Thirty-two years of a drawn out bear market can leave you a bit cynical. Have we really witnessed the bottom in global markets? Was that it? Really? Will the Fed now pivot back to an easing stance having only just embarked on QT? Can recent earnings which have been by and large encouraging really hold up? Our suspicion is that the third stage of the great QE unwind is imminent. So, buckle up as the ride could get very bumpy indeed! But amongst all this fear does Japan offer room to surprise global investors?

One great advantage of having lived through the great bear market in Japan is that these brutal rallies within bear markets are very common – you have lots of chances to buy and to sell! The secret is not to get sucked in at exactly the wrong time -: there has been no sense of panic in markets; no real liquidation of funds; no total despair amongst investors. Markets are becalmed, but for how long?

Our suspicion is that inflation has peaked in the US. Our advisors argue that US M2 is beginning to fall and the gradual erosion of household savings will force a return to work which will ease the excessively tight labour market. However, our hunch is that higher inflation will be sticky. Whilst global commodities have come off in the short run, secular long-term trends that will reverse part of the last twenty years of “globalisation” seem entrenched. A range of factors from underinvestment in capacity, supply side issues during COVID, the invasion of Ukraine and the increasingly belligerent rhetoric from China necessitate a complete rethink of capital structure, reshoring production ‘home’ or to ‘friendly’ countries. We assume that the great disinflationary boon to global economies is behind us.

We have no crystal ball, but our guess is that the S&P 500 falls again as at 15x earnings (under pressure) fair value is 3300. The unwind of just in time to just in case; optimised for efficiency to engineered for robust-ness; asset light to asset heavier; and from globalised to localised all suggest structural downward pressure on ROIC that is not easily captured in analyst modelling but will be impactful to market multiples.

The Fed continues to re-normalise monetary policy. The key lesson in financial markets is ‘don’t fight the Fed’ - in the end they will get what they want! Inflation has probably peaked but wages and shelter are still pushing CPI higher and so inflation will remain above trend for the foreseeable period. The inherent advantages of flexibility and energy independence suggest that the US will remain the strongest major economy. To curb inflation wage growth must moderate, usually accompanied by a rise in unemployment as the Fed increasingly admits. Until wage growth slows the Fed must continue their tightening path. Leading indicators are suggesting a downturn whilst lagging indicators

(employment and inflation) continue to hold up. The good news is that US households, corporates and the banking sector do not have the balance sheet leverage seen in Lehman’s. This is, to our eyes, a classic cyclical slowdown not a systemic crisis.

China, however, remains the canary in the coal mine. A dated economic model that has relied on capex heavy, debt fuelled growth with scant regard to returns is one that has ultimately always faced a reckoning. At best sub-par economic growth compared to history seems inevitable even if the ultimate trajectory is one of more sustainable growth. This will have significant implications for many industries.

Supportive factors for Japan

Japan has already faced its own (epic) capital heavy, asset-based bubble implosion. 30 years on the scars are still visible. For us Japan is not a story about the broad economy but improving governance and better ROIC - hard assets, pristine balance sheets and better news on share-holder returns are all going to be supportive of the market. The potential for meaningful capital change at many Japanese companies does hint that the market should no longer be as closely linked to the economy as it has been in the past. Zennor believes that the changed reality in Japan against a lagging perception offers Japan room to surprise to the upside.

