The fund rose by +26.9% in Yen terms since launch in February 2021*.

Whilst the overall move in the market (+3.5%) suggested a dull year, it was anything but seeing very significant rotation within the market. We witnessed the return of alpha generation for bottom-up stock picking fund managers after a decade when a handful of ‘quality growth’ companies have led the market at the expense of everything else. 2021 is really the first year that this positioning has been seriously questioned.

One of our core principles at Zennor is that Japan is in the early stages of a revolution in corporate governance. This will improve operating efficiency, unlock balance sheets, and raise valuation levels. Contrary to popular perception Japan has already improved ROE and earnings power meaningfully since 2010 which we believe is the primary reason that Japan has outperformed most developed markets. We believe that this will be a fruitful hunting ground for differentiated individual stock performance. Our opportunity set is constantly evolving as stocks, sectors and styles move in and out of investor favour. There are times when fear prevails and only the safest stocks are bid up; others when exuberance is abundant or when certain sectors are totally ignored. We look to exploit the Overlooked Assets, the Mispriced Cash flows and the Under Earning companies coupled with positive catalysts. We continue to see meaningful opportunity within the Japanese market with +101%** upside to intrinsic value in the Zennor Japan portfolio.

A brief look back at the growth bull market of the 2010s and some lessons learned

As with all investment waves, what starts as an undiscovered and compelling opportunity, evolves into a consensus, and then becomes propelled by momentum to unsustainable levels. We suspect that 2021 marked a high point for parts of the growth spectrum.

Starting in 2010 the problem was not finding reasonably priced growth - it was abundantly available. However, what was often misread as the decade progressed was the scarcity of growth in a deflationary, tech-impacted world within an excess liquidity environment, and the lack of mean reversion in earnings power for impacted industries. From 2018 growth multiples moved up far in advance of earnings power. These developments presented significant challenges for managers fixated on ‘cheapness’ rather than intrinsic value. The Zennor investment process has pragmatically adapted to reflect this environment.

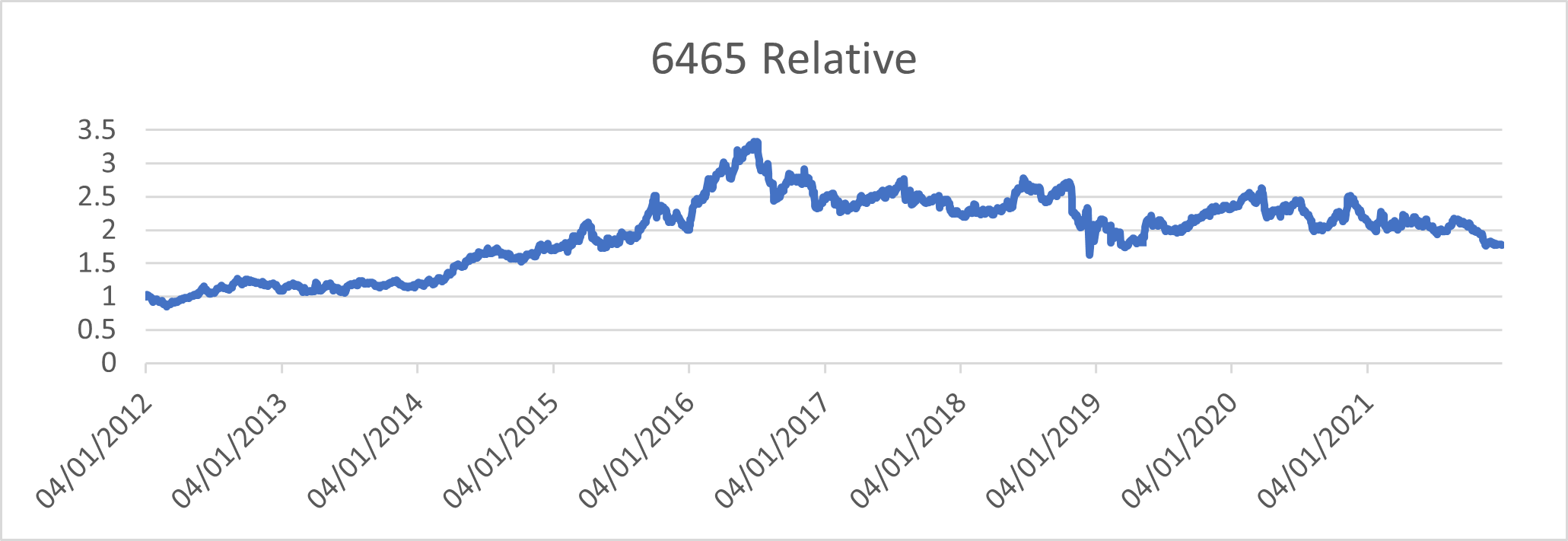

Hoshizaki (6465)

Here is the chart of Hoshizaki’s valuation relative to the Japanese market. As can be seen in 2012 it was only 0.6x the market; a mere eighteen months later the relative PER had hit 1.5x but it then went to over 3x before collapsing.

Source: Zennor Asset Management

Source: Zennor Asset Management

Earnings rose from Y16bn at the operating level to over Y36bn. This was much better growth compared to the earnings per share growth for the index until 2016. Subsequently, Hoshizaki stumbled and has derated. The moral of this story is that it was right to buy a great company at a low price, easy to sell it far too early and wrong to be too greedy and ignore deteriorating fundamentals.

