The Japanese market has had a strong start to the year, up +17% in Yen terms, on the back of a close to +30% year in 2023. It might feel that unless you have been on board, you have missed the boat. Zennor’s view is that the market has been playing catch up with the rest of the world and there are plenty of reasons to be optimistic.

Results season

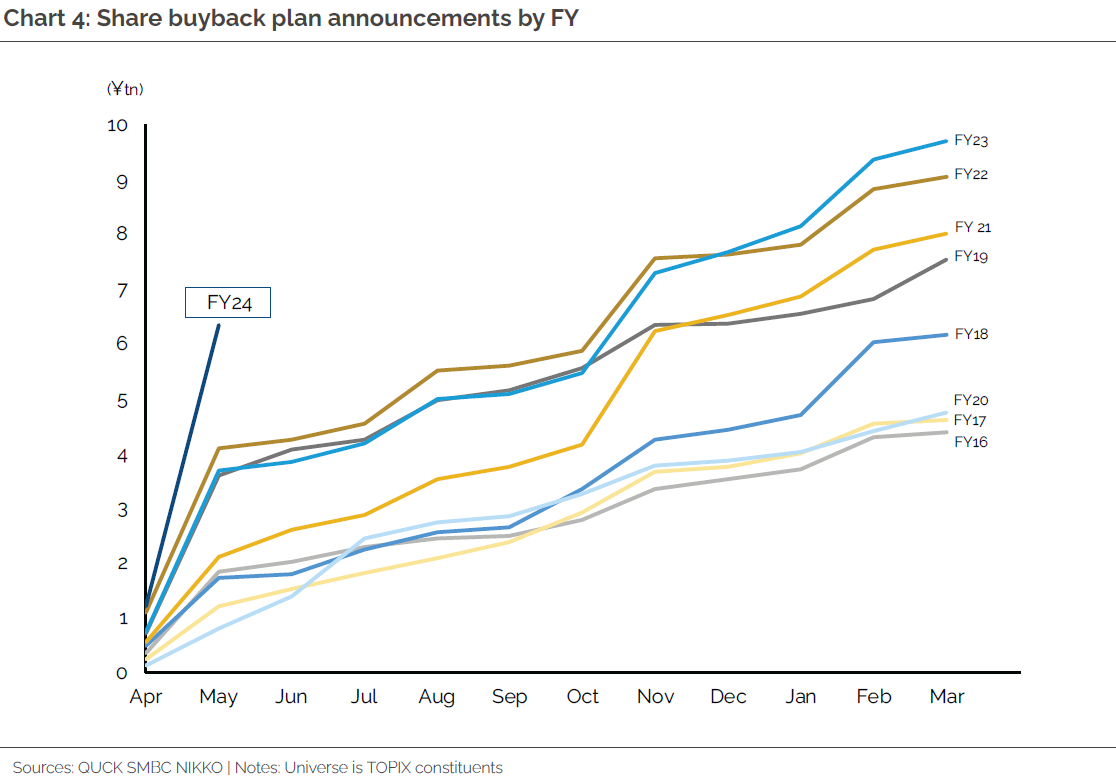

The results season has come to an end, and it was characterised by extreme fluctuations, with sales in aggregate rising by 5.4% YoY and recurring profit increasing by 16% YoY. However, the full year 2024 guidance is disappointing, as companies are expecting sales growth of +2.5% YoY and a drop in net profits of around -3% YoY. This seems excessively cautious given firm US demand, the continued weakness of the Yen, the successful passing through of cost increases, and the ongoing corporate governance reforms. Overall, the results for FY23 were buoyed by Toyota and a bounce back in earnings at electric utilities, with 48% of companies delivering positive surprises. Additionally, we have witnessed the largest buyback programmes ever during a quarter, with a figure of around $50bn, and dividends reaching record highs, while the structural dynamics of corporate governance reform remain intact, with year-to-date buyback announcements up by 23% YoY and dividend increases by +29% YoY.

