In this first investment view of 2026 we take a detailed look at the IFSL Evenlode Global Income portfolio, the performance drivers over the last year, and the broader equity market situation. It’s a longer read than our usual monthly missives, but we hope you find the discussion interesting and useful.

This time last year we wrote, ‘… at Evenlode we work to harness the power of companies that can churn out compounding from good earnings and dividend growth, funded by high returns on the capital invested in the business, while protecting our clients from the gyrations in valuations. We are currently in a period of high market returns driven materially by multiple expansion. Looking to the future, history suggests that today’s environment is one where managing valuation risk is critical. The challenge, as we have seen historically and more recently through the Covid and post-Covid period, is that the timescale over which the expansion and contraction of multiples, driven by sentiment and economics, can last for quite some time.’

A year has passed but we think this statement remains a good summary of the portfolio and its context at the current time. Indeed, many of our observations on the market environment are the same, if not amplified. Valuations across numerous measures, indices and asset classes are around peak levels while market concentration is higher than ever. These are conditions created by decreasing risk aversion – wittingly or not – and subsequent high valuations mean the outlook for long-term, risk-adjusted returns from headline market indices is muted. But as these trends extend, the long-term opportunity for the selective investor grows as ignored areas of the market become increasingly attractively valued, despite exhibiting strong fundamental qualities.

Those areas are prevalent in the IFSL Evenlode Global Income portfolio. We look for great businesses - companies that can maintain high returns on invested capital over long periods of time, backed by competitive advantages or economic moats[i]. We assess the value of each company using our proprietary model and construct a diversified portfolio with a view to long-term risk adjusted returns, letting the companies compound the cash flow for us and our clients. At their core these companies have pricing power - a secret sauce that yields excess value add and structural features that help them protect it, like intangible assets, switching costs and network effects[ii].

We are satisfied with how the portfolio is positioned and the underlying business performance, but rather less satisfied with the disappointing total return performance of the fund recently. Our group of portfolio companies have continued to exhibit good growth and excellent microeconomics, but this has not yet translated into share price performance, and they are, as a consequence, currently trading at undemanding valuations. Whilst the market returns of the fund have been underwhelming, the company valuations in themselves should, conversely, represent an opportunity for the future providing their fundamental performance holds up.

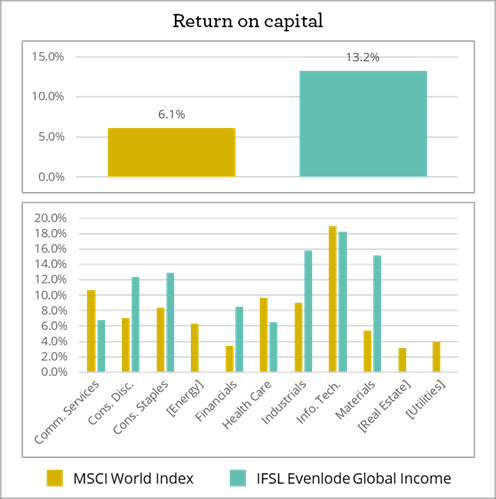

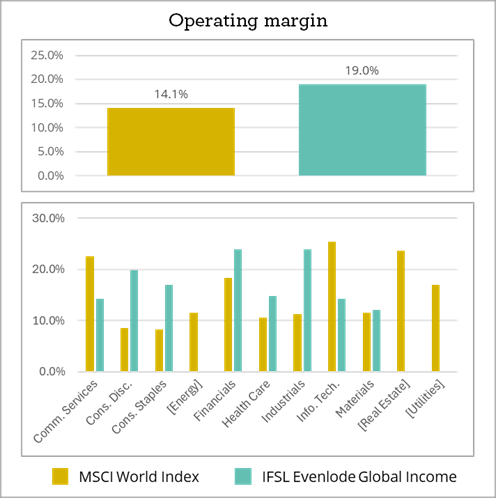

The following charts show that the portfolio has attractive microeconomics in the form of high returns on capital and margins, both in absolute terms and relative to the market. These characteristics drive the creation of excess cash flow that is ultimately what equity investors receive as their reward, and we would expect this over the long term given our highly selective investment process.

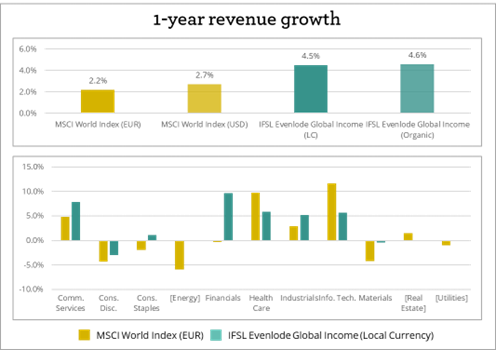

Good microeconomics translate to greater shareholder value if revenue growth is pushed through to drive compounding of free cash flow[iii]. The following chart shows that revenue for the portfolio is growing at least as well as the wider market. The modest result for the MSCI World Index is perhaps surprising, but makes sense given the overall challenging economic context outside of certain boom areas like AI spending.