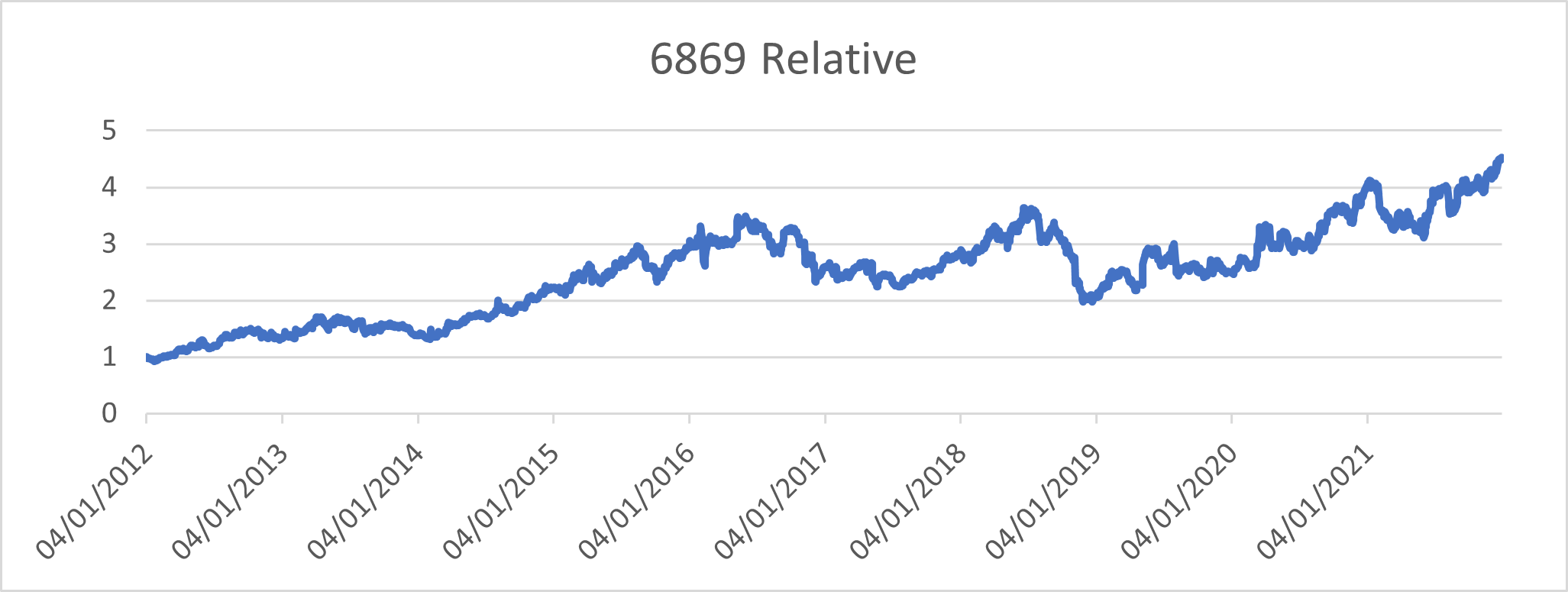

Sysmex (6869)

A blood testing device company which has successfully established itself globally. It combines engineering excellence, a strong business model and a shrewd management team. It is a great success.

Source: Zennor Asset Management

Source: Zennor Asset Management

In 2012 Sysmex was available at a discount to the market, by 2014 at a 1.5x premium and by 2021 4x the market at over 60x PER! Whilst Japanese EPS is up 2.5x over 10 years, Sysmex has seen its operating profit up 4x. It has also massively rerated. A better business and a rerating in an era of excess liquidity and scarce growth have produced turbo charged performance. With hindsight there have been several good buying opportunities in Sysmex – 2012, 2017 and 2020. Being pragmatic, we aim to exploit those few opportunities to buy great companies at a meaningful discount to intrinsic value. 2022, however, has begun to see a reckoning for some of these stocks. Great companies, perhaps at the wrong multiple?

The mistake for many value-oriented investors in 2010-20 was becoming too obsessive about deep, historical “value” with poor operations at the expense of not looking carefully enough at emerging businesses with winning ideas that were also compelling investments. Buying ‘cheap’ stocks whose underlying business has been profoundly disrupted with frequent negative ‘catalysts’ is not a good way to compound capital. Intrinsic value must mean focusing not just on the past glories but also future earnings power. The mistake growth investors today may be making is in overpaying for good companies, as the harsh falls in many smaller growth names over the last six months highlight. We are not wedded to deep value, or high growth, but simply wherever the best opportunities present themselves.

