Please note, these views represent the opinions of Dale Robertson and Gareth Rudd as of January 2023 and do not constitute investment advice.

The Challenge

The European Commission’s 2019 roadmap for becoming carbon-neutral by 2050 has at its heart decarbonisation of the power sector. The EU is mobilising €1tn of capital available for sustainable investments over the next decade. Within this, wind power generation is widely expected to be the EU’s primary source of power by 2050 - a clear multi-year megatrend for investment. However, gaining exposure to this attractive area has not been straightforward.

We have analysed the European wind turbine manufacturers – one angle with which to play “picks and shovels” to the megatrend. We have struggled to get our heads around the high valuations, taken alongside issues such as technological developments and a very competitive environment.

We have also examined several potential investments in renewables developers - the project management companies, which is another potentially attractive way to play the service provider angle.

It seems to us that many of these companies have fairly simplistic business models and can be characterised bluntly as follows - a business, with a field, which plans to install turbines and make money in several years’ time.

Identifying A Winner

Ox2 combines strong growth with being a service provider to the energy transition megatrend. It is fully funded from internally generated cashflows, with a strong balance sheet and it is therefore an attractive addition to the fund. Most business models appear to focus more on financial discount rates, cost of capital, maximising debt finance and maybe the promise of large profits long term. This is not our style of investing. Additionally, many of the companies which are engaged in development projects had a small concentration of projects, thus increasing the risk of any of these projects going wrong (delays etc).

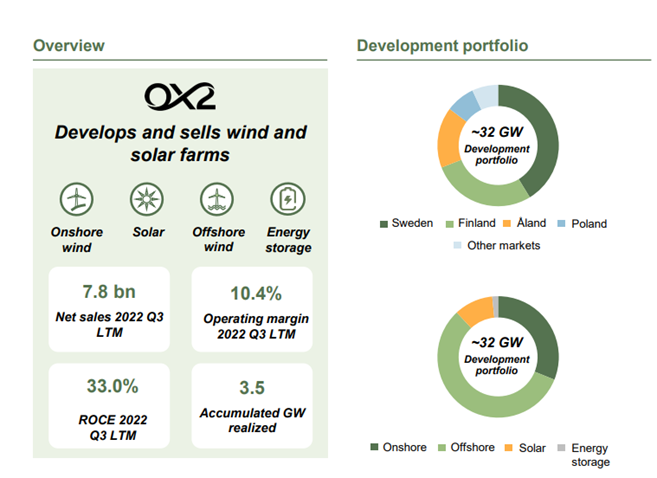

Ox2 is refreshingly different. Ox2 is a leading European wind project developer. It also has solar and energy projects within its portfolio, but it’s in onshore and offshore wind where the company has built an enviable track record.

Company Overview

Ox2 is involved in all aspects of wind farm development. It has projects in Sweden, Finland, Åland and Poland. It acquires rights (although not land, as it operates an asset-light business model), and then develops these rights achieving all of the required permissions, before selling projects on to large corporate buyers (utility companies and businesses such as Ikea) once they are ready for construction. Ox2’s involvement in the project doesn’t end there. They project manage construction, and in certain cases continue to operate and maintain the facilities once they start producing energy.

One major advantage which Ox2 has over many other businesses is experience. Founded in 2004, it has significant expertise in all aspects of project development. It has been involved in over 70 sites, and all have been profitable.

The company itself has been profitable and cash generative for several years, another rarity. This is down to the depth of the portfolio. Ox2 is extremely well capitalised, with over 10% of its current market capitalisation held in cash.

Source: Ox2 Q3 presentation 2022

Outlook

Given its strong order backlog, Ox2 is expected to grow its sales by 30-40% per annum over the next three years. The company is strongly cash generative and is on a free cashflow yield of over 5% - providing cash to fund future growth opportunities.

Ox2 combines strong growth with being a service provider to the energy transition megatrend. It is fully funded from internally generated cashflows, with a strong balance sheet and it is therefore an attractive addition to the fund.