The Nikkei 225 has just crossed ¥50,000 and since the lows of April, the Index has risen by 65% – quite remarkable. Even more striking has been the +20% move over just eight weeks since mid-August. But, as we have often experienced during our careers, such euphoria should be treated with caution.

An old boss at Martin Currie used to refer to this as the “stretched elastic-band syndrome”: markets can remain extended for some time before eventually snapping. Effectively, there are two markets today in Japan: a thematic and AI-dominated one, and almost everything else. A concentrated cohort of stocks driven by the demand for AI now dominate indices.

It is a time to remain calm. For those familiar with our investment process, periods of maximum pain are often the time to add and look for opportunities – and we would note that we have minimal exposure to AI. This lack of exposure has, of course, meant that our portfolios have missed some of the most significant gains in recent months. Still, we simply cannot reconcile valuations with our estimates of longer-run earnings power. Indeed, when the opportunity set for other companies remains exceptionally attractive, chasing ultra-high-multiple stocks is an unattractive use of your capital.

Concentration Risk

To give you some context for the concentration risk that has been building. Since early August, the TOPIX Index has gained 12.5%, with 11 of 33 sectors outperforming the market. Non-Ferrous Metals stand out at +91.6% year-to-date, dominated by AI infrastructure and materials names. Fujikura (+193% YTD), a key supplier of optical cables, now trades on a P/B of 13x and P/E of 50x. Mitsui Kinzoku, which produces copper alloys and electronic materials, has surged by 210% this year. The AI boom has driven much of this increase.

The Technology and AI segments have been rampant. In Information and Communications, SoftBank has soared 122% in ten weeks – the most frenzied activity we have seen since Q4 1999. Together, these two stocks account for over 20% of the Nikkei 225 and have become the representative AI stocks in Japan. We would not usually dwell on this, but the scale of concentration warrants attention this time.

KIOXIA, the Toshiba memory spin-out, is up 278% in eight weeks. Ibiden, a semiconductor packaging company, is up 73%, and Advantest, which provides testing equipment, is up 89%. Earnings in these areas have generally exceeded those of the broader market by a wide margin – Advantest today raised its full-year operating forecast by 25% - but this is not unexpected by the market given the heavy investment in AI datacentres. The question is how large their medium-term earnings power will be, given that the shares already trade at over 60x estimated FY2028 earnings. We see no margin of safety at 25X FY2 PBR.

So far, the AI and Technology themes dominate. But other areas also stand out, such as Defence –a key priority for the Takaichi government. The administration aims to revitalise Japan’s defence industry, including its shipbuilding sector and increase defence spending as a share of GDP. Mitsui E&S has risen 234% YTD, trading on a forward PER of 25x and P/B of 4x.

The parallels with Q4 1999 are clear in terms of thematic euphoria. Earnings and cash flow from AI capex investors such as Microsoft, Meta, Alphabet, and Amazon are enormous, but even these are being consumed by their investments. The “Magnificent Seven” driving much of the AI build-out are expected to invest over USD 5 trillion over the next five years, according to McKinsey. Bain estimates that to justify this level of capital expenditure, data centres would need to generate USD 2 trillion of annual revenue by 2030. Three years after ChatGPT’s launch, AI revenues remain modest still. The Magnificent Seven now represent 35% of total S&P 500 market capitalisation, and AI stocks have accounted for 75% of the index’s move over the past three years. Japan is now seeing a similar concentration; on 30th October, three stocks accounted for >100% of the Nikkei 225's move.