Our own stock and sector allocation is driven by the upside potential to intrinsic value, the presence of positive idiosyncratic catalysts and sensible diversification of ideas. This means that our exposure to overlooked assets, mispriced cash flows and under earners will vary (markedly) through time. In our pre-launch model, we had a healthy initial exposure to growth stocks that by February 2021 had moved to an overweight in cyclical areas of the market. Through Spring 2021 as growth derated and value soared closer to our intrinsic value estimates we flattened this exposure buying stocks such as T Hasegawa and BeNext Yumeshin. In December we reduced exposure to technology and real estate after our upside declined and recycled capital into construction, and consumer names that had been very derated due to Covid fears. This is a very dynamic capital allocation process where we are typically selling stocks with perhaps +10-25% upside left to buy those with 80-100%+ potential. Whilst many growth names still look seriously overvalued (to us) there are some that are now beginning to offer sensible valuation levels. Previous, bitter, experience suggests that you should not be too quick to try and call the turn in a cycle – at the bottom things are often far cheaper than you would have imagined they could be. Afterall a significant percentage of our portfolio already trades for ‘free’!

As we move into 2022, with an end to quantitative easing and a possible return to a more inflationary outlook for both wages and input costs, how many Hoshizaki’s will stumble and derate? If you don’t have a “margin of safety” in the valuation, then when the downward revision comes the pain can be severe. We always demand a margin of safety from valuation and balance sheet. Classically investors want to own companies with a strong balance sheet, robust free cash flow, an operating business with a future and at a meaningful discount to intrinsic value. What we at Zennor have brought to this is an additional insistence on positive catalysts to re-rate the shares higher – to avoid the deep value traps and minimise negative event risks. By skewing both valuation and catalysts in a positive direction we believe that we can create an asymmetric risk: reward profile that is compelling.

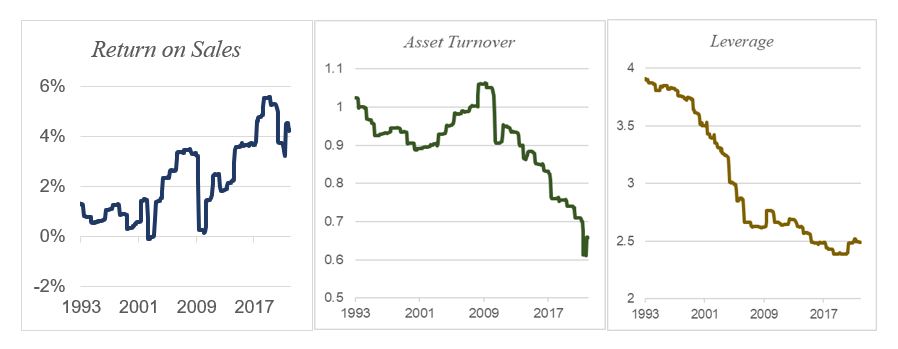

Zennor recognises that we are in a period of great structural change in Japan. The gradual revolution in corporate governance continues to push improved corporate behaviours and has opened the market for corporate control. Japan is frequently seen as a laggard in corporate efficiency and shareholder friendliness – and it is. Yet over the last decade governance has improved. Over the last decade ROE in Japan has steadily improved – however a closer look reveals that a huge opportunity remains. Japanese firms have raised ROE entirely through higher profit margins – measures of balance sheet efficiency such as Asset Turnover and Leverage have deteriorated. Japanese corporate profits and balance sheets have never been in better shape.

Source: SMBC, Nikko, Zennor Asset Management

The growing market for corporate control means that these large excess assets can now be competed for by other firms, P.E. and by activists. High profile investor engagement efforts at Toshiba and Fujitec are but the tip of an iceberg of investor activity. This leaves Japan in a unique position for a large developed market of many companies with enormous net financial assets, improving operating performance and very low valuation multiples. The governance revolution which started in the US in the 1980’s that moved to Europe in the 1990’s/2000’s, creating enormous corporate value in the process, has now moved to Japan.

This leaves investors in somewhat of a quandary. Many old industries are being disrupted so aspects of value investing are fraught with peril. Yet the overall multiples for growing businesses do not offer a margin of safety - dangerous for those focused on growth. What Zennor brings is a pragmatic approach that reflects the best of both mindsets – a significant margin of safety from balance sheet and valuation, and a strong awareness of future earnings power coupled with an insistence on positive catalysts.

Reviewing our trades of the last decade we sat down and realised whilst we had been very good at finding ideas we had not ‘run our winners’. At Zennor we are looking to be more flexible in our use of appropriate mental models for valuation. Looking at Mispriced Cashflows we have been more focused on understanding the earnings leverage in some corporate business models as they move from over capacity to structural tightness, such as Shinko Electric (6967). On the Overlooked Assets we are finding ‘deep value’ names, trading far below liquidation value, which may be bid for in either parent/child consolidation or where their capital strategy is changing dramatically. This means that the investment opportunities available in ‘old Japan’ can sometimes be just as exciting for us as those offered by growing businesses. This extremely heterogenous opportunity set is in large part why Zennor was established – there are very exciting businesses and there are very exciting valuations. We have tweaked a long-proven process to take more account of the changes driven not just by technology but also in market structure after the governance reforms. In some ways we have gone back thirty years fusing deep value with a pragmatic “growth at a reasonable price” approach.

What worked in 2021?

Zennor approaches the market with an absolute return mentality looking for what we believe are the most compelling 25-40 opportunities. We try and underwrite a +20% IRR on each investment, or ‘Stocks that can double’ on a 3-5 year time horizon. In 2021 we won more than we lost - compounding at +30%.

