After a sharp recovery from the lows of March, the UK stock market has been weakening since June, a trend which accelerated in the second half of October. As I write (28th October), the Evenlode Income fund has now fallen -11.7% since the start of the year compared to a fall of -21.0% for the FTSE All-Share.i

Investors are faced with two sources of significant short-term uncertainty at present. The first is the coronavirus crisis. Though vaccine programmes are progressing, Europe and the US have experienced an increase in cases and extra social-distancing measures have been reintroduced in many regions. This casts a shadow on the economic outlook over the winter months, particularly for the most crisis-hit sectors such as retail, hospitality, and travel. The second big uncertainty is the forthcoming US election, which is undoubtedly creating some additional investor nerves. Current consensus is for a Democratic presidency, but time will tell and for investors the decisiveness and extent of a victory (for either party) will be as important as the headline outcome in terms of its implications for future legislation and economic stimulus. My colleague Chris Elliott has written a piece this week discussing the US election in more detail, which is available on our website.

An Eye on The Horizon

Periods of heightened uncertainty, such as we find ourselves in, are always accompanied by a shortening of investor time horizons and a pick-up in volatility. This can feel quite stomach-churning for the long-term saver but are, unfortunately, inevitable. To use a maritime analogy, we at Evenlode think it is even more important than normal to keep our eyes on the horizon as the boat bobs around in these big, choppy waves. We will proceed carefully as usual, focusing on high quality companies that we think are attractively valued and well placed to grow over the longer-term, whilst remaining open to evolving the portfolio in response to opportunities.

In terms of aggregate valuations, we are quite reassured at present, with this year’s market reaction having brought our estimate of the portfolio’s long-term return potential back to levels last seen several years ago (see the valuation footnote for more detail).

Results Update

Many third quarter results have been released during October, with approximately two thirds of the portfolio updating investors in recent weeks. The trends that I have discussed since the onset of coronavirus have broadly continued, with a wide variation in performance by sector being a particular notable feature of this crisis.

Many of the most resilient performers belong to the consumer branded goods, healthcare, and technology/ digital sectors.

Consumer Goods

Unilever, Reckitt Benckiser, Procter & Gamble and Pepsi have all announced healthy trading over the last three months (all posting underlying sales growth within a range of +4% and +13%). The crisis has triggered a rapid acceleration in online sales for these companies. For Unilever and Procter & Gamble, this distribution channel saw sales growth of +76% and +50% in the third quarter and it now represents 10% and 12% of total sales respectively. This is a near-doubling on 2019 levels for both companies. Meanwhile, consumer habits have been changed by the crisis with strong growth in both at-home consumption (such as food, personal care and cleaning products) and hygiene categories (such as hand sanitisers). Whilst management teams expect some reversion of these patterns when the crisis subsides, there is a sense that new consumer habits have been formed that will last, particularly in relation to hygiene and working from home. This is how P & G’s management put it on their recent results call:

It’s hard for us to see, in our interactions with consumers, that we’re going to snap back and revert to the same attitudes and the same behaviours that we had collectively pre-COVID. In some ways this is analogous to our grandparents, for example, having survived the Great Depression. They continued to hold on to more food and canned items than I could ever understand. But it was because of what they’d been through. I’m sure there’ll be some level of reversion, but we do expect a permanent change at some level as well.

Healthcare

The healthcare sector has also been relatively resilient through the crisis, with the main impact caused by patients being unable to access hospitals. This was particularly pronounced during the initial hard lockdown phase. Roche management noted that, whilst this dynamic still persists, hospitals are beginning to function closer to normal than they were earlier in the year:

There were literally policies in place to tell people to shut down hospitals, except for very urgent cases and COVID-19. So, even if we now see an increased level of measures, with infection rates coming up again, that doesn't mean that hospitals will be shut down. And that's really the decisive point if you look at it from a healthcare industry point of view.

Technology and Digital Business Models

Technology companies have seen some strong demand from companies and individuals investing to adapt to a more virtual world. Microsoft continues to be a standout beneficiary with sales growth of +12% and earnings growth of +30% in the third quarter. Their business customers continue to invest heavily in further embedding cloud capabilities and digitalisation into their workflow. Meanwhile, Relx’s digital-orientated businesses (which represented nearly 90% of 2019 profit) have continued to grow steadily, as they continue to provide embedded digital subscriptions to academics, doctors, lawyers and other professionals, with a high level of renewal.

