During the first three weeks of November, the very positive news on coronavirus vaccines and the clarity provided by the US election led to a huge surge in investor’s animal spirits and a significant rally in global stock markets.

The vaccine news in particular has driven a huge, rapid rebound in the share prices of many of the companies that were most impacted by the onset of the pandemic. This trend had been developing slowly since the early summer but reached a crescendo in November. In the space of less than a month, the market consensus has largely priced in the return to a post-pandemic economic world by the middle of next year.

Mr Market: In Search of Excitement

More generally, economically exposed 'recovery' companies have performed strongly in November (particularly those that have a high level of financial and/or operational leverage). In contrast larger, less economically sensitive companies (‘defensive’ or more pejoratively ‘boring’ shares) have fallen out of favour during the month.

Evenlode Income is up significantly in November (+7.9%), but it has lagged the FTSE All-Share by some margin (+12.7%)1. The bulk of the fund’s relative underperformance in November has been driven by its lack of exposure to the energy sector and very limited exposure to the financials sector, both of which make up a large part of the UK market and led the November rally. The fund’s holdings in consumer branded goods and technology companies also dragged on return as these companies lagged the rally. The only company-specific negative performer of note was Sage, whose shares fell -4.8% during the month. The company released results that were in-line with expectations but management announced an increase of investment to drive growth in its cloud offering over the coming year.

Year-to-date, including November’s rally, the Evenlode Income fund has now fallen -8.6% compared to a fall of -13.2% for the FTSE All-Share2.

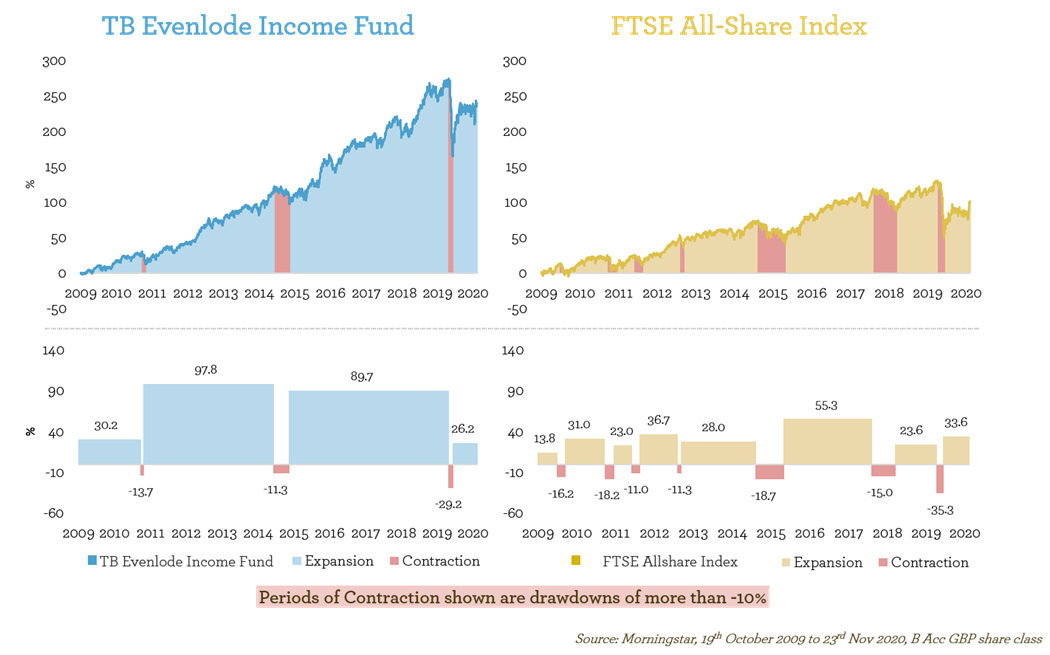

As I have mentioned before, our approach may appear unnecessarily austere at certain moments, such as during the last month. But as the two charts below show (with the shaded areas on each graph representing a drawdown of -10% or more), Evenlode Income’s performance has always been a little reminiscent of the tortoise and the hare when compared with the UK market.

We think of equity investing as a very long-term exercise in risk management. We manage risk carefully at all times because we are very aware that we’re not sure exactly what will happen in the future. This includes managing both fundamental risk and valuation risk. We think this approach works very well over the long-term but it does require discipline and patience.

An Optimistic Message

Though Mr Market may have been looking elsewhere in November, we remain positively disposed to the companies in the portfolio and feel optimistic about their prospects. They are a group of market-leading businesses with good prospects for long-term growth. We also think they are attractively valued, in fact as attractively valued as they have been for several years (as discussed in my October investment view).