Industrials is a very diverse sector but was our top contributor to return. BeNext Yumeshin (2154, +42%), the staffing agency, produced excellent returns. Synergies are now evident between the two merged companies, cash flow conversion is excellent and an improving operating margin is likely. Katakura (3001, +58%), a real estate play that we have held since inception, received an (rejected) MBO bid which highlighted its value. Nippo (1881, +26%), the road paver was subsumed by its parent Eneos (5020) at a premium. Nishimatsu Construction (1820, +43%) bought back close to 30% of the company and we sold into that event.

Within Financials we got Orix (8591, 33%) right. Despite headwinds from aircraft leasing, airports and hotels the company continued to buy back stock and raise the dividend, whilst the rest of the business is operating at pre-covid levels. Profits have been particularly robust at Orix USA and in the Real Estate and Insurance divisions. They also saw private equity exits in the USA (Roadsafe) and Japan (Yayoi). Our thesis that Orix is evolving towards a Macquarie / Brookfield model is not yet accepted by the market. Orix trades at half the multiple of those global peers and we believe the company has much further to go in its business model transformation.

Technology company Shinko Electric (6967, +99%) benefitted from the move from cyclical oversupply to a new tight supply/demand balance caused by the migration to new packaging materials and continued server demand. An improved earnings structure has left analysts constantly behind the curve with earnings expectations moving strongly higher. The company has the added benefit of being a Fujitsu group listed subsidiary offering the prospect of corporate action.

What went wrong in 2021?

We must confess sins both of commission and of omission. In hindsight we failed to capitalise on the tightness and dramatic recovery witnessed in the shipping industry. The shipping shares were obviously at a profoundly distressed level, the market was obviously improving, and we could see earnings would be very strong. Our only excuse for not having a position was (incorrect) concerns about the balance sheet position (too weak) given cash flow generation (much, much higher). This was a BIG and very expensive unforced error. Sun Corporation (6736, -31%) has so far not worked well. The value of its cash and stake in Cellebrite equates to Y100bn versus the current market cap of Sun Corp, which is Y50bn. Cellebrite itself now trades on 3X sales, which we think offers good value in this highly profitable software company, but has struggled since it de-SPACed. The lesson we have to take away is that if the underlying holding performs poorly then the stub trade will still rerate downwards. Finally, although we were aware of the Delta variant impact in summer, and we cut back our weightings to exposed stocks it is evident that we did not back our insight aggressively enough. We should act more decisively.

Global Outlook 2022

Zennor are fundamentally driven, bottom up investors. We are not market timers or macroeconomists! Our high level message is that Zennor believes that the economy will be OK in 2022 as COVID impacts dissipate and things normalise. A good part of our portfolio is centred on earnings power normalising as restrictions are lifted and disruptions abate.

- Monetary policy will remain accommodative but will tighten

- Structural reflationary pressure?

- Covid pent up demand remains

- Inventory cycle is underestimated

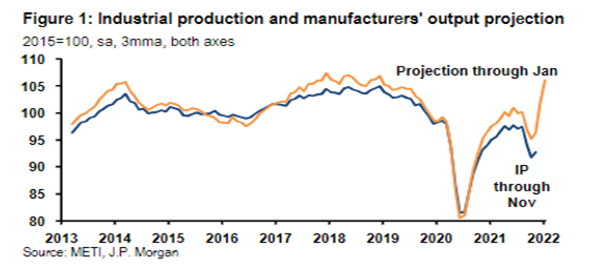

As we move into 2022 the global economy will continue to see above trend growth, but the threat of inflation is clear. Whilst central bankers are focused on rates and high powered money they neglect the potent force of private sector credit creation – unseen since the GFC. In this case it seems likely that central banks will find themselves quite far behind the curve. Many economies, including Japan, have laboured under Covid restrictions and there remains huge pent-up demand for re-opening, tourism, and eased supply chain disruptions that could provoke a powerful inventory rebuild cycle. We believe that structurally capex will rise as many countries have to upgrade their infrastructure, this also has implications for commodities where chronic underinvestment, long lead times and robust demand will lead to sustained structural tightness. Whilst, some of the inflationary pressures appear transitory, it is likely that a higher rate of inflation globally is here to stay vs. the goldilocks period of 2010-20.

With unemployment low through the developed world, wages are rising as well. Whilst we will see inflation moderate as the year progresses, structural tailwinds in the labour market seen in the last twenty years are less likely to occur. The twin tailwinds of a rising work force and globalisation are now reversing. Working age populations are predicted to fall from here, and “de-globalisation” of supply chains has started.

The Fed has begun to signal a more hawkish stance, and is tightening its monetary policy from a very accommodative stance. The tension between private sector credit creation and the Fed’s monetary policy tightening will be key to the overall global liquidity environment this year. It is probable that the tensions between inflation, rates and liquidity come to a head in 2023. We will watch this closely...

