We are seeing very large digital transformational efforts and projects that we are partnering with in all industries. Every company is becoming a digital company.

Satya Nadella, Microsoft CEO

Global stock markets have begun 2019 on a more positive note than the gloomy one on which they ended 2018. Though the world’s economy has clearly slowed (not least due to the uncertainty introduced by US trade tariffs) some stabilisation in leading economic indicators has helped sentiment in recent weeks, as has a significant reduction in US interest rate expectations driven by a more accommodative tone from the Federal Reserve. On the home front, investor hopes regarding Brexit have risen materially, with markets beginning to price out the likelihood of a ‘no deal’ Brexit scenario. This has led to a significant rally in both the pound and the share prices of UK small and medium-sized companies: particularly those with domestic UK exposure.

In the first few weeks of the year, the FTSE All-Share has risen by +7.4%, compared to a rise of +6.4% for the Evenlode Income fund.i

Investing Through Uncertainty

Nobody knows quite what will happen with Brexit. Regardless of the outcome we continue to focus on insulating our investors from a wide range of economic and political outcomes, both in the UK and across the world. To fulfil this aim we like to ensure that cash generation is well diversified by sector and geography (at least 80% of the portfolio will always be invested in UK-based companies, but many of these companies are British multinationals with market leading positions across the globeii). However, we have also been open to Brexit-related opportunities. We have increased exposure to several companies over recent months such as Moneysupermarket, Howden Joinery, Hays, Savills and Schroders where depressed sentiment (caused at least in part by Brexit uncertainty) has allowed us to add to high quality, market-leading businesses at attractive valuations. All the above companies have net-cash balance sheets, consistently generate free cash flow and in our view have good prospects over the longer-term.

Results Season

Since the beginning of the year, more than 80% of the companies in the Evenlode portfolio have released results, and the Evenlode team has been busy digesting the news and speaking to company management teams. I enjoy this time of year: it’s a good opportunity to get an update on a broad range of companies, sectors and themes. In terms of current trading we have been reassured by the steady progress and free cash growth that the Evenlode portfolio is generating, in what is by no means a straightforward environment. The current patchy, volatile backdrop was summed up well by Unilever’s management at their final results:

“The news, of course, continues to be dominated by economic and geopolitical uncertainty, whether that’s coming from real or threatened trade wars, uncertainty in governments, or popular protests. This is the new normal and the impact on consumers requires a rapid and effective local response from our brands. We have more than enough experience and knowledge in our local operations to manage this for the long-term.”

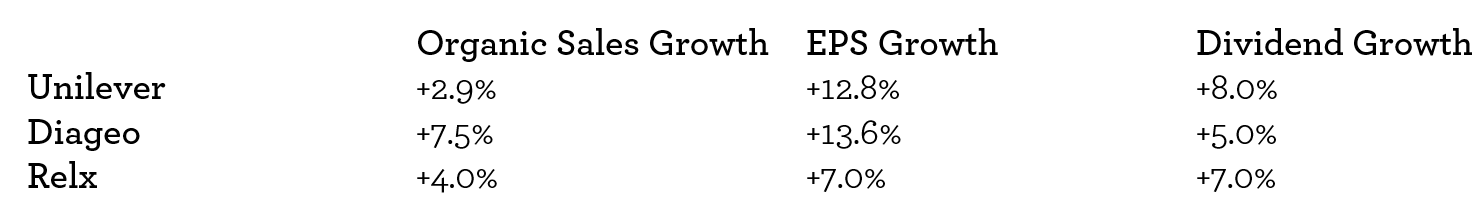

In a complex world and in a sector that is seeing not inconsiderable change, Unilever continued to deliver steady progress and a dividend increase of +8%. Good companies tend to be well placed to ‘grind it out’, even in difficult operating environments. Below are the growth rates in organic sales, earnings and dividends for the Evenlode Income fund’s three largest holdings, taken from their latest results.iii

For the overall portfolio, dividend growth has also been reassuring. We estimate year-on-year growth for the fund’s full year dividend (to 1st March 2019) will be approximately +4.3%iv. Looking ahead, we continue to see good prospects for modest real dividend growth over coming years, notwithstanding the political and economic uncertainty that the world currently finds itself with.

