Summary

Markets rebounded very strongly as a combination of monetary authorities and governments provided support to markets. In addition, economies showed various tentative signs of normalisation. After a challenging absolute and relative Q1, the fund rebounded strongly and regained some ground in Q2.

Commentary

In response to the Covid19 induced recession authorities stepped up to the plate and delivered what was requested of them. Monetary authorities doubled down on the enormous monetary expansion which has now gone exponential. Governments played their part with support programs for corporates and employment generally. It does appear that we will emerge from this crisis with much more debt in both the public and private sector. A medium-term rise in taxation looks more likely than not.

Based on observations around US-China relations and intra-EU relations, the risks around protectionism and nationalism look to have risen rather than receded as a result of Covid19. The US presidential elections could change this narrative. It may well be that a risk premium around globalisation and possible changes in how supply chains work and businesses operate could be appropriate.

To bring discussion closer to home and to more of an investable theme, the pandemic does appear to be confirming and arguably enhancing the ongoing technological revolution and related digitalisation. We have made this a key theme in our portfolio and have exposure to companies in semiconductor supply chain as well as a range of IT services companies. We regard these latter companies as modern day hi-tech pick and shovel providers. We have 27% of the fund directly exposed to this technology investment cycle and think that especially in IT Services where most of our holdings are small-cap, we have yet to be rewarded here.

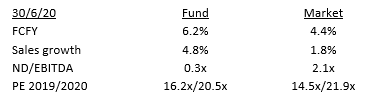

Whilst Q1 reporting season brought relief across most sectors, the reality is Q2 is the eye of the economic storm so results will be the ugliest and balance sheets the most stretched. Q2 will be a truer test of resilience than Q1. We have worked very hard in Q2 on company contact, especially with our smaller companies, to give ourselves comfort that balance sheets especially are strong enough to withstand some pretty bad operating numbers. As a reminder, our portfolio risk discipline provides a considerable margin of comfort here. Our portfolio ND/EBITDA currently stands at 0.3x with the market at 2.1x.

Attribution Highlights

After a Q1 where Growth wiped the floor with Value, Q2 was more balanced with both styles performing roughly in line with the index – so no particular style headwind or tailwind.

On the positive side there was a wide range of contributors across the sector and market cap spectrum. Good to see a couple of specific features:

- Our mid-cap semiconductor capital equipment companies ASM International and BE Semiconductor continue to contribute strongly. All the signs are that the semi cycle which had a pause in 2019 is set to rebound strongly even through this crisis and into 2021/2022. Both these holdings are taking share in growing addressable markets – a powerful combination.

- Two of the top 3 performers are small cap holdings both of which had significant newsflow. Since inception our small-caps haven’t contributed in the way we would have hoped given their operating performance, so it was good to see upon decisive news there was appetite for these shares – both of which still look good value despite the bounces. We have 27% of the fund in companies capitalised <€1bn and there is very significant unrealised value in this area

On the downside and in such a strong market there were no major detractors. The bottom 10 contains stocks which either just didn’t do very much or which we sold during the quarter and therefore look like poor performers when in reality the proceeds would have been switched into stocks which would have, on average, gone up.

Activity

We have been active during the period.

- New holdings during the period include Ahold (food retail), Cegedim (IT – healthcare), Prosus (tracking vehicle for Tencent) and Rejlers (Swedish consultant turnaround)

- Holdings sold during the period include: GAM, lastminute.com, AMG and Saras. The investment case on all these companies fundamentally changed as a result of Covid-19. Balance sheets were called into question and we had a rich list of new potential holdings. Net result is improved portfolio quality

- We also made the following switches which improved the growth and quality of the fund at comparable valuations. Nordea switched into Svenska Handelsbanken and Randstad switched into Amadeus Fire.

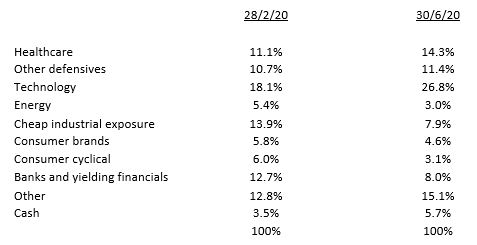

Compared with around the peak of the market, the net effect of this activity is summarised as follows:

Source: Chelverton Asset Management, Factset, 30 June 2020

Conclusion

Markets have decided that the monetary experiments are going to end well, resultant debt burdens can be managed and that economies will recover decisively. We are less sure, and the temptation is to be bearish. Fortunately, we don’t need to make such macro calls with a fully invested fund. We continue to apply relatively old-fashioned principles such as cash flow and balance sheet analysis as well as valuation discipline. You do not need to lose valuation discipline to get growth and quality into a portfolio. Our fund is delivering meaningfully higher growth than the market at a cash flow discount to the market. All with a lower financial risk profile. As markets work their way through the implications of the recession and recovery we are confident we will work our way up the league tables.

Source: Chelverton Asset Management, Factset, 30 June 2020