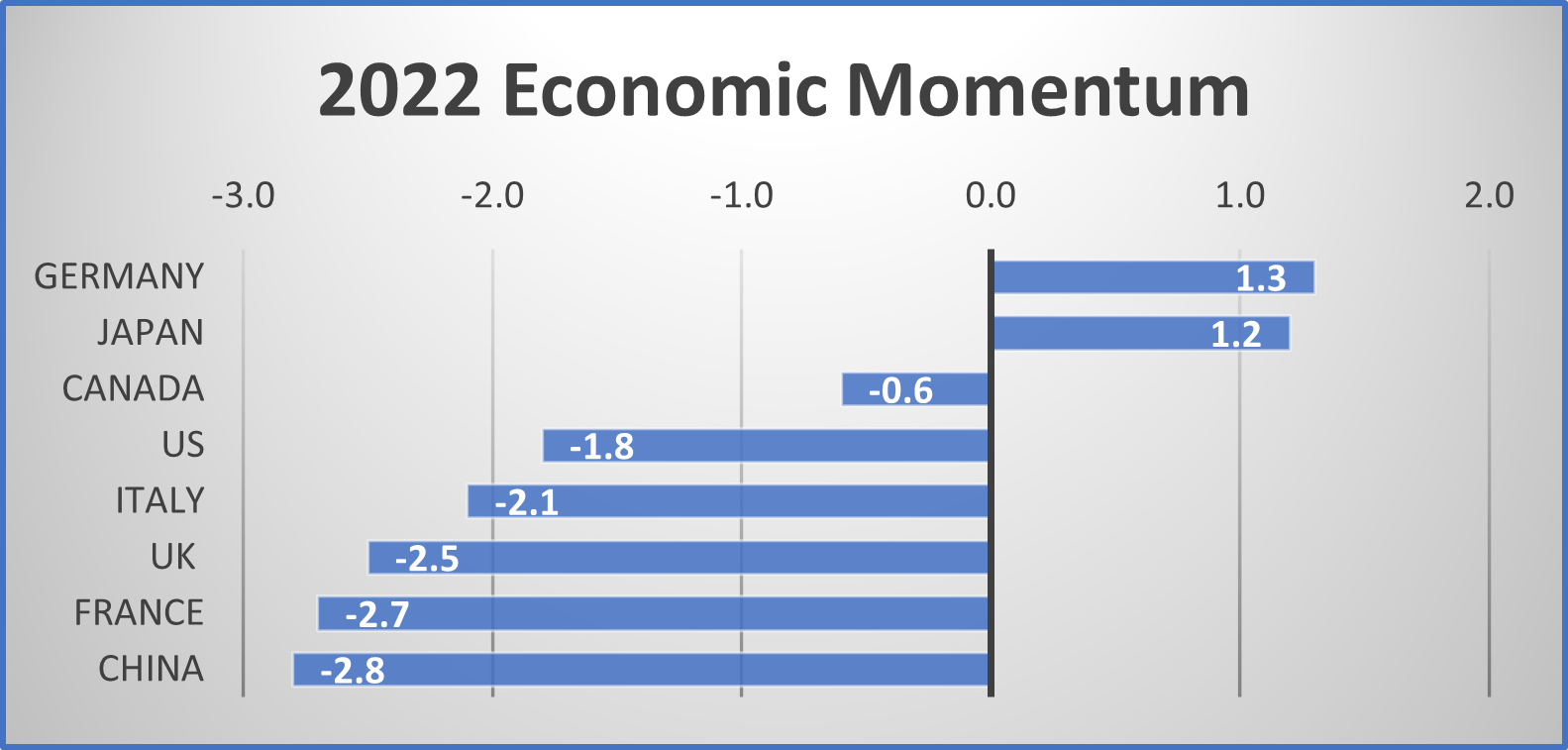

The Japanese economy will, with Germany, see the best YOY change in real GDP.

Source: CLSA

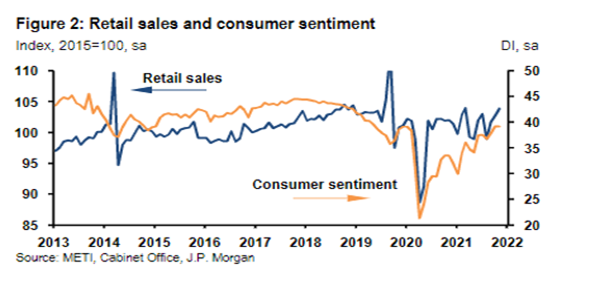

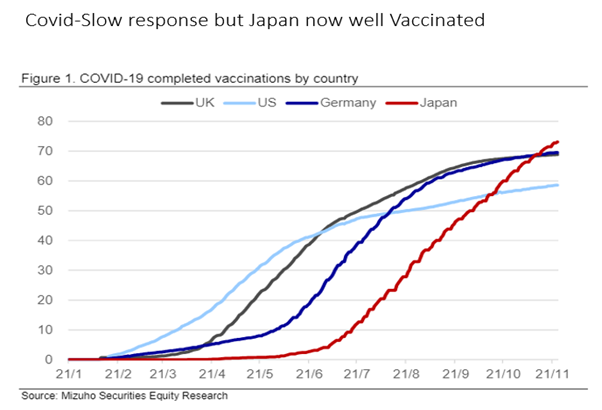

Much of this is to do with the economy being shut down for much of last year as Japan was slow to vaccinate, and was hit tremendously hard by supply side issues and a dramatic slowdown in auto production. These negatives are all expected to reverse. Japan is also a country that has struggled to generate inflation over the last 30 years. An end to global disinflation should feed through into Japanese inflation rates.

We believe that most economists under estimate the impacts of restocking and inventory cycles on production. As US auto sales rise from 12-> 18m and inventory days from 20 -> 40 this means that in addition to the 6m incease in volume there is also a huge jump in required inventory for the OEMs and within the supply chain as well.

