At the half-way point of 2020, the 6-month performance figures from a global equity market perspective would suggest that it has been a fairly unremarkable period of time since the new year celebrations. The MSCI World index is down -5.8% in dollar terms, and the S&P 500 down -3.4%, moves that even in periods of low volatility can be achieved in a few off days. The Evenlode Global Dividend fund is down a little more, -7.8%.

We know that the reality has been anything but unremarkable, and there has been a profound shifting of the business and economic sands underlying the period’s returns. Closer to home this is visible in the performance of the FTSE All Share index, which was down -23% in dollar terms in the first half of the year1 thanks to its exposure to financial companies and the oil sector. European markets more broadly are in negative territory, albeit with a more moderate decline. Having crossed the end of a quarter we are due a review and dissection of the Evenlode Global income strategy’s performance, which we detail below.

The driving forces in the market reflect the winners and losers in a lockdown world. The aforementioned financials, oil & gas, bricks-and-mortar retailers, certain industrial companies and others have been disrupted, whilst the sudden need for at-home shopping, connectivity, entertainment and a renewal of interest in matters of healthcare has also created winners. How much of this reflects a permanent shift in demand, and how much will be reversed once business returns more to normal remains to be seen, but the impact on market returns has been significant.

Before considering the wider trends, we discuss three holdings in the portfolio that have been affected by the coronavirus pandemic and the ensuing lockdowns. These examples draw out some key aspects of the Evenlode investment process such as examining competitive positions, approaches to financial management, and looking at near term challenges versus longer run opportunities.

Part of the process is to examine the valuation opportunity versus the risks individual businesses face, and as things stand we are comfortable with the balance of quality and value in the portfolio. It consists of good businesses, with stable or improving competitive positions that are, in our estimation, currently trading at sensible valuations in the market or better. The three businesses discussed exhibit those characteristics, but also show that every investment case has positives and negatives that should be considered as part of a rounded investment view.

CTS Eventim

CTS Eventim are the European leaders in ticketing and live entertainment. In normal times, around 250m tickets are sold using their systems each year. In the industry, different countries are dominated by a single player with typically 80-90% market share, which means CTS is able to consistently generate cash. As we have noted previously, the importance of not stretching the resources of a business by taking on too much debt is one of the standout takeaways from the current crisis, and CTS has prudently managed its balance sheet.

2020 has been challenging as social distancing measures have resulted in postponements and cancellations of events around the world, effectively pausing the live entertainment industry until lockdowns are eased. CTS Eventim were hit hard in March as the pandemic hit Europe, leading to a 35% drop in revenues in the first quarter, which includes a positive first two months of the year. Most events have been moved to a later date and in May, CTS declared that they expected that 85% of this summer’s events would be postponed while 15% would be cancelled.

Thanks to its prudent management, CTS entered the crisis with enough cash to withstand an extended period of no events and the suspension of the dividend for this year further solidifies their financial position. A large portion of the cash position represents prepayments from consumers for tickets, and this working capital has been protected by legislation for the issuance of vouchers (rather than refunds) in their largest regions. Costs associated with cancelled events are covered in part by insurance, another reflection of financial prudence.

The short-term outlook for live entertainment is of course currently uncertain. However, demand from both consumers and artists for a return is high - since the proliferation of music streaming, the majority of artists’ income now comes from touring. Ticket volumes may be impacted by measures such as reduced crowd sizes, as a ‘new normal’ is established, but there are also opportunities; online ticket sales have better economics than traditional ticket booths. While the COVID-19 crisis has certainly had a significant impact, our research has left us reassured that CTS’s business is well positioned to manage the impact in the short-term, while the long-term investment case remains strong.

Medtronic

Medtronic is one of the largest medical technology companies, serving 72 million patients in 150 countries worldwide. Competitive advantages include high switching costs, a strong intellectual property protection and brand loyalty based on quality. Medtronic is the market leader in several categories of critical devices and continuously innovates to stay at the forefront of technology. Long-term demographic tailwinds include trends such as ageing global populations and improved access to treatment in emerging markets.

COVID-19 struck Medtronic’s operations through widespread deferrals of non-essential procedures, meaning revenue decreased -25% in the first three months of 2020, with product sales dropping over -30% and several planned product launches being delayed. However, demand surged for respiratory, airway, and life support products and the company targeted a five-times increased ventilator capacity by the end of June. Looking beyond the pandemic, opportunities include increased take-up of medical technology in emerging markets, wider corporate partnerships (such as recent work with Intel and Space-X) and technological improvements.

Siemens Healthineers

Siemens Healthineers is a global market leader in both medical imaging, for example CT, MRI and X-Ray scanners, and in diagnostic equipment. Whilst both imaging and diagnostics have a clear role to play in detecting coronavirus and managing the pandemic, the disruption to routine testing has impacted the company, much as with Medtronic above. Some 57% of revenues are derived from servicing, consumables and reagents sold after the initial equipment purchase, which is usually a steady source of turnover but has seen falling demand whilst medical systems focus on detecting Covid-19. These revenues will clearly return as patient need for non-Covid testing has not vanished, but the exact path of a return to normality is unclear.