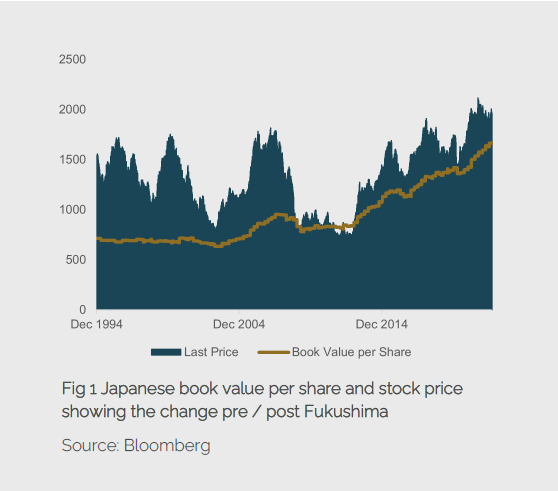

It is undeniable that the slower global growth environment has weighed on Japanese market valuations this year – despite this head-wind profits remain solid and free cash flow positive. This is a real contrast to the pre-Fukushima Japan where growth slowdowns led to negative cash flow, capital calls, a decline in shareholder equity and valuation pressure. This old Japan had highly volatile valuations and cash flows - the new Japan has shown much more stable and growing cash flows which the market has moved in line with. Only very rarely since 2012 has the market traded below book and even then, only briefly during COVID (March 2020). The current 1.1x PBR suggests only limited downside and 1X should offer strong support in a worse case scenario. The presence on Japanese balance sheets of many valuable physical assets such as proper-ty, cash and securities may be slightly unfashionable, but it does offer strong downside protection as the stock price is underwritten by assets AND offers the optionality that these assets can be redeployed to in-crease corporate value. In essence this is what the revolution in corporate governance is about – changing how, and for whom, corporate cash flows and balance sheets are used. What we are seeing today is exactly that – a more defensive market than in the past with Japan in line with the US YTD comfortably outperforming Europe and EM, constructive shareholder pressure and corporates stepping up their capital returns (not capital raises!) in response (Fig 1).

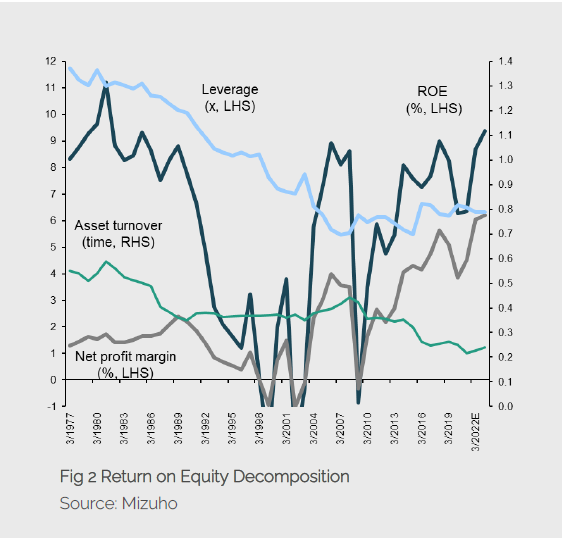

We can see this behaviour change in the Japanese RoE decomposition (Fig 2). Whilst RoE is at nearly record levels the way Japanese companies produce this return has changed. Profitability has grown strongly over the last decade and balance sheets have also become much stronger. In an economic slowdown strong balance sheets are a boon limiting downside, especially if companies can start to return excess assets to shareholders.

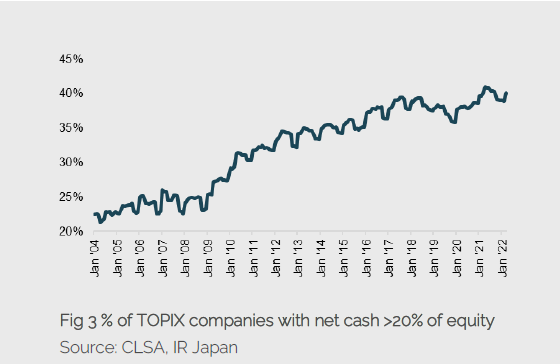

With more than 40% of companies showing net cash >20% of equity this is supportive of the whole market and in stark contrast to some markets where tangible book has almost been eliminated. At Zennor we believe that this balance sheet strengthening pro-cess has gone too far and many of these balance sheets are now ‘too strong’ (and often understated) but offering a relatively easy way to grow RoE through increased capital return. The still low pay-out ratios also provide companies with an opportunity to improve returns without impairing balance sheet strength.

Many of our holdings fit into the category of those companies with excessive balance strength, low valuation multiples and pressure for this to change.

Higher company profitability has facilitated a build-up of corporate net cash (Fig 3).

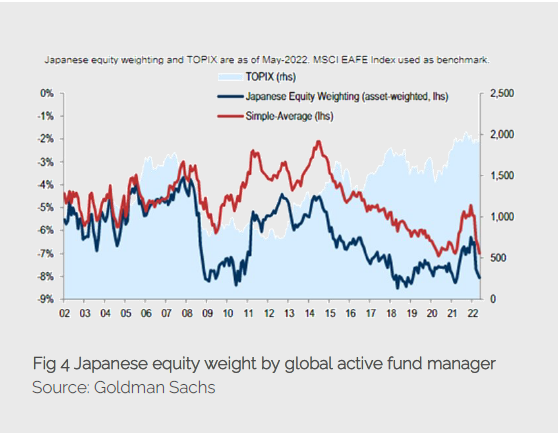

Despite these positive changes foreign investors have been net sellers for the last five years – there are few ‘macro’ tourists left. Foreign weightings in Japan are now close to their lowest weighting since 2009/10 at the beginning of Abenomics and the start of the governance revolution (Fig 4).