Over Investment

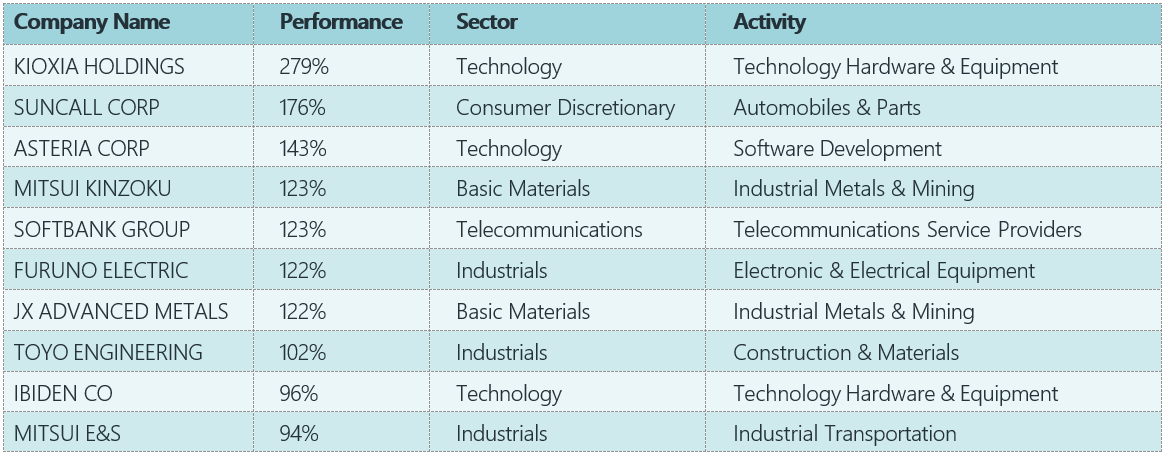

In our view, the biggest risk lies in over-investment. History offers plenty of parallels –the US railroad boom and the 1999 telecom bubble among them. The question is: what happens to the “asset-light” tech model when capex becomes this aggressive? Such investment surges rarely lead to high returns for those deploying capital. The recent market dynamics can be neatly captured by the chart below (Chart 1). KIOXIA, Mitsui Kinzoku, JX Advanced, Ibiden, and SoftBank are all part of the AI theme, while Mitsui E&S fits squarely within the shipbuilding theme.

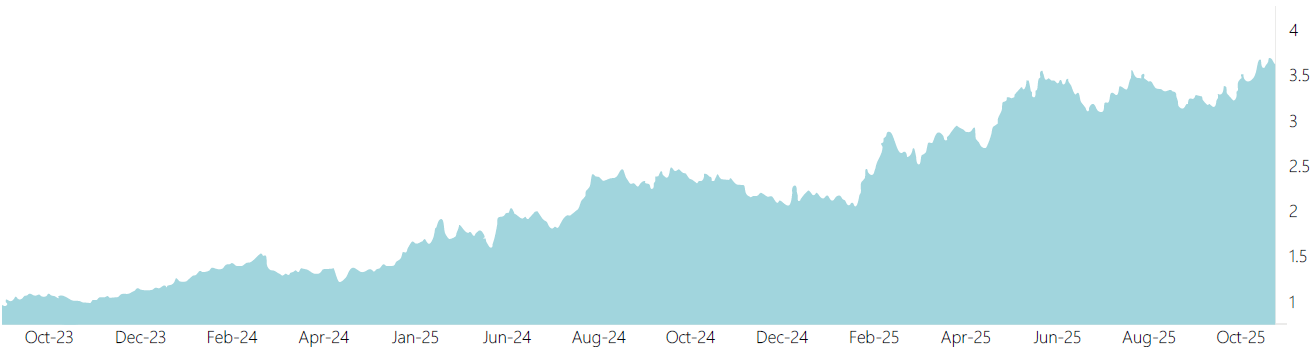

The second chart (Chart 2) highlights the relative price-to-book multiple of Mitsubishi Heavy Industries (MHI) –the strongest defence proxy in Japan, in our view. MHI’s relative price-to-book has tripled from its lows, and the stock now trades on 50x forward PER and 6.2x stated book value. In contrast, the broad market now trades on a forward PER of 18x. Looking across the key subsectors within technology, Non-Ferrous Metals now trade on 28x PER, and the Electrical Appliances sector on 27x PER.

