Today the Bank of Japan took one further step to normalising Japanese interest rates. Whilst the market’s initial reaction was one of mild disappointment we view this as setting the ground for further change next year and a balance between those who wanted no action and those looking for bigger change.

What happened?

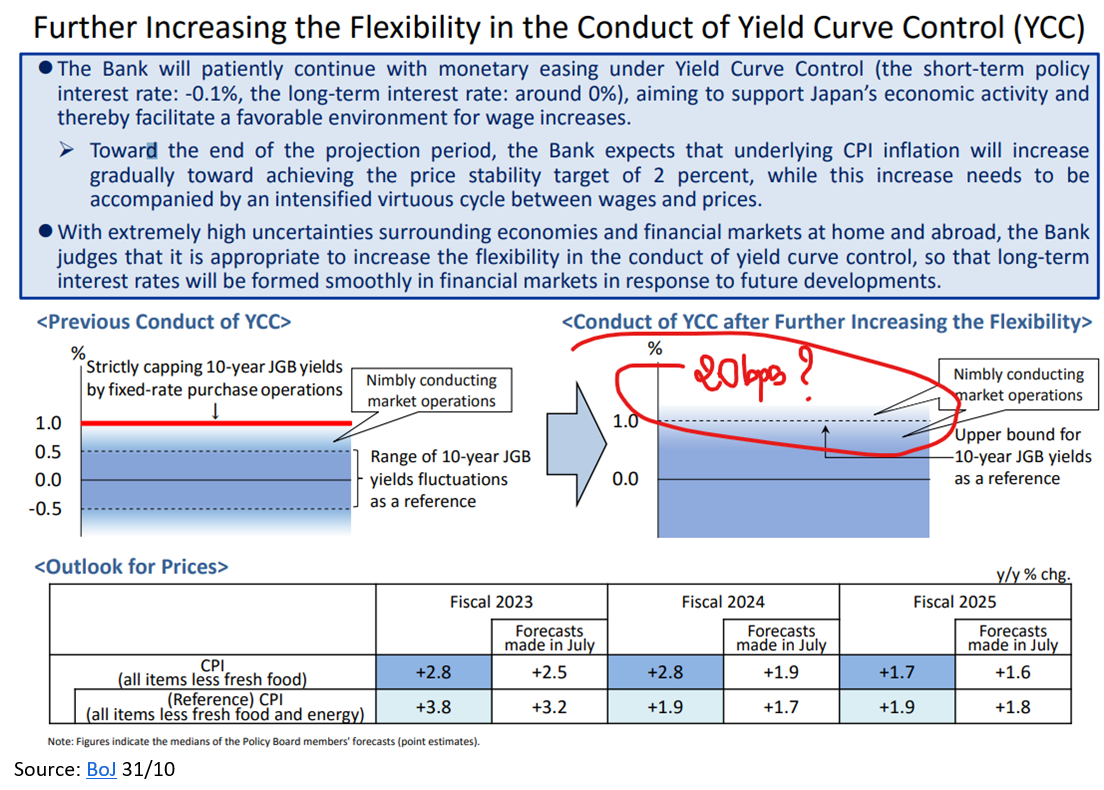

The BoJ indicate that their Yield Curve Control policy was not rigidly fixed at 1% but was now a ‘range’ around 1%. Effectively this abandons the YCC policy as a binding policy constraint.

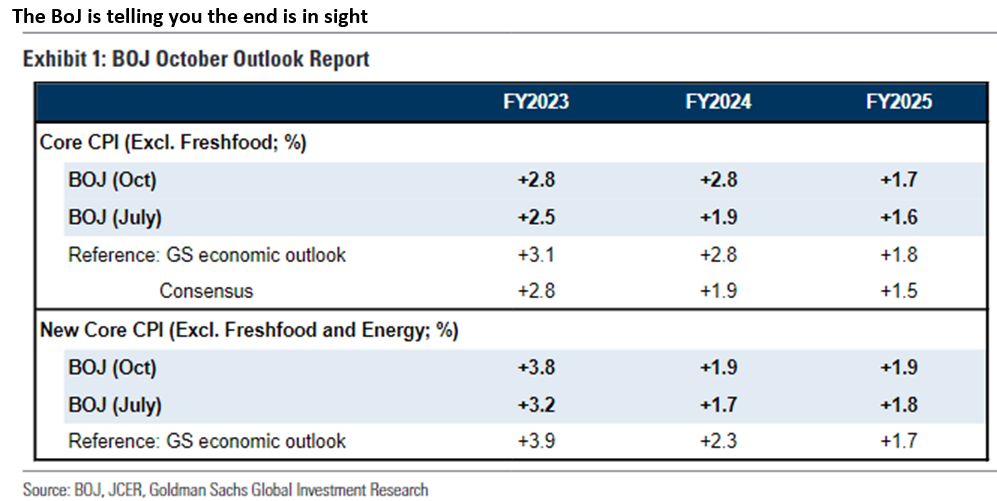

The Bank of Japan increased their inflation outlook for 2023 (2.5->2.8%) and 2024 (1.9->2.8%) - substantially over 2%. This would mark three consecutive years of >2% inflation. However it has retained 2025s outlook at 1.7% which maintains a more dovish policy tilt. IE they are indicating that although 3 years of >2% inflation is likely to be achieved this is not yet firmly embedded. Their preferred core core CPI measure remains just under 2% reinforcing this message about core reflationary pressures being slightly below their target level.