Although Japan was incredibly slow to roll out the vaccine, we anticipate a gradual reopening in Spring 2022.

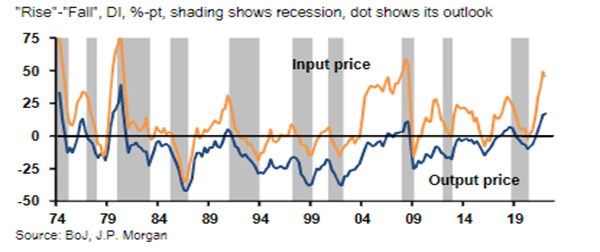

Whilst developed markets grapple with inflation, Japan at least for the time being is less affected. The Bank of Japan is modestly raising its outlook on inflation, driven by rises in the price of oil and natural gas. However, there is a clear bifurcation between manufacturers raising prices and non-manufacturers who are generally not. At this junction the BOJ is predicting +3.2% Real GDP and 1.2% Core CPI. If the Yen were to keep depreciating and oil rises further, then the CPI could hit 2%.

The Japanese Stockmarket

We continue to think that the Japanese market is attractive:

- Underowned by global investors – even compared to normal!

- Strong growth in earnings not matched by rising valuations

- Record RoE and record cash generation

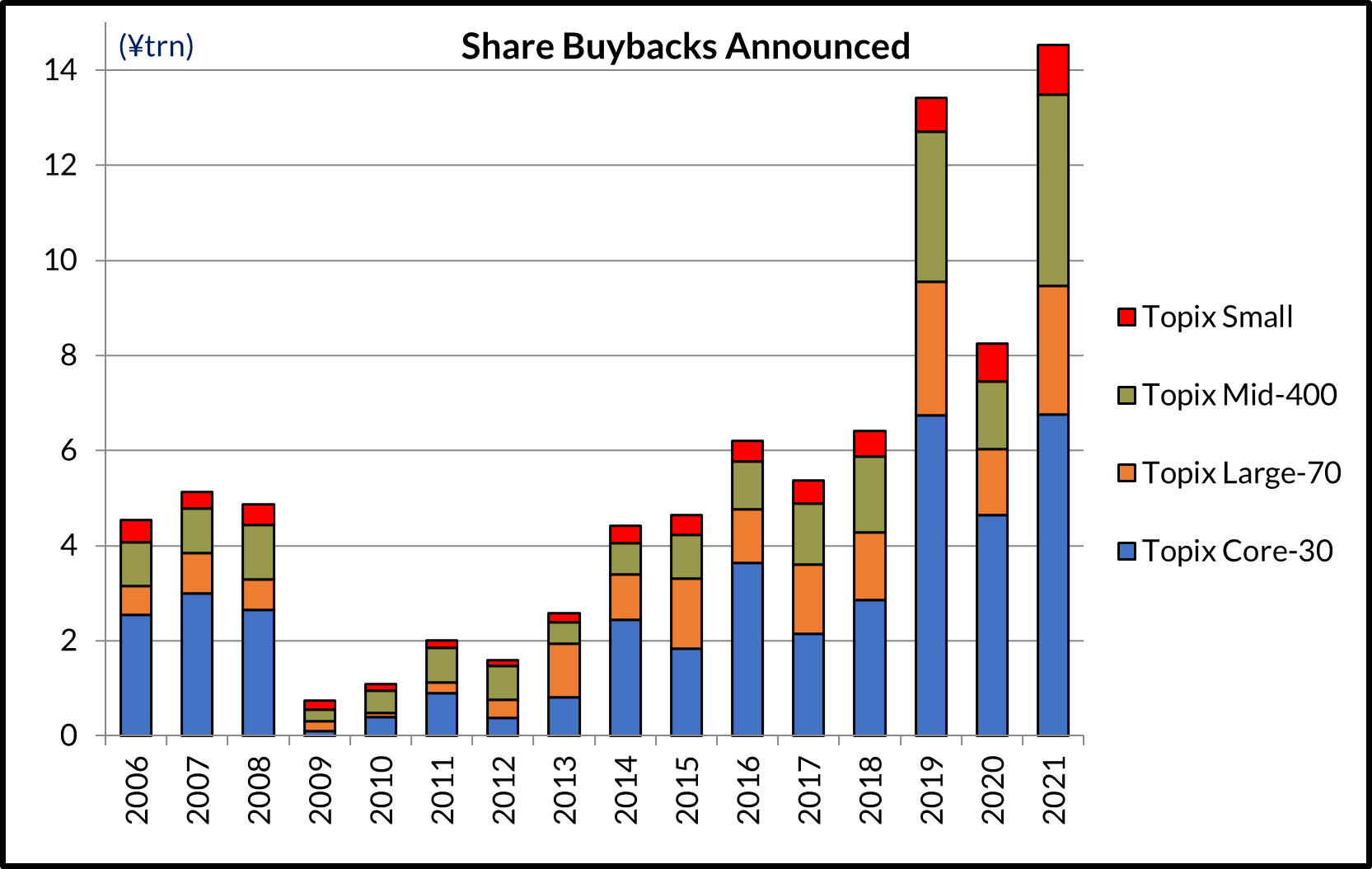

- Improving governance and increasing buybacks and dividends

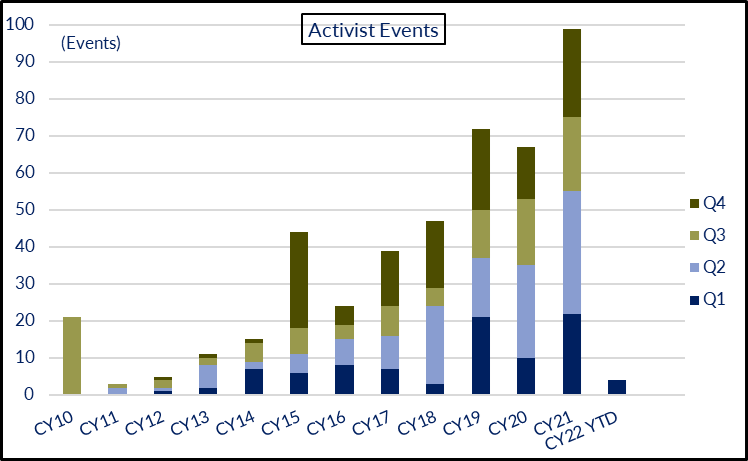

- Market for corporate control is open

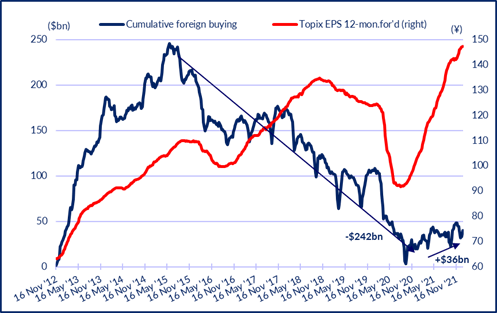

Japan remains neglected by global investors. Nicholas Smith at CLSA has a wonderful chart illustrating this.

Source CLSA

Source CLSA

The market has risen +240% since 2012 yet earnings have outstripped that, rising over +300%. The Japanese market has derated at a time when most other markets have seen valuations expand. The US market has returned +500% since 2012 but earnings have risen only +200%. The foreigner put in over $200bn in the heady days of Abenomics only to take it all out again. How then has the market carried on going up? Simply, that Japanese companies and private equity firms have been buying themselves at a record rate. It also shows that Japan does not need foreign investors to perform well.

Earnings per share continue to go up. Return on Invested Capital has gone up. Share buybacks are plentiful and corporations think THEIR market is good value. At a time when cost cutting has run its course overseas we can still see further gains in ROIC, just from simple balance sheet restructuring. In contrast to Japanese corporates and private equity, Goldman Sachs calculate that the typical foreign institutional mandate is about 8% underweight Japan. With a cyclical recovery, low multiples and ample opportunity for balance sheet reform this suggests that many investors are offside.