The changing dynamics of the Japanese economy

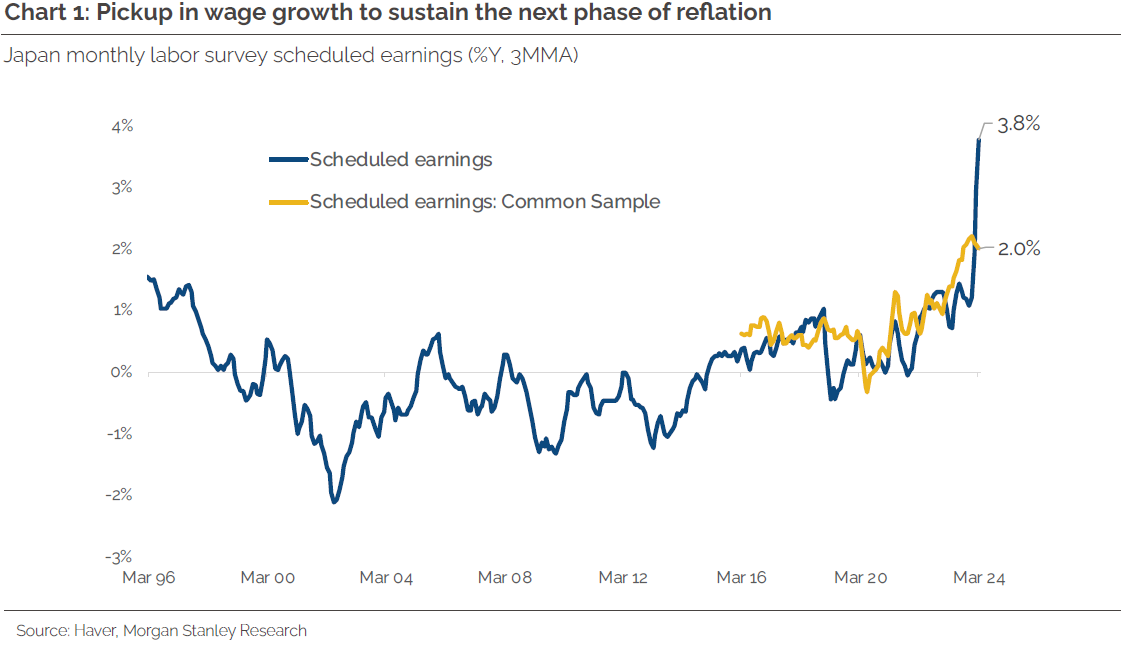

A few months ago, the Bank of Japan (‘BOJ’) announced a significant change in monetary policy. They put an end to negative interest rates and yield curve control. The BOJ is likely to incrementally tighten its policy, possibly again in July 2024. The interest rate on excess reserves is currently at 0.1%. The driving force behind this change is the emergence of nominal wage growth and a normalised inflation level. Companies, the Tokyo Stock Exchange (TSE), and Prime Minister Fumio Kishida are all keen to raise productivity. In fact, most of the companies we own have announced large increases in employee salaries. The labour market is extremely tight, and we expect to see further increases in real wage growth. Companies are also now able to raise prices across the board, and the success rate of passing through these increases is quite high.

The deglobalisation of the global economy bodes well for Japan. During the 1990s, capital expenditure was curbed, and debt deflation has given way to mild inflation but there is a sea change taking place that should not be underestimated. A virtuous cycle for domestic capex seems likely as companies strive to raise productivity. In fact, domestic capital expenditure has been flat for most of the past thirty years, with the focus during globalisation being on overseas capex. However, this is changing as the tectonic plates shift. According to the Tankan survey, large companies plan to increase capital expenditure by over 4% in FY24. From Toyota to Denso, Shinetsu and Komatsu, there are significant domestic capex plans. Japan's demographics are poor, with labour in short supply and the threat from China ever- present. However suddenly Japan is relevant. During our recent trips to southern Japan, we witnessed the profound changes brought about by the rollout of TSMC semiconductor plants. Chipmakers globally need Japan, especially Taiwan. This is good news for the semiconductor, construction, and machinery sectors.