Nonetheless, the outlook in the long run for both these ‘aftermarket’ revenues and new equipment sales is strong, and the company has continued to roll out its Atellica high-throughput automated testing solution. Even during the pandemic a ten year partnership was signed with the Pennsylvania health system for lab equipment, demonstrating that customers are also seeing through the immediate pressures towards their long term requirements, although there is some indication that purchase decisions are taking longer than normal.

Fund performance - The headlines

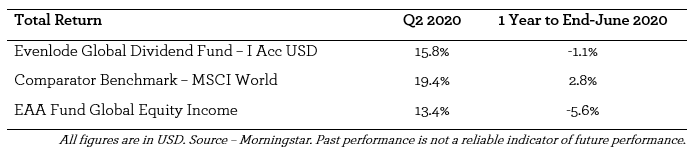

The Evenlode Global Dividend fund’s performance for the last quarter and over the last year is summarised as follows:

The second quarter saw a reversal of the first’s misfortune for the fund and its benchmark, with the fund standing down -7.8% for the six months to end-June and the MSCI World index down -5.8%. Over a year, the MSCI World is up almost three percent, and the fund has lagged somewhat over that period, though not by as much as Morningstar’s Global Equity Income sector in aggregate.

That either the Evenlode Global Dividend fund or its benchmark have one year returns hovering around zero is worthy of note, and not just because of the pandemic and its effects on the global economy. The period preceding July 1st 2019 saw a rapid appreciation in equity prices, something that does not normally proceed uninterrupted. We have of course had significant volatility in the meantime, but a casual observer of the markets who only examines her portfolio mid-year would possibly be wondering if and when the continuing bull market might run out of steam.

Examining the performance of the MSCI World benchmark is revealing. Over a year the top five contributors have returned an average of 164%, being Apple, Tesla, Microsoft, Amazon and Nvidia. We will look at the relative performance of the Evenlode Global Dividend strategy in more detail below, but being responsible for essentially all of the positive return for the benchmark highlights the impact that these large companies have on the headline index.

Which companies contributed in the quarter?

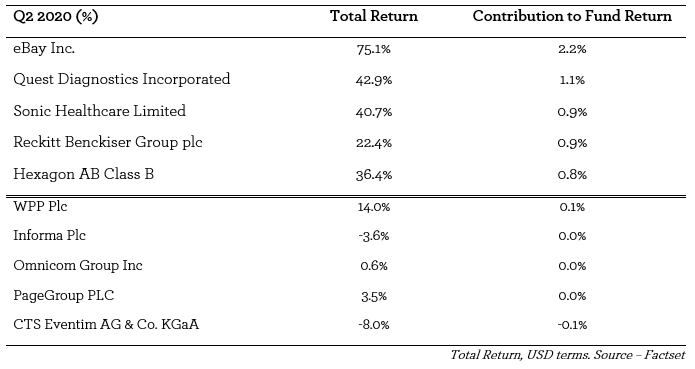

The table below shows the top five and bottom five contributors to total return:

Technology and healthcare companies feature heavily near the top of the list of contributors, with both medical testing (Quest and Sonic) and consumer health (Reckitt Benckiser) featuring, replacing the representation from pharmaceutical companies in the prior quarter. The positive position of the medical testing companies is not as obvious as it might at first seem; as noted for Siemens Healthineers above these companies are experiencing meaningful disruption to their businesses as routine testing is postponed in favour of Covid-19 detection. The positive contribution in the most recent quarter is due to these companies rebounding from prior-quarter declines. eBay is experiencing a resurgence in interest in the platform as shoppers move online and sellers seek out a convenient virtual storefront from which to sell their wares. Technology company Hexagon was a new holding in the quarter as the share price declined on worries about its exposure to industrial end-markets in general and the oil and gas sector in particular. We however view its capabilities in serving the growing needs of customers using positioning technology for efficiency and automation as likely to experience robust demand in the longer term.

At the bottom of the list of contributors is another new holding, CTS Eventim, discussed above. We disposed of trade exhibitions and publishing company Informa in the quarter, which was a small position in the fund that had rallied as it strengthened its balance sheet through equity issuance. We maintain an Informa position in the UK-focussed Evenlode Income fund, but with more options in the global income universe we felt it better on balance to recycle funds into other holdings. Recruiter PageGroup and advertisers Omincom and WPP are suffering from disruption to demand for their services as a result of the pandemic, but have good positions in their niches and we retain the holdings.