We’ve shown the MSCI World Index and the portfolio across different currencies to cut through some of the volatility seen in foreign exchange markets in 2025, particularly the dollar. The broad point is similar whichever currency basis we choose; the portfolio stands up well against the index. That said, the c.5% organic revenue[iv] growth the portfolio is exhibiting is at the low side of what we think is achievable from a portfolio of quality businesses. Some companies do currently have growth in sales that is slow or slightly negative, with 16% of the portfolio having less than +3% growth expected for 2025. Amongst these only two - LVMH and Pernod Ricard - are expected to see a decline in sales, of -2% to -3% organically. We expect sales of these slower-growing businesses to improve as their end markets recover. Just under half of the portfolio is expected to exhibit mid-single digit growth through companies such as L’Oréal, Medtronic, and Wolters Kluwer. The balance - a little over a third of the portfolio - should grow in the high single digits to double digits, for example travel software company Amadeus, credit reference agency Experian, and software giant Microsoft. It is, interestingly, in some of these faster growing names where greater value is emerging in the market, so there may be an opportunity to allocate more of the portfolio to these in the fullness of time. We will see.

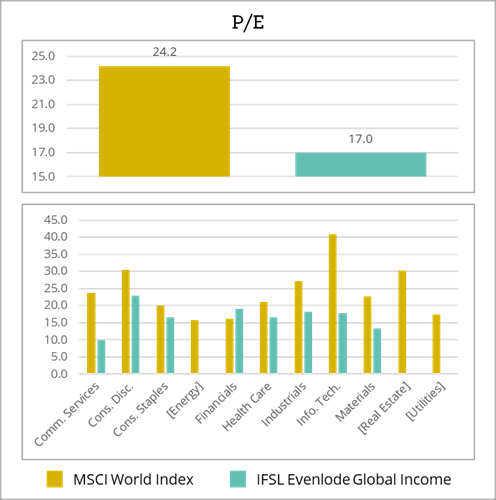

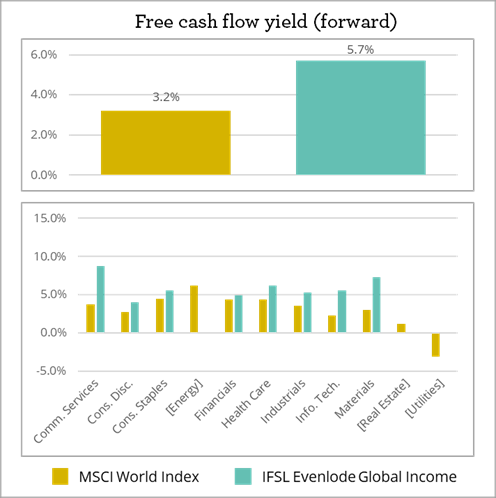

All the same, as it stands the portfolio’s companies have better financial structures to push growth through, and similar or better growth than the market. This should mean these businesses are more expensive to own. The opposite is currently true, and this is highly unusual. The following charts show two valuation measures, the price/earnings multiple[v], and free cash flow yield[vi]. We have shown both the portfolio/market level and individual sector figures in order to highlight that this phenomenon is present across differing areas of the market.

To be able to invest in great companies that are growing well, at attractive valuations on both an absolute and relative basis presents a rare opportunity, but capturing it is requiring patience as investors.

The philosophy behind the Evenlode investment process is quite simple, and as long as returns on capital and growth are maintained in the medium term then the economics will mathematically deliver shareholder value. We have seen that this has continued to be the case for the portfolio, but we don’t take it for granted that businesses stay the same or assume they don’t face disruptive threats. We examine business models in detail and provide some analysis below on a selection of portfolio companies that have performed positively and negatively in market terms over the last year. Whilst not every company will perform as expected in fundamental business terms, we do think that the portfolio is well placed in attractive markets and with strong competitive positions.

We think there are a number of reasons for the disappointing performance. One is that there are certain themes around which there is a current or near future promise of faster revenue growth. Chief amongst these are capital expenditure on artificial intelligence infrastructure, which is a current boom, and defence spending in Europe, which has near-future promise. We don’t dismiss these

themes; portfolio company Microsoft is at the epicentre of the AI race. But as can be the case, the market is putting a great deal of value on the promise, reducing the margin of safety that might account for disappointing results. In this sense the market might be described as risk-ambiguous, or just out-and-out ‘risk-on’ in its current nature.

Another factor that has been explored by market observers is the impact of increasing volumes of capital flowing into passive strategies, i.e. those that track some kind of index, are essentially price insensitive. Without getting into the technical details, we do think that the ‘passivisation’ phenomenon is at the very least a contributory factor to the significant valuation divergences that have been seen in the market. On top of the thematic mood of the market, valuations of some equities and sectors have been stretched to very high levels. Not all businesses have been caught in the updraft though.

