Events of the last 6 months are a useful reminder of the folly of macro forecasting. You can now place your bets anywhere between a stagflationary environment and a re-enactment of the roaring 20’s! Our approach to incorporating different macro scenarios is both bottom up and top down. At the stock level we incorporate a (typically very) wide range of macro outcomes in our cash flow scenario analysis work. From a top-down perspective our portfolio construction deliberations consider sensitivity to different macro scenarios. Without committing to a specific macro outcome in this piece we are going to focus on our portfolio structure as a consideration for how we might fare in a worsening economic environment.

Firstly, a digression. When we were talking about establishing this fund five years ago, one of the basic premises was that we did not want to be beholden to a particular style being in vogue or having a portfolio whose success was largely dependent on a particular macroeconomic outcome. Been there, done that. Hence from a stylistic perspective we adopted a blend of value and growth, and by emphasising the under-researched parts of the market we have been able to focus on smaller companies where we feel the structural growth opportunities outweigh cyclical considerations.

It is this latter point, structural versus cyclical we seek to emphasise in this note. Without of course being immune to cyclical pressures, we feel the fund is positioned to benefit from structural more so than cyclical factors and that this distinction should help us through what could be a more challenging economic environment.

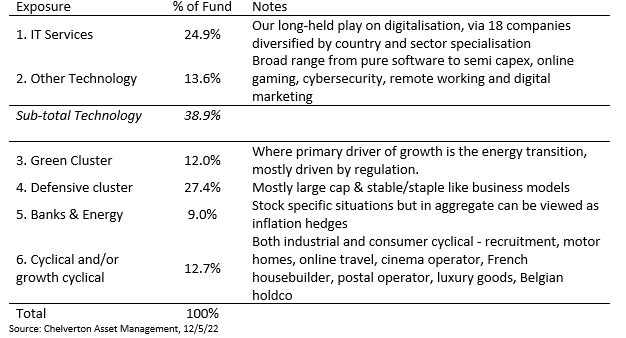

The standard factsheet depiction of a portfolio can give helpful information, but, in our view is best supplemented by thinking more about the underlying exposures and why they exist in a portfolio. The following table is another way of thinking about our portfolio and the narrative which follows expands on the exposures:

The following sections take each of these groupings in turn prior to looking at how this might compare to ‘the market’.

IT Services

The key debate here is whether an economic slowdown might derail the strong tailwinds these companies are experiencing from the technology investment by their clients. The consistent message we get from our holdings is that the work they are doing, and the tailwinds are so strong that (at this stage obviously) they are confident their growth will continue.

Companies are telling us that the constraint on growth is not ability to get clients, it is shortage of IT engineers and we are seeing this in prices being passed on to clients. We believe there is a significant shortage of human capital in the areas of Artificial Intelligence and Machine Learning over the coming decade and that the companies we have invested in can benefit from this supply/demand mismatch.

Many of our holdings are due to receive a boost from ‘NextGenerationEU’, the stimulus package which will boost digital investment where it is needed most. Of course, there is risk that fiscal priorities change but we believe this stimulus is a long-term committed one.

For this segment of the portfolio then, we feel confident that whilst there may be some project deferrals, we will continue to get good growth from a group of companies with diversified exposure.

Other Technology

This is a more heterogenous grouping and more difficult to make generalisations.

- Following a sharp correction, we are in the process of building back up our semi-capex exposure (BESI and ASM International) as we feel the structural case is very strong.

- We think the cases of Huddly (remote working), JDC (digitalisation of German insurance contracts), MGI & Enad (online gaming), Cyberoo (cybersecurity software), Serviceware (measurement software) and Prosus (Tencent exposure) are case specific enough to not be strongly correlated to a downturn.

- Alkemy replaced Artefact as our key digital marketing exposure and the structural case allied to valuation after a fall makes this one of our better ideas right now – even though there might be a nearer-term reduction in client spend.

- Neosperience and Digital360 are held for their exposure to the aforementioned EU stimulus plan.

There will be some elements of cyclicality in this group, but we are happy that the strength of the structural growth means this group can grow sales and cash flows through a tougher economic environment.

Green Cluster

Thematically it may seem obvious to seek exposure to the energy transition. Executing this in practice is another thing again. Obvious areas such as wind turbine manufacturers have major headwinds from their capital intensity and supply chain issues. Solar players, amongst which many recent IPOs, look unattractive due to extreme leverage and inappropriate embedded return assumptions – in our opinion.

Nevertheless, like IT Services, we can use a pick and shovel approach to achieve solid exposure here. Consultants such as Arcadis, Rejlers and Caverion are involved in a wide range of projects around water usage, energy efficiency and the achievement of a number of other UN Sustainable Development Goals. Signify is a market leader in energy efficient lighting solutions. Like Signify, Recticel has specific regulatory drivers in its field of insulation panels. Greenvolt is a management story currently in biomass sector, pre-build wind projects, and is expanding into installing solar panels onto Spanish roofs. INIT provides solutions which supports the electrification of public transport.

There can always be slowdowns in growth but the regulatory support for these companies is strong on a multi-year level.

