I was recently informed that to have ‘tea’ means to have ‘hot gossip’ or ‘drama’. A quick Google confirmed that the definition provided by my fourteen-year-old in-house internet correspondent was indeed correct. Like many a novel cultural phenomenon, the term was popularised via the internet. Memes are shared in a flash and can rapidly add to the lexicon.

The start of 2021 has seen the financial world wake up to the power of the “meme investment”, the GameStop/WallStreetBets phenomenon being the most (in)famous example of ordinary internet-dwellers moving markets. As with many internet fads, we were happy to let that one pass us by (at least financially), but there has certainly been something driving equity markets in recent months and retail investor activity forms at least part of the picture. The S&P 500 index hit a new high this week, with a sell-off of technology companies earlier in March reversing course.

We have set out our role as stewards of our clients’ capital as consisting of two parts - first identifying decent, asset light, cash generative businesses, and second investing in them at attractive prices. Short-term fluctuations in share prices interest us in relation to the second part. Such price moves can throw up interesting valuation opportunities within the sub-set of companies that we have previously identified as high quality, cash-compounders. Whether the market is driven by professionals, computers, or people getting ideas from Reddit, we can still apply this process.

The market fortunes of the businesses we select will in the long run be determined by how they fare in their real-world operations (in the short run that is not necessarily so, as GameStop amply demonstrates). The first quarter of the calendar year gives us the opportunity to assess how companies are getting on fundamentally as a majority publish their full year results. Has any metaphorical tea been spilt in the Evenlode Global Income and Dividend portfolios?

Results - Keeping it in the cup

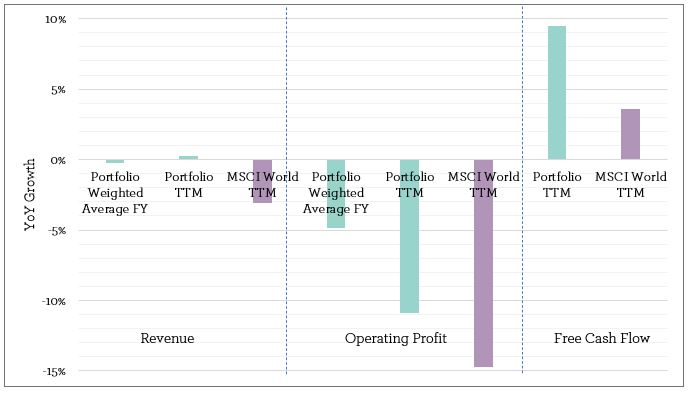

The 2020 corporate experience was dominated by reaction to coronavirus-induced lockdowns. Within the portfolio this was no different. There were some companies for whom the pandemic was a benefit, and others which suffered financially. However, for the majority of companies, whilst there was no doubt a lot of paddling that had to go on to keep things swimming in the right direction, the out-turn was financially pretty benign. Three quarters of the portfolio reported revenues that remained within 10% of the prior year’s result, and over half fluctuated by less than 5%(1). Overall revenues were flat on a weighted average basis, and profitability dipped marginally(2) as companies absorbed additional costs to remain safe and operational during the pandemic.

Importantly, thinking about our strategy targeting cash generative companies, free cash flow grew for the businesses within the portfolio(3), as pandemic-related costs were offset by reduced spending on things like corporate travel and marketing, improved working capital, and in certain cases by lower capital expenditures. These costs will likely return in the future, but perhaps with a different magnitude and mix of where cash is spent. It seems likely that business travel will be subdued for some time, but the infrastructure to enable reliable (and endurable) remote collaboration will require investment.

Of the beneficiaries of the pandemic, medical diagnostics outsourcers Sonic Healthcare and Quest Diagnostics were the most obvious, with full year revenues growing by +33% and +22% respectively. This does mask the underlying volatility that these businesses experienced though. Early in the pandemic they had to deal with a severe drop off in the routine medical testing that is their bread and butter. Subsequently Covid-19 testing came on stream and healthcare systems learned to cope with the new virus and more run-of-the-mill illnesses simultaneously, before reversing with the winter-induced second wave of coronavirus. That volatility through the year is reflected by the quarter-to-quarter performance across most areas of the portfolio, demonstrated by overall fourth quarter revenues increasing by 5% compared to a year earlier(4), following more difficult second and third quarters. Staying with the positives, online marketplace operator eBay saw full year revenues increase by +20% as enforced home-dwelling encouraged shoppers and merchants online.

