in this way.

Dividends

Evenlode Income's current dividend yield is 3.5% and the first three interim dividends for the year ending February 2019 have been increased by +4.5%³. Dividend growth has averaged approximately +7% since the fund's launch and our focus on providing real dividend growth over the medium and long-term remains central to our approach. Looking ahead, I continue to feel that modest real dividend growth is a realistic expectation.

Looking ahead, I continue to feel that modest real dividend growth is a realistic expectation

Performance Drivers in 2018

One of the key themes that drove Evenlode Income's out-performance during the year was takeover activity. The three strongest contributors to performance were Fidessa, UBM and Jardine Lloyd Thomson , all of which announced recommended takeovers and exited the portfolio as a result (these three holdings combined added +3.0 % to the fund's 2018 performance). Another key theme was the out-performance of the fund's healthcare exposure, with Smith & Nephew, Astrazeneca and Glaxosmithkline the next most significant contributors to performance after the three takeovers mentioned above. These holdings all benefited from good fundamental progress as well as their relative lack of economic sensitivity as concerns over the global economic outlook grew. More generally we were pleased with the portfolio's steady progress in the context of a very mixed backdrop, particularly in terms of healthy free cash flow generation. Several holdings performed well thanks to good fundamental performance, including Compass, Diageo, Procter & Gamble, Aveva , Microsoft and Cisco.

Turning to the more disappointing end of the portfolio, the two most negative contributors were Sage and WPP, both of which I have discussed in some detail in recent investment views. Sage lowered expectations during the year and had a change of Chief Executive. The company's transition to cloud-based products presents some risks but we think new management's planned investments are sensible for both customers and long-term Sage shareholders. We continue to like the company's predictable, highly cash generative business model, and long-term growth prospects. WPP under-performed in 2018 as the company reduced guidance. WPP's management have a lot to do over the next couple of years, which comes with some execution risk. However, we are encouraged by new management's focus on organic investment, client satisfaction, portfolio simplification and a strengthening balance sheet. Meanwhile, free cash flow generation remains strong. Other negative contributors of note included PZ Cussons and Imperial Brands, both of which were removed from the portfolio earlier in the year for fundamental reasons (see next section below).

Main Changes in 2018

It's always a little difficult to generalise about changes made during the year, as they tend to be made for stock specific reasons. However, there was a clear trend in the first few months of 2018, that resulted in a significant shift to the portfolio, when several of the portfolio's highest quality franchises underperformed considerably during a period when Mr Market was more interested in economically-sensitive shares. We added to several holdings including Relx, Smith & Nephew, Reckitt Benckiser, Compass, Sage, Unilever and Pepsi. The additions to Relx, Smith & Nephew and Reckitt Benckiser were particularly significant.

In terms of new holdings Kone was introduced to the portfolio in February, and Hays, Savills and Schroders were introduced in late summer/early autumn. All four companies operate in very different industries but share several key characteristics: a strong competitive position, a highly cash generative business model and a net cash balance sheet. They are also, in our view, currently trading at attractive valuations.

In terms of exits Fidessa, UBM and Jardine Lloyd Thomson left the portfolio due to takeovers. We also removed the fund's holdings in PZ Cussons and Imperial Brands. We felt that Imperial's current balance sheet and dividend policy did not place the business in a strong position to invest and adapt in a changing industry . Though there is much to like about PZ Cussons, we had some concerns over its relatively high exposure to the UK in categories that are experiencing pricing pressure. On the sell-side, we also reduced exposure earlier in the year to several shares following strong performance, including Rotork, Burberry, Aveva, Page Group and Microsoft. More recently, market conditions have begun to inject more value back into several of these companies, in some cases significantly.

Outlook 2019

Looking ahead to 2019, sentiment towards the global economic outlook has become quite depressed, with worries over trade tariffs, their impact on the US and Chinese economies and, closer to home, a high level of uncertainty over quite how Brexit will pan-out. This is a notable change in mood from even a year ago, when sentiment was quite buoyant towards the global economy and stock market, and valuations commensurately less attractive.

Valuation management remains a key part of our process, and we continue to nudge the portfolio gently towards those areas of the fund and investable universe where we see the most attractive combination of quality and long-term valuation appeal. Another characteristic we have been particularly focused on over the last five years is balance sheet strength, given an overall environment in which many companies have been taking on more debt (making them more vulnerable to negative economic developments and/or interest rate rises).

we continue to nudge the portfolio gently towards those areas of the fund and investable universe where we see the most attractive combination of quality and long-term valuation appeal

The stock market's short-term twists and turns are as unpredictable as normal heading into 2019. However, we think there are many well managed, competitively-advantaged, cash-generative businesses listed in the UK with good prospects for growth over the long-term. We will continue to invest with a mindset that focuses on this long-term potential whilst managing valuation, fundamental risk and diversification along the way.

We look forward to updating you on Evenlode Income's progress during 2019, a year in which (on October 19th) the fund will reach its ten-year anniversary. As always, please do get in touch if you have any queries.

Hugh & the Evenlode Team

9th January 2019