Chart 1: Topix Largest Contributors Year-to-Date

Source: Zennor Asset Management, Bloomberg data 28.10.2025

Chart 2: Mitsubishi Heavy Industries: Relative Price-to-Book Multiple

Source: Zennor Asset Management, Bloomberg data 28.10.2025

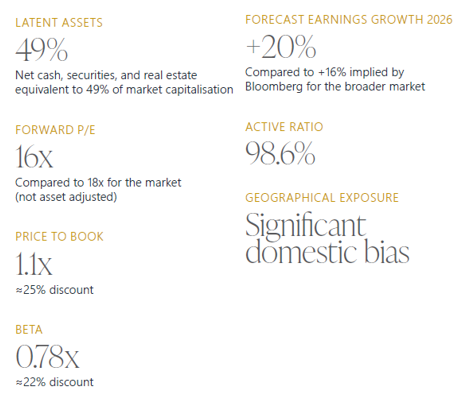

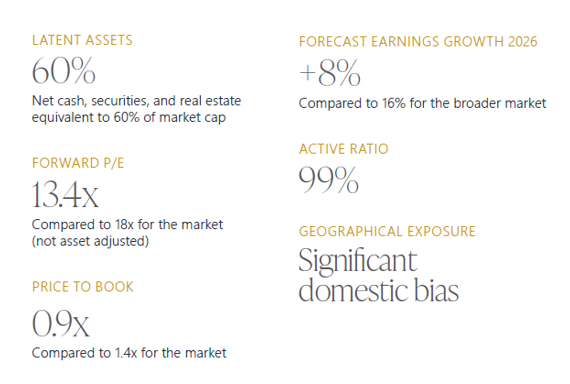

Zennor Japan Fund: Portfolio Characteristics

The strongest earnings growth within the Zennor Japan Fund Portfolio ‘ZJF’ comes from Genda (9166), where the PER will compress from 62x to 16x (13X IFRS) and from our regional banks, which are seeing +15% earnings growth. Our technology holdings exhibit a much lower beta, with no direct AI exposure (0.99x vs. 1.4x). The materials weighting, which includes some technology materials exposure, is expected to deliver +17% earnings growth next year.