Of those that suffered, things were particularly acute for the recruitment sector, with PageGroup’s revenue falling by -29% and Adecco’s by -15%. Adecco was helped by being more in temporary staffing and mass recruitment, seeing demand from sectors such as logistics and supermarket retail to support the sudden increase in home shopping. This was not sufficient to offset the brakes being put on many people either wanting or being able to move jobs however. Of the portfolio’s larger holdings, eyewear and eyecare giant EssilorLuxottica’s revenue fell -17%, with a lack of holidays and travel retail meaning demand for sunglasses in particular was severely affected. Where businesses have seen more meaningful impacts from the pandemic we have carefully considered their financial strength. In all of these cases discussed, cash flow has been resilient and balance sheets are strong. Confidence from management has been demonstrated by the retention of the dividend payout in Adecco’s case, and its resumption from EssilorLuxottica.

So to belabour the metaphor, while some cups have been jolted resulting in a minor of spillage of hot beverage onto the corporate coffee table, the majority has managed to stay pretty much contained in its vessel.

Reading the leaves

This sort of steady performance is not the sort of thing to get the pulse racing, but as we noted in our January investment view steady corporate performance is the sort of thing that we target. That we have seen it within the portfolio was not a foregone conclusion of course (particularly last year of all years), and so we are reasonably happy with the result. By way of comparison, the MSCI World Index showed revenue and profit declines greater than the portfolio, as summarised on the chart [below](5) (FY = Latest Full Financial Year, TTM=Trailing Twelve Months as at 31 December 2020. Portfolio figures are different due to companies having different financial year ends).

Source: Evenlode Investment Management Ltd

The equity market appears to agree that the sort of performance exhibited by companies within our portfolio is not exciting and instead is being driven by sectors where there has been a lot more drama (e.g. financials, resources companies), and by companies where valuations are weighted more on future earnings than current ones, particularly (but not exclusively) in the world of information technology.

Some of our favoured companies and sectors are currently being a bit left out of the market excitement, which is ok – it means we have good companies we can invest in at increasingly attractive prices – but it does mean that there is currently a drag on the relative performance of the portfolio against the market. Of particular note is the consumer goods sector where companies like Nestle, PepsiCo and Procter & Gamble have seen their share prices drift down as others have surged ahead. We are seeing something similar in the healthcare sector too, where even the very positive results seen by Quest and Sonic have not been sufficient to raise their market valuations over the last six months or so.

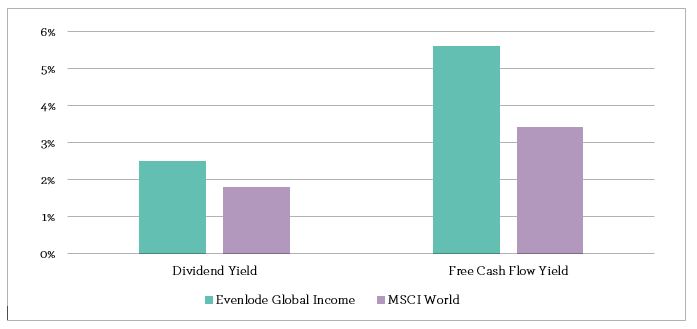

The chart(6) reflects this trend in terms of two valuation metrics we look at regularly – dividend yield and free cash flow yield, compared to the MSCI World index. We usually aim for a free cash flow yield premium to the broader market, which demonstrates valuation discipline, but the differential has widened of late.

Source: Evenlode Investment Management Ltd

One final observation of note to a dividend-focused strategy is what has happened to corporate distributions over the last year. The portfolio’s distribution fell by -10% year-on-year(7) as some of the more troubled companies rightly conserved their cash. We are now seeing this reverse, with an average increase in the full year dividends declared by portfolio companies of +8%, plus the re-instatement of previously cancelled dividends. We are forecasting an increase in the fund’s payout for this financial year of +16% at the time of writing. We issue the usual caveat about the uncertainty of forecasts, but with strong free cash flow and balance sheets in evidence backing these prospective dividends we can perhaps err on the side of positivity.

So in conclusion the portfolio has seen robust revenues, strong cash flows, decent valuations, limited drama, and no ‘tea’.

So in conclusion the portfolio has seen robust revenues, strong cash flows, decent valuations, limited drama, and no ‘tea’. We’re unlikely to get ‘memed’ (is that a thing?) with such mundanities, but it does set up the prospect of attractive risk-adjusted returns through time.

That’s hopefully worth putting somewhere on the internet, even if it’s just our own website.

Ben Peters, Chris Elliott and the Evenlode team

17th March 2021