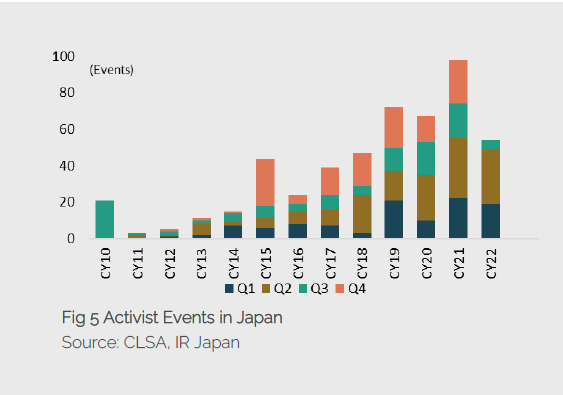

The new buyers of the market are companies, activists, and private equity not global investors. It is rare that these industrial buyers pay close attention to quoted market prices suggesting a persistent and significant valuation gap exists between low public and higher private market valuations. A lower market encourages rather than discourages these investors – as witnessed by the record level of activist and PE activity in Japan this year (Fig 5). The pool that Zennor fishes in is very similar to those that these ‘smart investors’ are looking at where unconstrained by index constraints we are simply looking for the most attractive opportunities where stocks trade at meaningful discounts to intrinsic value and have a clear catalyst to close the gap. We still find the greatest opportunities lie in overlooked asset rich and under earning restructuring names but already see several increasingly mispriced cash flow investments making their way onto our watchlists.

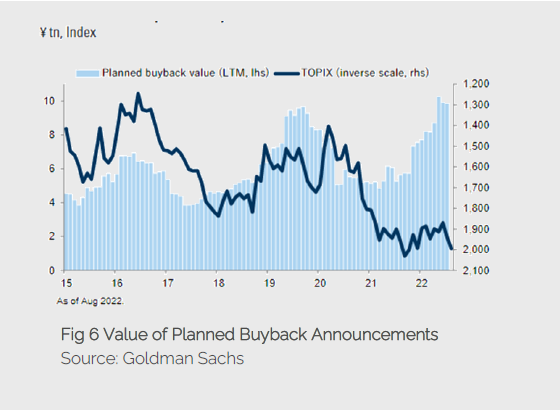

Corporate behaviour has changed over the past years, and they have become more adept at capital allocation -: as valuations have declined companies have stepped up their buyback and capital return plans. In FY21 share buybacks were $59bn and this fiscal year we will easily exceed that (Fig 6).

Despite the macro challenges that we might face the Zennor portfolio is focused on businesses we believe to be meaningfully undervalued that have strong positive, idiosyncratic, catalysts. Recent months have suggested that this positioning is currently defensive with only <50% down-side participation but retaining >100% market upside participation. Whilst we, and other investors, are naturally concerned about the economic outlook we are also very encouraged by the stock-by-stock governance improvement that we observe. In recent weeks several firms have reached and exceeded their intrinsic value estimates and we have had many candidates competing for space in the portfolio as we have exited these positions. This, to Zennor, suggests a market that is full of opportunity to allocate capital towards attractive investments – macro concerns notwithstanding. It is no accident that we have emphasised economic cyclicality as a negative risk factor and this has led us to-wards new investments in overlooked assets, and healthcare. These positions are not very sensitive to the economy, and we are hopefully that the specific catalysts we are anticipating will be strong enough to move the shares towards their much higher absolute intrinsic value levels. If the past year has shown us ‘who has been swimming naked’ it is equally important to remember the other side of Buffet’s quote "We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful". Our strategy of asymmetric positioning of ‘tails: do not lose much; heads: win a lot’ should protect capital in the short run, offer a good (catalyst driven) prospect for attractive absolute returns on those investments and leave us free to be aggressive as and when fear rises and we are presented with the opportunity to be greedy.

It is very apparent to us that the revolution in corporate governance has led to real change in Japan over the past decade since the Abenomics launch – book value and cash flows have steadily increased; payout ratios have expanded; balance sheets have swelled as cash flows have outpaced growth in shareholder return – the Japanese corporate is in underappreciated rude health. Global markets have not reflected this profound shift in Japanese corporate behaviour as market wide valuation has not increased. At a time of global stress these rich balance sheets, improved governance, increased activism all suggest that Japan has plenty of room to surprise.