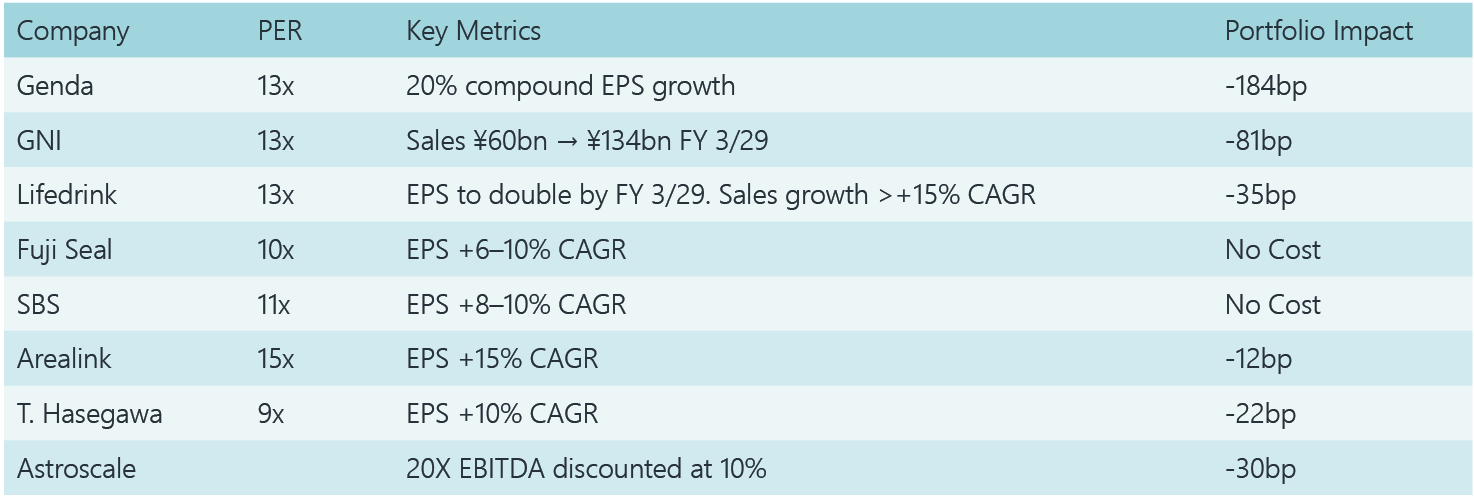

The crossover with the Zennor Japan Income Fund ‘ZJI’ currently stands at 61%. While ZJF includes several high-growth situations, ZJI remains a more value-focused, corporate-governance-driven strategy. Both blend value and GARP (growth at a reasonable price), but the “High Growth” element, which typically does not pay dividends, is not in the Income Fund. The “High Growth” element - just four stocks – has been a notable drag this year after several years of strong contribution. We are actively reviewing this space for new opportunities, growth names. We believe that some funds are selling these growth compounders to fund an increase in their AI exposure. We believe that selling 20% compounders at <15x to buy the AI thematic at 50x+ is unlikely to be rewarding in the medium term. This growth exposure is the primary driver of the performance difference between the two funds. ZJI has not had the “high growth” element and therefore has fared somewhat better.