These companies have coped and adapted very well during the crisis. Some companies have been more impacted by others, but in aggregate fundamentals have remained very resilient, with revenue for the weighted average portfolio expected to fall by only -4% in 2020. Whilst this resilience and adaptability has been reassuring, I think it’s also important to note that the vaccine successes and the likely end of the pandemic next year is straightforwardly good news for the Evenlode Income portfolio. This is by no means a collection of businesses that are only (or perfectly) suited for trading in pandemic-like-conditions. The management teams of these companies would much prefer a more favourable economic environment in which to operate. If global economic growth recovers in the next year or two, their growth rates will also pick up.

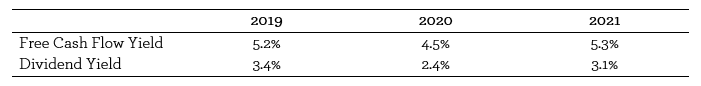

As shown below, the portfolio’s cash flow stream has also been impacted in 2020 along with revenues but has remained resilient. It is also expected to recover by a healthy amount next year3:

In terms of the dividend, our view on this year’s distribution for Evenlode Income hasn’t changed much over the last few weeks. We continue to expect the dividend stream to fall by approximately -25% for the fund’s current financial year, to February 2021 (compared to an expected fall of approximately -40% for the UK market’s dividend stream for the 2020 calendar year). As the table above suggests, dividends are then forecast to recover quite strongly in the following year, by +15% or more. The recent vaccine news obviously gives us more confidence in the likelihood and strength of this rebound. Longer-term, we think the prospects for real dividend growth remain positive, thanks to both the competitive strength and market growth enjoyed by the underlying holdings.

Business as Usual

During September and October, we had been topping up several holdings that had been negatively impacted by the crisis (such as Relx, Diageo, Smiths Group, Ashmore, GlaxoSmithKline, Spectris, Ashmore, Cisco and Intel), where we liked the combination of cash generation and valuation appeal. We also trimmed a few holdings back that had outperformed, such as Astrazeneca, Kone, Intertek and Howden Joinery.

Then in the first half of November, we removed Kone from the portfolio and added a new position in Hargreaves Lansdown (HL); both of these changes were made for valuation reasons. HL’s share price has underperformed recently due to a slowdown in client flows and some concerns over the potential for new entrants into the UK’s direct-to-consumer investment platform industry. However, we think HL’s competitive position remains strong and the long-term growth in its addressable market is attractive. The company has a net-cash balance sheet, a low capital intensity, and is highly cash generative, a combination which leads to attractive dividend characteristics. In the second half of November, we have at the margin trimmed back some of the strongest performers, including Smiths Group and Spectris, where the very strong rally brought these holdings up to the maximum position sizes we have set as part of our investment process. We have also topped up some underperforming positions such as Unilever and Sage. In summary, it has been business as usual for the fund, with gradual change driven by valuation considerations.