As expected, the technology sector has not been entirely immune from the economic downturn. Holdings such as IBM and Intel have noted that some of their customers have reduced investment levels since the initial surge in lockdown-related investment when businesses had to transform the way that they worked practically overnight. However, whilst not without some economic sensitivity, the digitalisation trend remains a structural, multi-year growth opportunity that many of the holdings in the portfolio are well placed to benefit from.

Coping with Covid

The hardest hit businesses have, on the whole, continued to see difficult trading conditions in the third quarter, albeit with some improvement versus the second quarter of the year. The recruitment companies Hays and Page Group, for instance, announced third quarter sales down -29% and -31% year-on-year. And food caterer Compass reported sales down -41% year-on-year, as lockdown measures continue to impact the business. Though short-term trading is tough, there is a definite sense of the ‘strong growing stronger’ through this crisis. It looks like Compass will have their strongest year for new business wins in North America, as management note a flight-to-trust within the industry. Contract retention rates are also running at approximately 95% with existing customers. Meanwhile, Hays and Page Group are using their financial strength to deepen relationships with customers and invest in recruitment sub-sectors with good long-term potential such as technology and life sciences.

Though this theme - of high quality market leaders benefiting from their financial strength, reputation and levels of customer trust - is perhaps most accentuated in the hardest hit areas of the portfolio, it is a recurring motif for most market-leading companies we follow and speak to. This quiet strengthening of competitive position won’t immediately show up in financial results, but it is of great significance for the long-term investor. It reminds me of the old city saying:

you make your money in a bear market, you just don’t realise it at the time.

The Long Haul

Before signing off I’d like to mention that the Evenlode Income fund was launched on 19th October 2009 and therefore had its eleventh anniversary this month. Over this period, the compound total return per annum after fees was +11.4% p.a. for Evenlode compared to +5.5% p.a. for the FTSE All-Share and +6.1% p.a. for the IA UK All Companies sector.ii

The last eleven years have seen no shortage of vicissitudes and uncertainty. If they have taught us anything it is to avoid making big predictions, to invest with a steady long-term mindset, and to focus carefully on managing risk along the way.

We, the Evenlode team, will continue to plough this furrow, and we look forward to updating you on the portfolio’s progress in the months and years ahead.

Hugh Yarrow and the Evenlode Team

Please note, these views represent the opinions of Hugh Yarrow as of 28th October 2020 and do not constitute investment advice.

Valuation Footnote

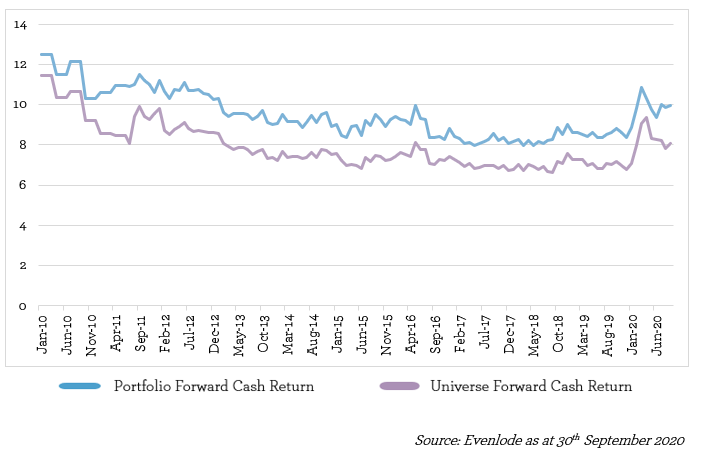

I have used this chart in past investment views to give a rough feel as to how the valuation environment looks through an ‘Evenlode lens’:

It shows our ‘forward cash return’ valuation measure and how it has varied for both the portfolio and the investable universe since the early days of the fund. It is based on our company-by-company estimates of cash generation over 10-15 years and more, so is very much a long-term measure and as such looks beyond the current crisis. It will tell you nothing about what the shares of these companies might do over the next few weeks or months. However, very crudely, we think of it as a back-of-the-envelope proxy for the annualised total return potential you might expect over the genuinely long-term (i.e. 5-7 years or more) from our estimates of fundamental cash generation. Having been in a less attractive environment over the last few years, the market reaction has brought aggregate valuations back to levels last seen in the first few years of the fund.