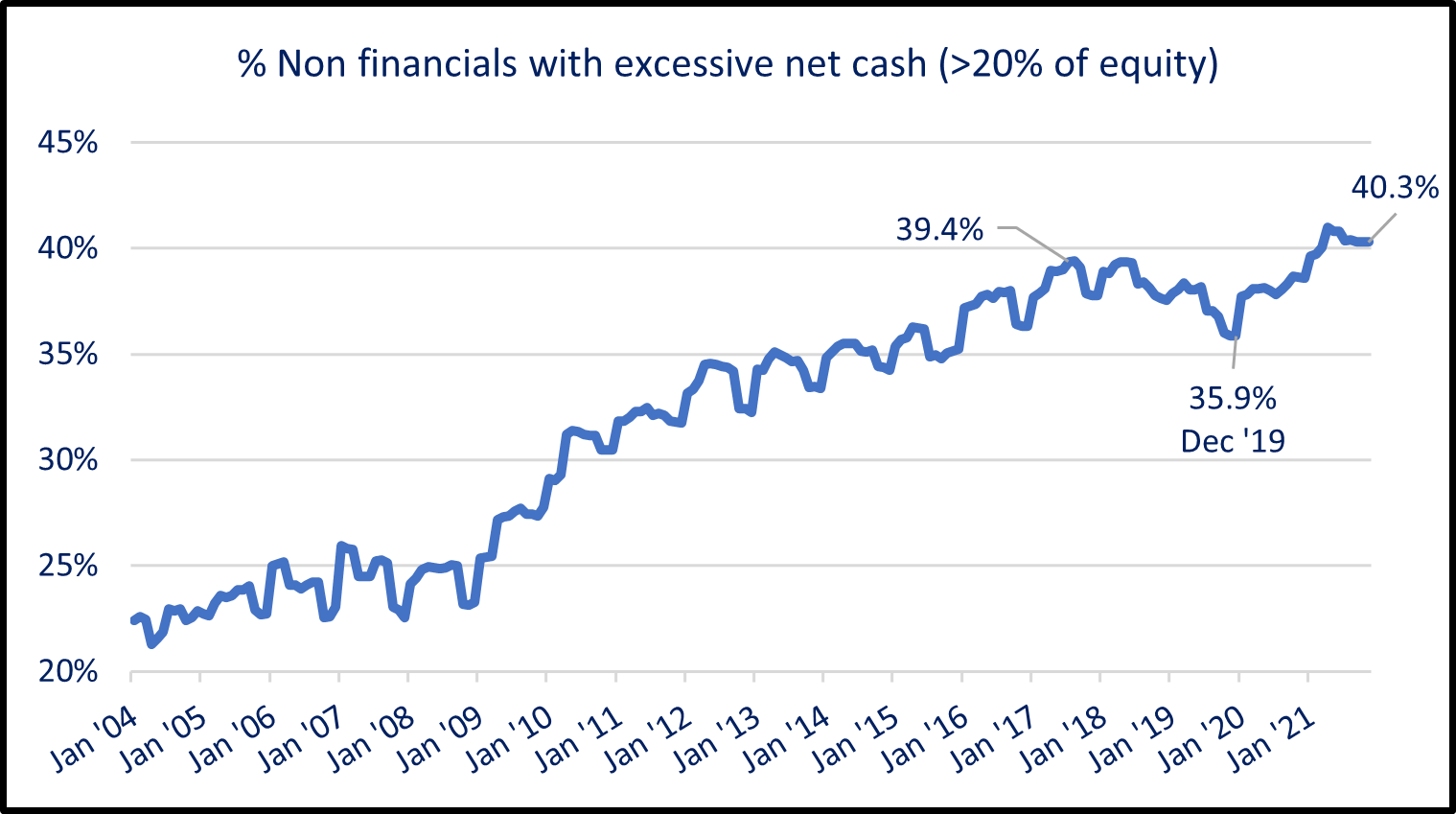

Half of TSE First Section stocks trade at below break up value and >40% of companies have in excess of 20% of shareholders equity in net cash. Buybacks were up +70% YoY and activist events up +40%. Despite these buybacks and higher dividends, cash continues to pile up at a record rate.

Source: CLSA

The combination of better governance, high cash generation and low valuations are driving changes in capital policy AND in activism.

Source: CLSA

Source: CLSA

Activism is alive and well with a record year. The portfolio benefitted from this trend with seven capital events. To name a few - Katakura 3001 (MBO), Daibiru 8803 (Mitsui OSK 9107), Nippo 1881 (Eneos 5020), Secom Joshinetsu 4342 (Secom 9735), Nishimatsu 1820 (tender), Jafco 8595 (15% buyback). This continues to be a theme to which we have meaningful exposure.

Source: CLSA

Source: CLSA

How are we positioning the portfolio for 2022?

As we start 2022 we have top sliced some of the biggest winners from last year given limited upside. The new positions have tended to be consumer oriented after a torrid 2021. At a portfolio level we see 101% upside to intrinsic value.

Cognisant that we don’t want to end up stuck in the perennial “value traps”, we have, however, changed the shape of our finacials exposure. MUFG (8306) is now weighted at >5%, and is a beneficiary of rising US interest rates through Morgan Stanley. This was funded through exiting venture capital firm JAFCO (8595) whose NAV moves directionally in line with smaller growth names and is exposed to growth derating pressures.

We have also rebuilt positions in auto parts stocks ahead of what we expect will be a production recovery next year. We expect much higher than consensus earnings in 2023 and several new technologies that should offer more visible structural earnings growth as they kick in. For Koito (7276), Adaptive Beam Lighting in the USA, followed up by LIDAR sensors from its partner Cepton for GM offer a powerful growth trajectory. Musashi Seimitsu 7220 continues to win increased orders at both VW and Nidec (6594) for its EV products which we believe can drive a 15% CAGR. Zennor believes NSK (6471) management is changing its approach to its underperforming Electronic Power Steering division. We also believe that the market is underestimating the potential benefits from a shift to electronic vehicles in its automobile bearings business. Recently we reinvested the money from Mitsui OSK’s bid for Daibiru into construction company Kumagai Gumi (1861), with a current total shareholder return of >7% per annum, improving trading, a large listed shareholder trading at a discount to net financial assets.

We remain very overweight technology materials, where Japan still retains a commanding lead, such as C. Uyemura (4966) that continues to perform well and offers value on <11x PER. T. Hasegawa (4958) is a stock where we see the business moving into a sustained phase of growth driven by their international business. This $1bn company is so far uncovered by mainstream analysts but has made great strides in strategy, disclosure and governance in the last year.

The Zennor Japan Portfolio trades on 11x forward PER, a discount to the market’s 15x, and on 0.78x book value versus 1.2x for the overall market. Our firms have substantially stronger balance sheets further reducing valuations and risk. Our portfolio upside to Intrinsic Value is +101%**, somewhat in excess of our 20% annualised ambition. In terms of short-term index potential, a relative return in excess of >10% seems realistic.

Zennor Corporate Update

2021 was an eventful year for Zennor Asset Management LLP. We launched our Japan fund, Zennor became FCA registered, and we were very pleased to welcome Sachin Patel as our COO in December 2021.

We are very grateful to all of our investors as well as our (often unsung but not unappreciated) team: Petya, Sachin and Hugh; and also for all the hard work done by our marketing partner, Spring Capital. We would also like to thank Michael Alen-Buckley, Roger Mayhew and Paul Kirkby from Zennor Capital Holdings Ltd. for their ongoing advice and encouragement.

Thank you all for your support.

James Salter and David Mitchinson

20th January 2022