The key change for us was not the YCC ‘tweak’ but the uplift in inflation outlook that emphasises that the BoJ reflationary policy is working AND that more work remains to be done. We suspect this sense that the BoJ will remain accommodative for longer was what nudged the Yen lower today. Tactically this makes sense but misses the strategic shift that EXIT is now coming.

This step has significantly weakened the logic around YCC and has moved the BoJ decisively towards an exit of YCC. Economists now expect further action but it is unclear whether NIRP or YCC will be ended first. The key determinant of further change will be the Spring Shunto wage round where the BoJ highlighted this explicitly as a key factor in their thinking about inflation durability.

Taken together this combination of changed inflationary expectations and flexibility in the long end of the curve clearly sets the BoJ on a normalising path even if the tweak today fell short of what some had been pushing for.

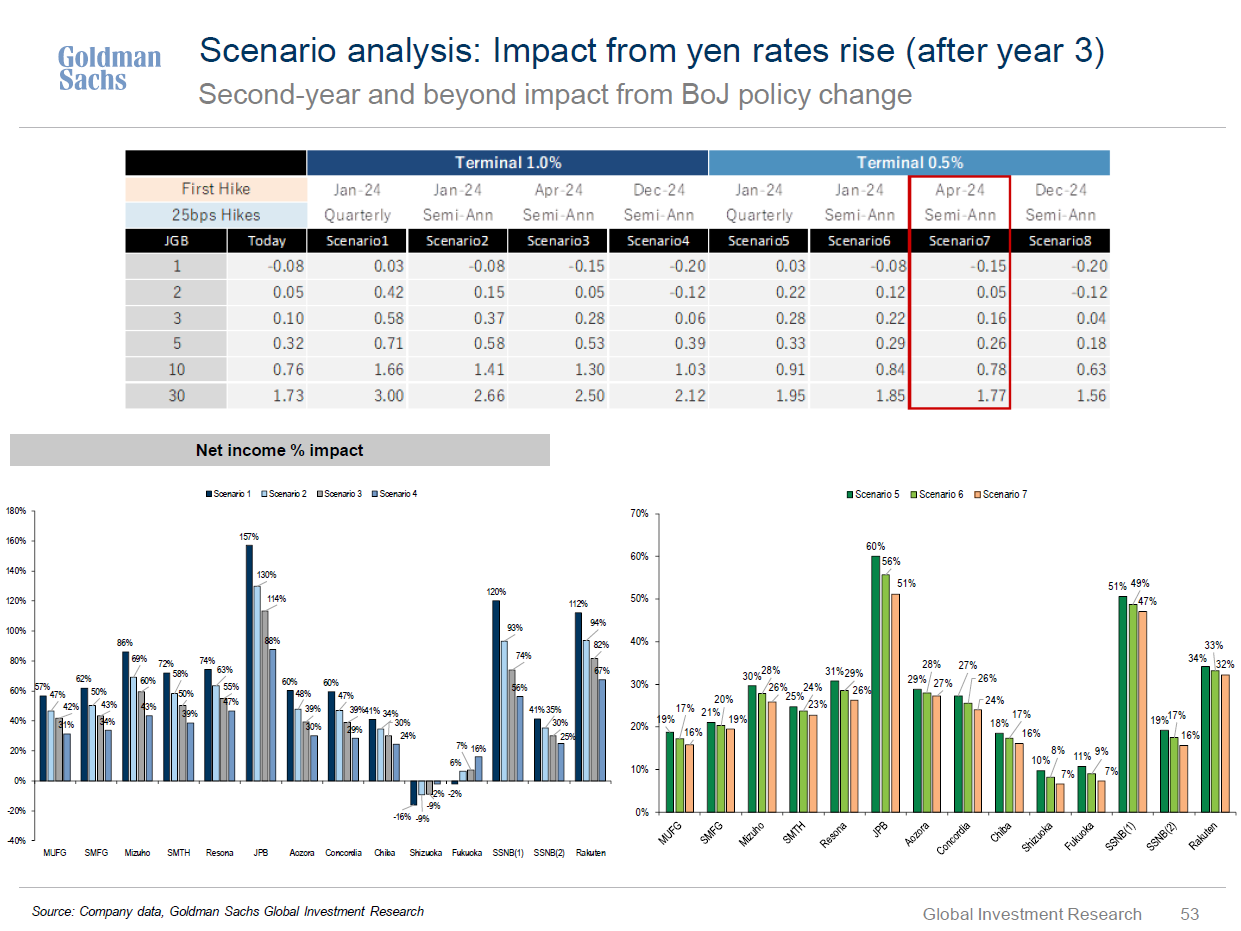

At a stock level this has limited direct impact on earnings but a change in short rates would be very impactful for financials and for regional and deposit rich banks especially. It would also substantially help those companies with large cash positions.

Goldman Sachs has estimated the net income profitability impact of short term rates moving up to 0.5%. We have exposure to Rakuten Bank and t Japan Post – two of the most rate sensitive financials. The impact on profitability should be in excess of 50% and possibly much more. We also own a number of regional banks that are especially geared to higher rates (and capital structure reform) but not covered by GS.

David Mitchinson & James Salter

31st October 2023