Digitalisation and Efficiency

This month I’d like to briefly discuss some case studies of companies that are taking advantage of the trends towards greater digitalisation and efficiency in the global economy. This theme is perhaps the most ubiquitous that we come across when talking to companies in all sectors and all parts of the world. Every leadership team wants to increase efficiency: to save waste, increase adaptability and put themselves in as healthy a condition as possible to cope with a rapidly changing, complex world. And as the quote from Satya Nadella at the top of this piece suggests, all companies are digital companies now. Given the importance of digitalisation to both a company’s long-term value creation and long-term competitive advantage, it’s a topic that we’ve spent a lot more time talking about over recent weeks than Brexit, Donald Trump or the likely short-term direction of US interest rates!

Companies such as Relx that sell digital information, data analytics and software products are particularly well placed to benefit from these trends, given the structural demand growth in this market. We continue to think Relx’s organic-led growth strategy is very compelling. As management reiterated at Relx’s full year results: our ambition is to always improve the sophistication of our tools, the value of our tools, and therefore the desire of our customers to want more of them. This simple, well-articulated strategy makes a great deal of sense to us as long-term shareholders.

Data analytics continues to spread its way through a wide range of industries, including traditionally slow-moving sectors such as engineering. Long-term Evenlode holding Spectris is a high-quality test and measurement company which enjoys very strong positions in its markets. However, new management think there is plenty of untapped potential for profitable growth, not least in terms of data analytics. The high-precision equipment Spectris sells produce all sorts of data on anything from the composition of healthcare drugs to the performance of wind turbines. This creates an opportunity, not dissimilar to Relx’s, as Spectris management highlighted at recent results: we generate a huge amount of data for our customers, and being able to provide greater diagnostics and predictive capability around our instruments allows us to provide greater value to our customers which is what they are seeking. Spectris are investing in their diagnostics, prognostics and artificial intelligence capabilities to take advantage.

Elsewhere, Diageo has developed an in-house marketing tool that utilises data analytics and machine learning. It is helping the company make better decisions on their marketing spend and focus it more appropriately to the right potential audience. As management put it, we see momentum and opportunities to invest more behind our brands. We’re doing it with more data-based analytics and more evidence which gives us more confidence in the return from this investment. Sales are growing at a healthy rate for Diageo (not least gin sales +28% globally in the six months to December 2018!) helped in part by this new approach.

As a final example, in last year’s August investment view (Rewarding Strategies For Long-Term Shareholders) I discussed Moneysupermarket’s significant investment in technology infrastructure over the last few years, the benefits of which are now beginning to come to fruition on their website and mobile app. These new technologies and algorithms are beginning to make the small things easier: making the sites easier to use, making it easier to get through question sets, easier to find results and faster to use, particularly on small screen devices. Helped by this new approach, Moneysupermarket’s customers saved more than £2.1bn last year, whilst customer satisfaction scores and average revenue per users increased. Spare cash continues to build up on the balance sheet and the company announced a +6% dividend increase and a £40m return of cash to shareholders alongside final results.

Remembering Jack Bogle

Before signing off, I’d like to mention Jack Bogle, who died last month at the age of 89. As well as popularising the low-cost index fund, Bogle has been one of the most thoughtful commentators on business and the investment industry over the last fifty years. He has been a great champion of long-term thinking and was very articulate on the importance of integrity, character, culture and relationships in the business world - not least the importance of ‘client-focus’ and ‘professionalism’ in the investment industry.

Here are three Bogle quotes which I believe illustrate these themes well:

“The most important things in life and in business can’t be measured. Tell me, please, if you can, how to value friendship, cooperation, dedication, and spirit. Categorically, the firm that ignores the intangible qualities that the human beings who are our colleagues bring to their careers will never build a great workforce or a great organization.”

“No matter what career you choose, do your best to hold high its traditional professional values in which serving the client is always the highest priority.”

“In the long-run, stock returns have depended almost entirely on the reality of the relatively predictable investment returns earned by business. The totally unpredictable perceptions of market participants, reflected in momentary stock prices and in the changing multiples that drive speculative returns, essentially have counted for nothing. It is economics that control long-term equity returns; the impact of emotions, so dominant in the short-term, dissolves. Therefore, the stock market is a giant distraction from the business of investing.”

In a world which sometimes appears too ‘busy’ to see the wood for the trees, he will be sadly missed. In the spirit of Bogle, we will continue to try our hardest each day for our clients, whilst investing with the principles of long-termism and good stewardship always in mind.

Hugh and the Evenlode Team

27th February 2019

Please note, these views represent the opinions of Hugh Yarrow as at 27th February 2019 and do not constitute investment advice.