Valuation Appeal

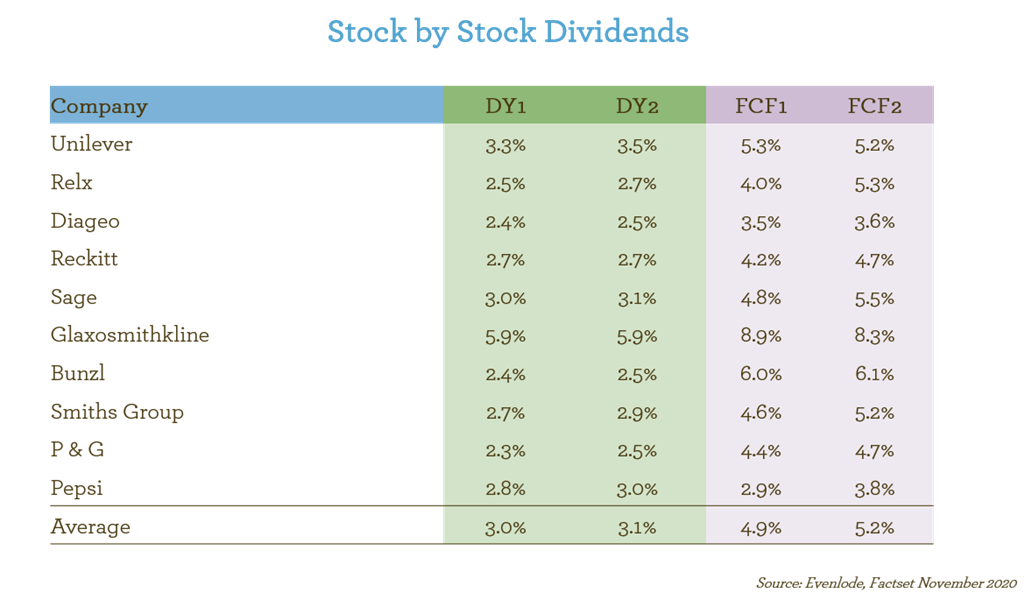

In the context of the recent market rotation, it’s worth looking at the current forecasts for Dividend Yields (DY) and Free Cash Flow Yield (FCF) of the top ten positions in the fund for both 2021 and 2022.

We find this valuation picture reassuring. Due to the way that we construct the portfolio, the top ten holdings tend to be some of the more stable, repeat-purchase (‘boring’) businesses in the portfolio. I think it is interesting to note that despite having these qualities, these larger holdings trade on an average dividend yield for next year of more than 3% and an average free cash flow yield of more than 5%. Even Reckitt, which has arguably been the only stock in the portfolio (other than perhaps Microsoft and P & G) to genuinely benefit from the pandemic, is trading on an attractive free cash flow yield of 4.2% this year moving to 4.7% next year.

Deflation Versus Inflation

I’d like to finish this month’s view with some economic thoughts. As regular readers will know, we don’t aim to make big predictions on economic developments, but we do think a lot about the various possibilities and want to make sure that the companies in the portfolio are capable of adapting reasonably well to whatever they are faced with.

Perhaps one of the most interesting economic conundrums in the world today is the existence of conflicting deflationary and inflationary forces.

The Pull of Deflation

Looking past the immediate effects of the pandemic, several factors that have led to quite deflationary conditions over recent years will remain in place after the pandemic, or in some cases intensify. One clear legacy of the crisis will be the huge amount of debt that will be left on government and private sector balance sheets. Ageing demographics and technological disruption will also remain important, multi-year deflationary forces. Though an immediate bounce-back in economic activity is almost a mathematical certainty (as people begin to eat out again, travel again etc.) there may well also be some lingering psychological impact from the crisis that continues to impact on demand and consumer behaviour in a deflationary manner. For instance, the stay-at-home trend and remote working are likely to persist to some degree. People have invested time and money in their homes and their work-from-home set-ups, so may still travel less and spend less out of the home over the medium-term. More generally, many people have lived through two ‘once in a lifetime’ economic shocks in their lifetime now (both the Great Financial Crisis and the Pandemic). This will cast a psychological shadow on many individuals who, as a result of this combination of experiences, may choose to save more money and be more careful with their spending decisions.

The Push of Inflation

In summary, deflationary forces abound. But on the other hand, given the levels of debt the world will be left with post-pandemic, and more generally the huge monetary and fiscal response to the crisis, there is clearly also the possibility of higher inflation at some point in coming years, which would help erode the real value of these borrowings. Several clients have asked us how we view this inflation risk, and whether it has any implications for the portfolio or for our future investment strategy. In summary, and as discussed in more detail in my June investment view, we think there is no perfect way of insulating one’s savings from an environment in which inflation is rising (particularly if the rise is rapid). However, there are four key characteristics that we think provide a company (and its shares) with some very important safety buffers if such a scenario were ever to unfold:

- A market-leading competitive position: Provides a business with pricing power and therefore inflation protection.

- An asset-light business model: Capital expenditure requirements remain low relative to cash generation even when the price level is rising.

- A strong balance sheet: Helps insulate a company from the rising cost of debt if, as is likely, interest rates ultimately begin to rise, as inflation becomes entrenched.

- A high and growing free cash flow yield: Offers protection if higher inflation leads to higher interest rates and bond yields.

The nice thing about all four of these qualities is that they are not just desirable in inflationary conditions, but are also desirable in more deflationary conditions (and anything in between).

To conclude, none of us know quite what will happen over the next few years. But market-leading companies with asset-light economics, good growth prospects and attractive valuations should remain good friends to long-term patient savers.

In terms of the Evenlode Income portfolio, we will aim to continue to curate a list of companies that possess these characteristics over coming months and years. We feel cautiously optimistic as we head towards 2021 and look forward to updating you on the fund’s progress.

Hugh and The Evenlode Team

November 2020

Please note, these views represent the opinions of Hugh Yarrow as of 30th November 2020 and do not constitute investment advice.