Corporate governance revolution progress

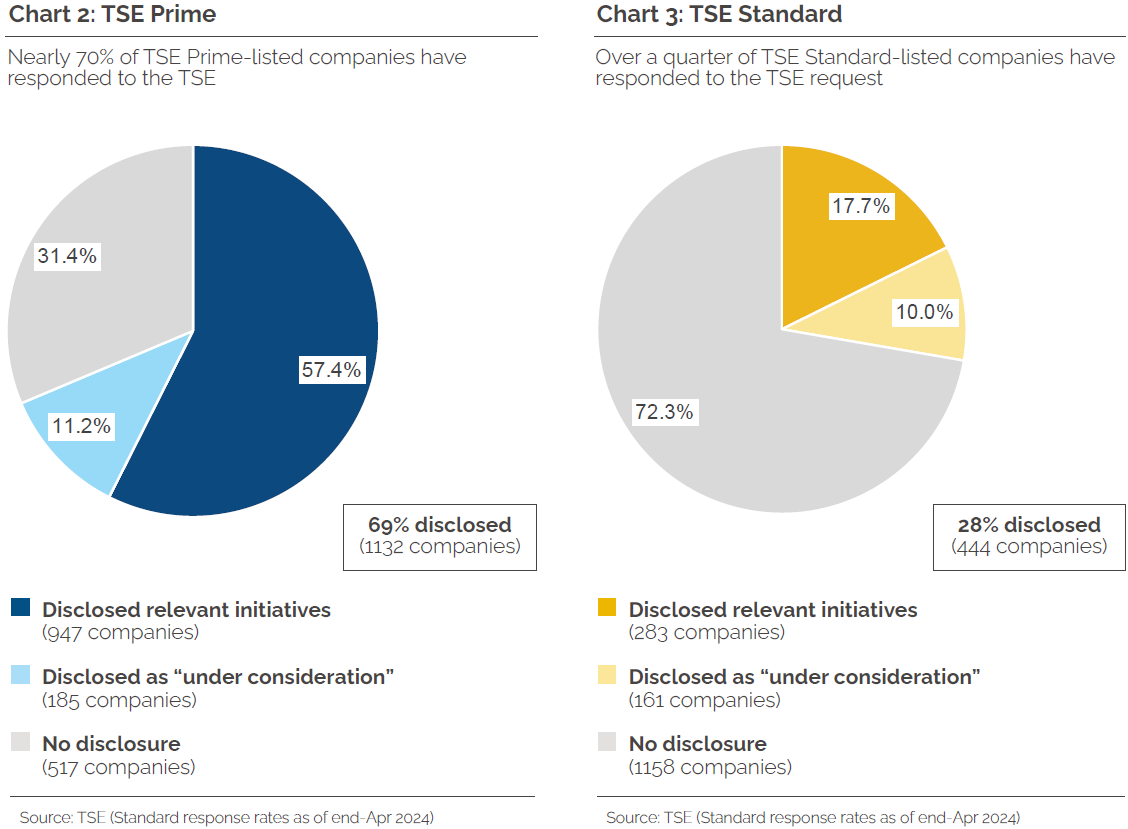

Earlier in the year the Tokyo Stock Exchange (‘TSE’) asked companies trading below book value to explain their cost of capital workings and return on invested capital. The TSE is also eager to change management policy towards growth strategies. This includes exiting unprofitable businesses, restructuring the capital base, divesting idle assets, and using leverage instead of cash. They want companies to have a clear understanding of the cost of capital versus the return on invested capital. However, we still find that many of the companies we follow underestimate the cost of capital, and their large cash holdings inflate the cost dramatically.