Growth Holdings – Valuation Overview

Source: Zennor Asset Management, Bloomberg data 28.10.2025

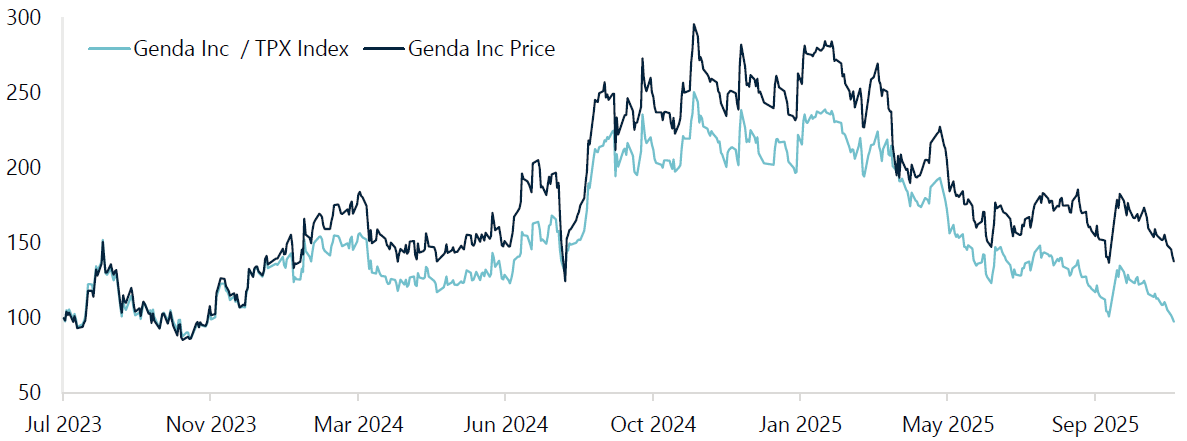

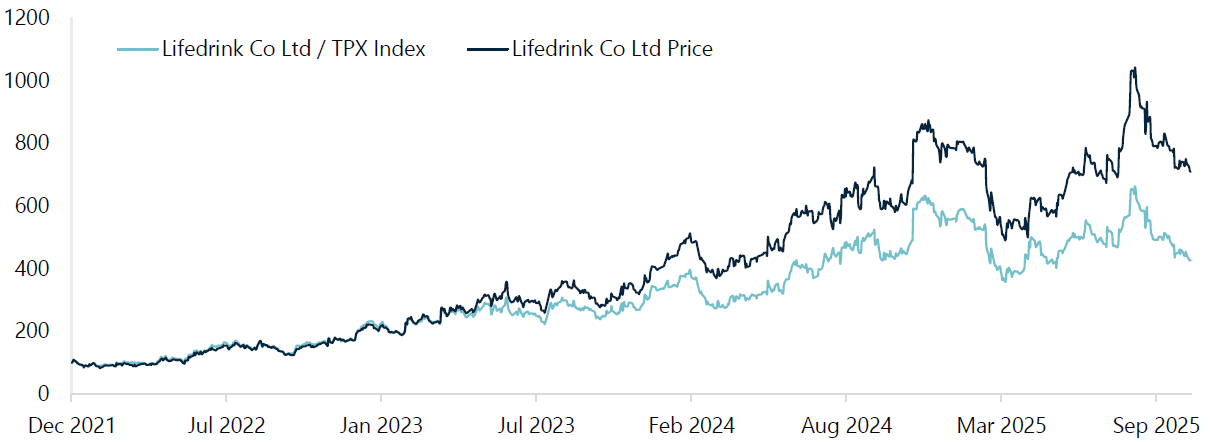

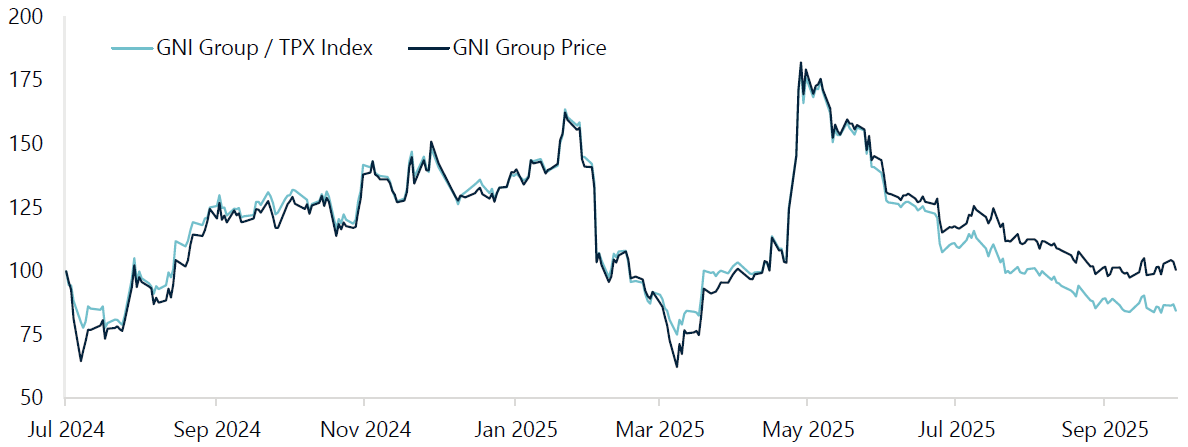

The following page has three charts which to illustrate the performance of three of our growth holdings. These holdings have underperfomaned significantly relative to the market in recent months. At the time of writing, the Zennor Japan Fund is +2% versus the broad market, but well below its earlier peak. We have witnessed several such junctures over the years – and while the timing is uncertain, market concentration always ends eventually. We do not know when a change will happen, and it may not happen this year, but as one of our new colleagues put it, we could easily see the technology-heavy Nikkei 225 fall 15% without hesitation or notice.

Genda Inc. Absolute Performance vs Relative Performance to Topix Since Position Initiated

Source: Zennor Asset Management, Bloomberg data 31/07/2023 - 29/10/2025

Lifedrink Co Inc. Absolute Performance vs Relative Performance to Topix Since Position Initiated

Source: Zennor Asset Management, Bloomberg data 21/12/2021 - 29/10/2025

GNI Group Ltd. Absolute Performance vs Relative Performance to Topix Since Position Initiated

Source: Zennor Asset Management, Bloomberg data 30/07/2024 - 29/10/2025

Zennor Japan Income Fund: Portfolio Characteristics

Turning to the Zennor Japan Income Fund ‘ZJI’-this portfolio has little exposure to higher-growth names given our yield requirements. Companies such as Genda (9166), Lifedrink (2585), and GNI (2160) do not yet pay dividends and therefore remain outside the fund’s investable universe. The ZJI adopts a deeper value-based approach, lacking the outright growth component of ZJF and instead offering a purer play on corporate governance reform in Japan.