Sector view

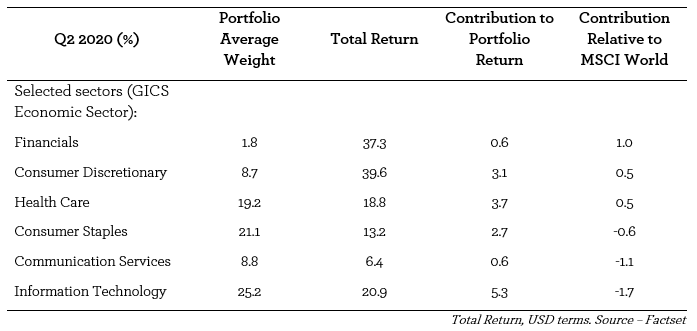

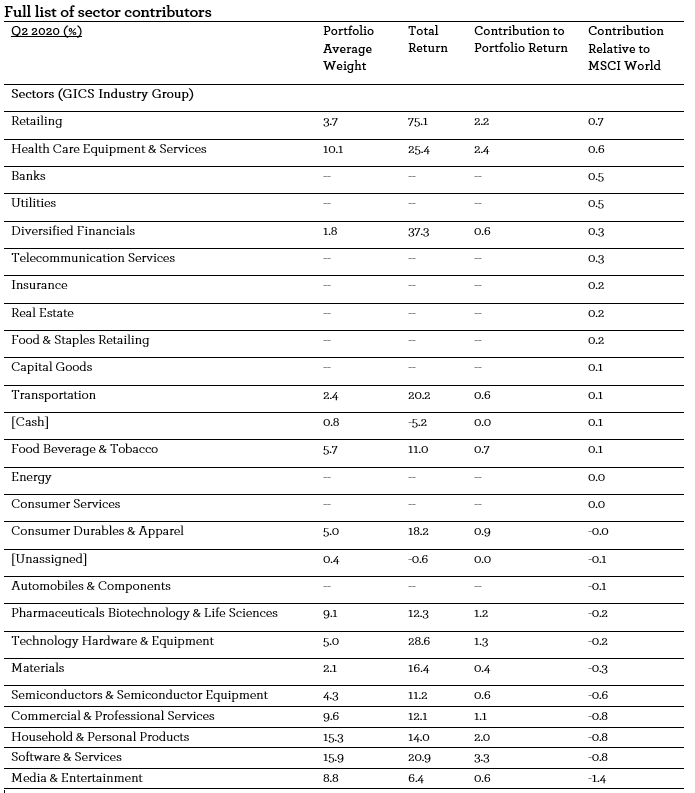

There are many ways to look at the performance of sectors within the portfolio. At its most basic we can look at the contribution of a sector to the overall performance of the portfolio, but we can also look at the performance against the fund’s benchmark to get an insight into what’s driving relative performance. Both are summarised in the table below which extracts sectors of interest and is ordered by the relative impact on returns compared to the MSCI World benchmark. A full table with sub-sector breakdowns can be found in the note at the end of this report.

As in Q1, the second quarter’s main contributor to relative performance was the financials sector, as the fund’s holding in exchange operator Euronext enjoyed strong returns. The MSCI World index’s exposure to banking and insurance companies caused the sector lag more broadly as these business models are negatively affected by the ultra-low interest rate environment we find ourselves in. In the health care sector, firms like Quest and Sonic rebounded, whilst others such as pharma and diagnostics company Roche were solid through both the first and second quarters.

The information technology sector negatively affected relative returns, with the sector being the main driver of the MSCI World’s upward performance. The fund has exposure to information technology, and owns Microsoft from the elite group, but despite a strong performance in absolute terms it did not keep up with the broader sub-sector of the market which was up some 30%.

Commercial services rebounded but again not as much as the broader market, including companies like recruiters PageGroup and Adecco (which are included in the industrials sector), and advertising agencies like Omnicom and Publicis (in the communication services sector).

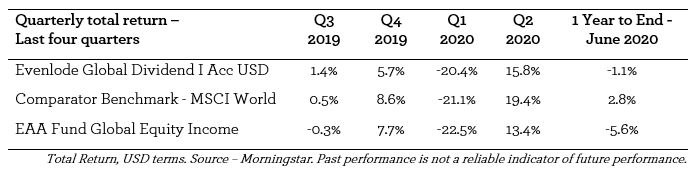

Quarterly view

The last four quarters paint a picture that is broadly as we would expect for the Evenlode Global Dividend Fund, with relative underperformance in the very strong market of the quarter just gone, outperformance in the very weak market in the prior quarter, and a mixed bag in the second half of 2019 when markets were more range-bound. On average this is what we have experienced with the Evenlode strategies through time, although averages of course include variations from the norm during any given period of time.

Looking ahead

We hope that this dissection of the Evenlode Global Dividend Fund’s performance is of some interest, particularly in a period when equity prices have been moving so much, both down and up, in a short space of time. Whilst acknowledging that the sands have shifted in the recent past, we take a longer-term view on equity investment. We are focused on both the qualities of the companies we invest in on behalf of our clients, and the valuations that are being offered in the market, and we continue to assess if there are any more permanent effects of the pandemic in our analysis of companies.

It has been a period of disruption, and our portfolio companies have seen challenges as they navigate through the pandemic-induced lockdown situation. We have made some changes to the portfolio where we feel the balance of opportunity and risk has shifted; recently we disposed of fashion company Hugo Boss due to a number of different factors. However, the core of the portfolio remains largely unchanged and we will continue to evolve the holdings where we believe it is prudent to do so.

Ben Peters, Chris Elliott, Rob Strachan and the Evenlode team

13th July 2020

Please note, these views represent the opinions of the Evenlode team as of 13th July 2020 and do not constitute investment advice.