Up until the end of April 2024, 57% of prime companies have responded to the TSE requests whilst 31% have not disclosed and 11% are “studying” (Chart 2). The standard market is a different story. 72% have no disclosure (Chart 3). We have a large exposure to mid and small caps in the Zennor funds. Small caps have been lagging for six years. There are some explanations for this, the most obvious being that big value stocks have responded more significantly to the TSE demands with some enormous share buybacks announced during the earnings season from the likes of Toyota, MS&AD, and Eneos.

Chart 4 shows how buyback announcements have steadily been increasing year after year, until 2024 when there was a dramatic spike in the first quarter, which has been most notable in the mega cap space.

Many of our smaller cap stocks did a little but not enough. The "learning" process still has a long way to go. This is the opportunity we are looking at and engaging with. Small-cap stocks have a forward PER of 12x and a price to book ratio of 1.1x, while the core 30 have a forward PER of 17.3x and a price to book ratio of 1.8x.

We like to have soft engagement with our portfolio companies where we feel a bit of encouragement is required and have had some good results from this policy, particularly with small caps. Kurimoto, a civil engineering firm, raised its dividend payout ratio to 50%. It aimed for an ROE of over 7% and will cut cross shareholdings by 30-40%. With half of these unrealised gains going back to shareholders, the dividend yield should be over 7%. Sintokogyo, a deeply undervalued machinery company, made a positive first step by increasing its dividend payout ratio to 60% and using capital for meaningful M&A. Tsubakimoto Chain announced a 5% dividend yield and a 5% share buyback. One of the large cap names in both funds, MS&AD, after several conversations, at last announced an 8% share buyback and a dividend yield of 5%. This is an ongoing process and a theme that could run and run, which should drive share prices for those companies that return accumulated cash to shareholders.

The Yen

The Yen’s weakness has generally benefitted corporate Japan, but it has also caused the prices of imported goods to rise rapidly. As a result, many exporters have moved their production abroad, reducing the benefits of a weak Yen. To prevent further decline, the Ministry of Finance (‘MOF’) intervened by spending a record Y9.8 trillion to support the currency. Despite these efforts, the Yen remains problematic, having lost 10% of its value against the dollar and even more against sterling. This year the trade of selling Yen and buying dollar continues, as Japanese interest rates are not expected to rise significantly, and US rates are unlikely to decline rapidly due to persistent inflation. The MOF is currently guarding against further depreciation with a reserve of over $1 Trillion, but if this fails, the BOJ may have to raise interest rates to defend the currency, risking the economic recovery. Japan still has a large current account surplus, and according to purchasing power parity, the Yen should be much stronger.

In summary

You might think that you have missed the opportunity. Zennor’s perspective is that we are still at an early stage of management teams that are finally becoming aware of the cost of capital. This year net cash across the market continued to increase despite the unprecedented dividends and buybacks. We have not even begun to reduce what are clearly excess balance sheets. Cash, securities, real estate, other non-core assets and operations will all be looked at. We anticipate a surge of M&A (both divesting and investing) as well as outsourcing of non- core activities as firms realise how costly those operations and assets are in terms of capital. Firms must both decrease total assets and be more selective in how they are used. The result will be a significant increase in RoIC and along with those valuations.

One such example to illustrate this is our holding DaiNippon Printing, which generates at least 80% of its profit from only 20% of revenues. It holds massive real estate, securities and cash positions. Implicitly 80% of its profit comes from only around 10% of its total capital base. What would a lean and focused DaiNippon earn in RoIC and what multiple would it command? Rather higher than 0.9x PBR? The company also has several activists, domestic and foreign, ‘engaging’ with them. This is not atypical. However, we are at the beginning of this long road and not at the end.

We have reached base camp…now the hard part starts. In the short-term caution may keep a lid on the major large-cap indices, but the catalyst for change could be the strength of the Yen versus forecasts, further corporate governance news, and a recovering Chinese economy combined with strength in the US economy. There is a strong correlation between small caps, especially GARP ones and US interest rates, which if they begin to fall from mid-year should act as a tailwind for the space. Also, if you think that the corporate governance story trickles down the market cap scale, then there remains a significant opportunity in the medium term.