The fund’s positioning reflects its emphasis on balance-sheet strength, net-cash holdings, and governance-driven value creation — a somewhat different profile from the more growth-exposed ZJF, yet complementary within the broader strategy.

The Yen Remains Undervalued

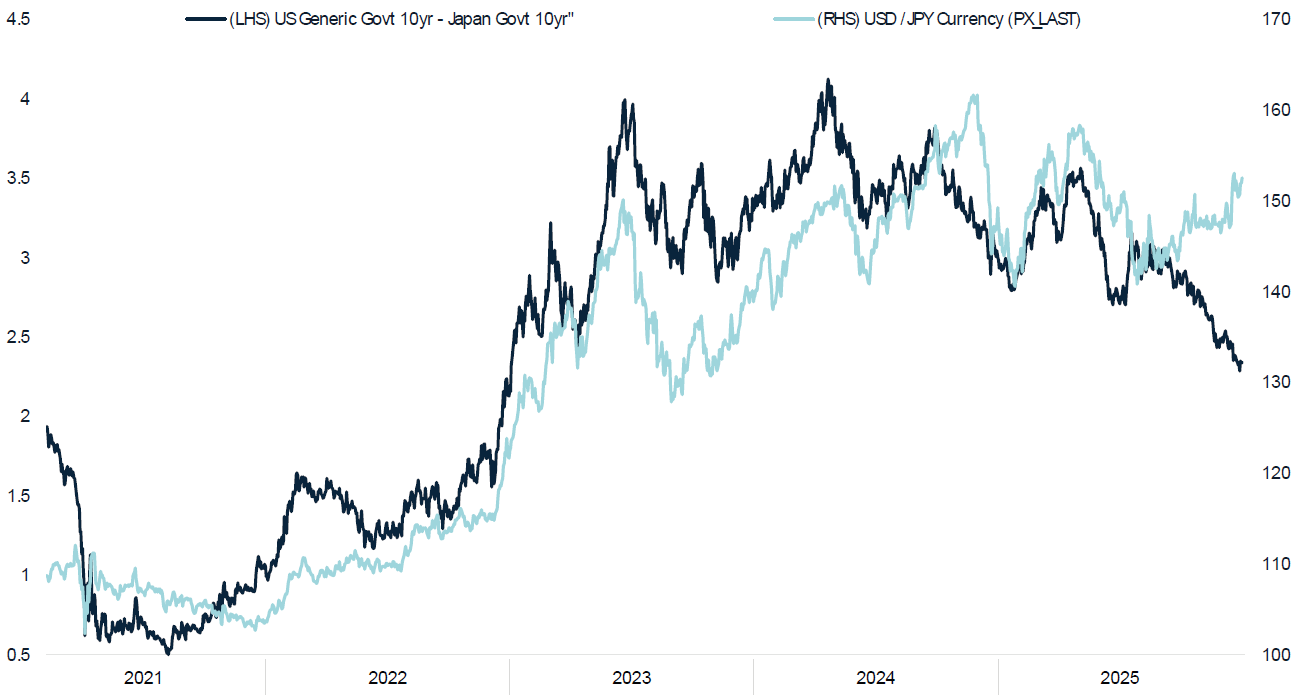

While reviewing Bloomberg data, we came across an interesting chart on the yen. We continue to believe it remains a deeply undervalued currency – surely something must give at some point? Could an October rate hike occur? Unlikely, but the Bank of Japan has long sought both political stability and a cooling of trade tensions. With Bessent and Trump recently in Tokyo, the air appears –at least for now – to have cleared somewhat.

Japanese Yen Trades Cheap: 10y rate differentials point to USD/JPY near 130

Source: Zennor Asset Management, Bloomberg data 28/10/2025

Maximum pain is a time for opportunity

It has been a remarkable year for markets and it reminds us of the lead-up to the tech bubble in late 1999. But if truth be told, no one knows when, or if, the market will change. It is a time to remain disciplined and resolutely focused on the long-term objectives for our funds. And to again remind ourselves that the time of maximum pain is a time for opportunity.

James, David & Nicolò