Summer in the UK suddenly seems like a long time ago, a sepia-toned fading memory of a world where we could go out and do stuff. At Evenlode we have continued to work from home with just the occasional get-together in the office (orchestrated safely of course). We would like to take this opportunity to offer our thanks to the Evenlode team, who have diligently carried on the work of analysing companies, considering portfolio changes, making them happen and communicating with the outside world. We are also grateful to all of our operating partners for their remarkably smooth transition into the new normal and are pleased to report that our operations have continued as normal, despite the shift to remote working.

Equity markets appear to have got used to the new normal as well and are shrugging off the looming winter with its likely lockdowns and lack of Christmas parties, instead looking to the bright side. For investors who were willing to ride out the mid-year market volatility, returns have been acceptable if not spectacular for the fund and its benchmarks.

Washing hands

So how has the market managed to remain chipper in the face of a dismal-looking festive season? Whilst the pandemic response has been very bad for some companies, and of course the individuals who work for them, it hasn’t had the same effect across all sectors of the global economy. We can’t comment on every company of course, but your fund’s portfolio gives us a window into the economy, one that we look through on a quarterly basis thanks to mandated corporate reporting.

As the global economy locked down early in 2020, we reviewed the fund’s portfolio, characterising companies into three buckets. The first contains firms where we thought there was a reasonable chance of them continuing something like normal operations, and where demand for their goods and services was likely to face limited disruption. We called this bucket ‘business almost as usual’. There is no usual at the best of times, let alone now, but the label seemed to work. It includes companies like IT consultancy Accenture, healthcare firm Roche, and consumer goods giant P&G.

The second bucket we dubbed the ‘walking wounded’, firms where there would be an impact but it was unlikely to be very severe, perhaps due to the company having multiple business lines. For example Swedish technology company Hexagon, a holding we initiated in March, derives some of its revenue from the oil and gas sector. This part of the economy has been particularly badly hit by the global economic slowdown, and longer-term trends towards sustainability are not in its favour either. However, for Hexagon other industrial and agricultural applications using the firm’s positioning technology are relatively unaffected. Other examples in this bucket include Australian medical services provider Sonic Healthcare, and German industrial-consumer conglomerate Henkel.

The third bucket was reserved for businesses that were in all likelihood going to suffer quite badly (labelled as ‘severe cases’), and we naturally paid even closer attention to these businesses. While we are by nature long-term investors, we are also conscious of the short-term risks that businesses face and will sell if there is a high likelihood of permanent loss of capital for our co-investors. Conversely, we should certainly not panic and sell a good business just because it is likely to have a difficult quarter or two. While the third bucket was a relatively low proportion of the fund, it did contain examples from both the ‘keep’ and ‘sell’ sides of the coin. For example, we continue to hold recruiters Adecco and PageGroup, who have solid financing to weather the storm, but disposed of Disney. The decision to sell was attributable in part to concerns around the long-term competitive dynamics in the world of consumer media, but also to shorter term factors. The firm’s debt burden has increased following the acquisition of 21st Century Fox and combines negatively with the near-term demand shock of its parks and resorts shutting down.

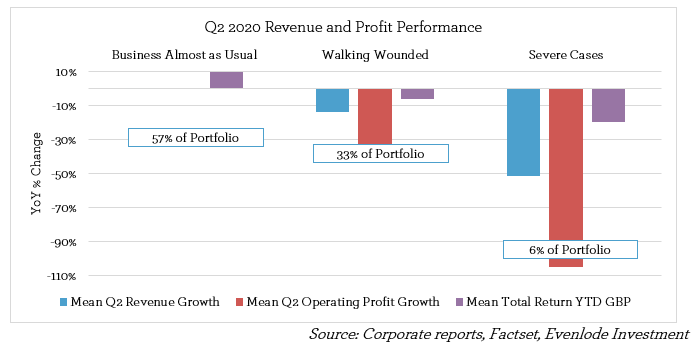

We have continued to find these categorisations helpful as the coronavirus situation has evolved; they have enabled us to map corporate response and performance during the pandemic, and to make decisions at an individual stock and portfolio level. We have re-classified a few companies as things have developed, but by and large our categorisations have remained intact. As we stand in early-October, 57% of the portfolio is in the ‘business almost as usual’ category, a third make up the ‘walking wounded’, and just 6% are ‘severe cases’. These proportions have remained broadly static but work has been going on under the bonnet; we made disposals of Sabre, Informa, Disney and Boss, all of which were in the severe cases class. We also bought a severe case, ticketing company CTS Eventim, on which we have written previously.

The chart above shows the most recent view through the corporate reporting window, from the second quarter of the year to the end of July 2020, grouped according to our Covid classifications. This time was a real acid test, a quarter when lockdowns were at their peak and many sectors of the economy were suffering. In aggregate the results experienced by companies mirrored the expectations implied by our categorisations. The majority of the portfolio companies we have classified as experiencing business almost as usual showed exactly that, with revenue and profitability flat compared to the same quarter in 2019. The walking wounded had revenues down in the low double digits, with operating leverage and additional Covid-related costs sending profitability down by a third year on year. As the above chart shows, profitability was wiped out for our small number of severe cases.

The market price reaction has also matched our categorisations, and in the mix there are reasons to be cheerful. Flat profitability is a good result in the circumstances and shows that at least parts of the economy can cope with coronavirus. A positive market reaction is perhaps a rational response. However, those companies more affected by the effects of lockdown did see share price declines, with the market washing its hands of the more difficult cases.

We believe all of the companies remaining in the portfolio have good long-term prospects, despite any short-term wobbles, and we have moved to make the most of valuation opportunities as they have arisen. However, it is really companies thriving into the future that will drive long term returns, and we are certainly looking forward to coming out of the other side of what may be a difficult winter.

Making space

A final word on portfolio turnover. Having made a number of disposals and acquisitions over the last seven months it may sound as though there has been a radical reshaping of the portfolio. Whilst activity has been elevated it has not been dizzyingly high, and we retain many great stalwarts who, barring the unexpected, we expect to be part of the fund for many years to come.

That said, some changes have been made and the sales we have undertaken for fundamental reasons have made space for a few new holdings. The portfolio’s turnover, as measured by sales within the portfolio compared to the average fund size, has averaged in the mid-teens since launch nearly three years ago, and for the last year has been 21%. The chart above depicts this on a quarterly basis and shows that whilst activity ticked up in the last quarter it was by no means frenzied. This is as we would expect during a time of economic and market volatility, and there will be quieter times in the future - although we can’t be sure when.

Ben Peters, Chris Elliott and the Evenlode team

12th October 2020

Please note, these views represent the opinions of the Evenlode team as of 12th October 2020 and do not constitute investment advice.