Defensive Cluster

Without compromising our value/growth objectives, we specifically built up this cluster as a protection against possible market falls.

- Our pharma holdings are in here, as are Unilever, Essity (tissue & related) and Vidrala (glass bottles) in staple like areas.

- Industrial companies whose profits are based on their service/repeat offerings are in here – Kone and Knorr-Bremse.

- Swedish Match was in here to be defensive but has just received a takeover bid.

As a group we would expect outperformance from this cluster in a market downturn. If this proves to be the case we are likely to use holdings from here as a source of cash for ideas, which will be thrown up in a sell-off.

Banks & Energy

Positions here are as close as we get to holding deep value names - both these sectors offer inflation protection as well as stock specific cases.

For many years now speaking to bank executives they have been crying out for higher rates so they can rebuild crushed margins. So, whilst we acknowledge the risk in a downturn of downgrades, the combination of valuation plus margin upside favours some exposure here.

In Energy, we own an integrated company Shell and TGS which is a play on the restart of exploration activity. We purchased these positions in Q1 as we felt that risk reward favoured a higher oil price over our investable time horizon.

Cyclicals

Again a varied list of companies in here – mostly with more obvious cyclical growth characteristics.

- Amadeus Fire in German IT/Finance recruitment, Kinepolis as a cinema operator and D’Ieteren we worry less about from a cyclical perspective as they are all high-quality operators who take share in adversity.

- We had cause to recently sell BPost and reduce Knaus Tabbert (motor homes) when we reflected on risk/rewards. We retained PostNL from the postal sector – long term value remains compelling.

- Kaufman & Broad is a French housebuilder whose activities are financed by their customers and whose management stake and high dividend yield give us comfort.

- Kering and Siemens are two recently initiated positions as deratings in their respective sectors offer good entry points – we’ll build position sizes up over time.

Completing the stocks in here is lastminute.com our travel recovery play.

There’s an element of subjectivity in the placement of stocks in these 6 segments but we don’t think overanalysing or trying to come up with a false level of precision is appropriate - at any time, and especially this environment. So, when we consider the above we see obvious cyclicality in somewhere between a quarter and a third of our portfolio.

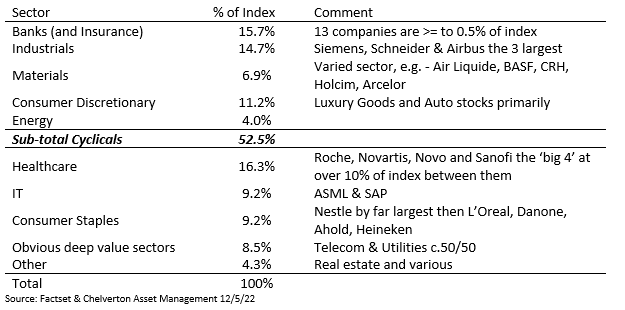

Structure of European Index

The common perception is that Europe is a more cyclical market than most. The outperformance of the high-quality growth stocks in recent years has eroded this, but the following table shows that in the broadest sense Europe still has a high level of cyclicality:

Again, without trying to be too precise, we would probably call c.50% of the index as cyclically exposed. Our simple conclusion from this is that, although clearly not immune, our portfolio should be significantly less exposed to the downgrade cycle than the market overall. This is logical when you consider our limited exposure to large sectors such as banks, industrials and consumer discretionary.

Small and Mid Cap Exposure

The other angle we need to think about is our small and mid cap exposure. At 70% of the fund, we could conclude that we are more exposed to an economic downturn. From a fundamental point of view, we would push back strongly on this. The analysis above we hope helps but when allied to our standard value, growth and risk charts we think our portfolio metrics tell a strong story.

Whilst of course we will have exposure to lower growth and falling estimates, we feel that in the areas we have exposure, the structural opportunities for our portfolio will outweigh the cyclical, certainly over any time period that matters to the long-term investor.

One thing which is difficult to quantify in a down market is forced selling of small caps as an asset class. We would make 3 observations:

- The small cap stocks which appear in our top 10/20 holdings are naturally our highest conviction ideas and we have grown with most of them over the last 4-5 years. As we have written about elsewhere these companies have by some distance the safest balance sheets in our portfolio

- Last year we took the decision to diversify our number of holdings and went from 40 to currently 62 holdings partially as an acknowledgement of this risk

- We have taken a tactical decision to carry an extra 2-3% cash in the current environment to allow us to take advantage of any forced selling in our core holdings (i.e. now 5-6% in total)

Conclusion

If it is to be a recession, we would argue that the worst combination of portfolio characteristics you can have would be cyclicality, leverage and high valuations. Our metrics show that we have the converse of this - a cheap portfolio on well considered cash flow metrics and a safe portfolio balance sheet. In addition, and as we have analysed above, we have a disproportionately high exposure to companies with strong structural drivers and less reliance to companies needing strong cyclical conditions to perform.

We of course cannot and would not wish to, eliminate cyclical exposure but we feel we can look forward to whatever the cycle brings. If our assessment of the structural is correct, then we will be well set when opportunities present themselves from both within and outwith the portfolio.