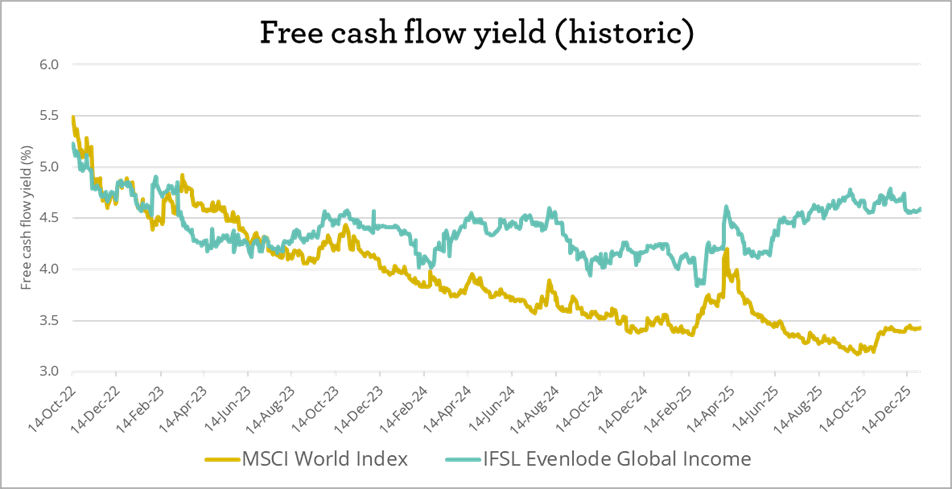

Whatever the reason for market moves, as fundamental investors who do think that corporate valuations matter to expected future returns, we should look to make the most of lofty and depressed valuations if they occur. We can see how the opportunity has developed over time by again looking at free cash flow yield as a measure of value. The chart below shows the recent history of the free cash flow yield for the fund and the market - the amount of excess cash flow you get relative to how much you pay for it. A few years ago they were similar. We thought that made sense and was still good in absolute terms given the qualities of the companies we own. In 2025 you can see the gap has grown to a level that we think does not make sense, and that gap represents the opportunity.

As you would expect, the free cash flow yield for the fund has remained relatively stable throughout as we have managed valuation risk. However, with valuation risk seemingly less important to the broader market, the market has got more expensive. We’ll return to the broader market below, but before that we should look at the portfolio’s market performance and some of its key drivers.

2025 performance

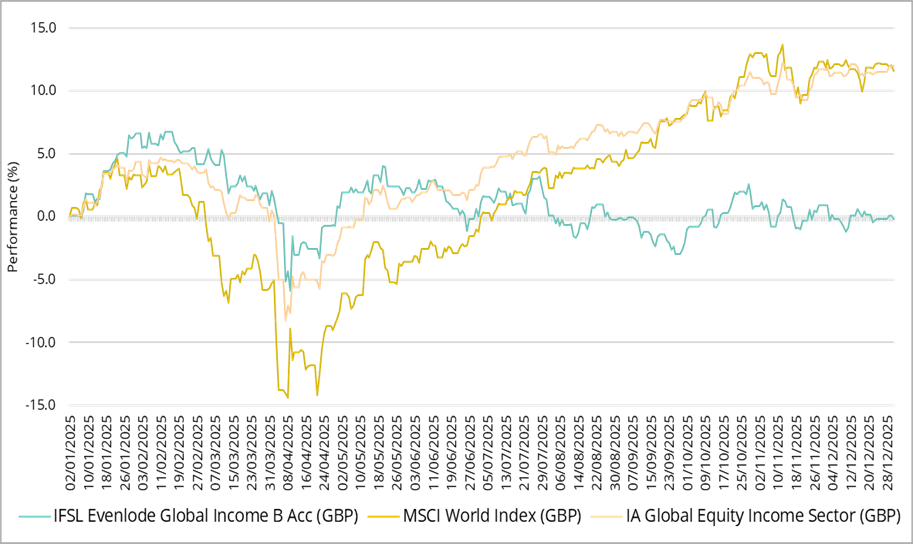

In 2025 the portfolio’s total return was 0% vs 12.8% for the MSCI World Index, the fund’s comparator benchmark. As you can see in the chart below these numbers alone hide what was a rather volatile year for the market.

In the early part of the year - notably before Trump’s Liberation Day in April- the market corrected which we attributed to a reversion of prevailing extended valuation levels. This correction was followed by the tariff announcement which caused a precipitous drop in the market. More importantly US treasury prices also fell, increasing the US government’s refinancing rate for their substantially leveraged balance sheet. This was likely a key factor in causing the president to pause the implementation of tariffs. During this volatile period the fund performed strongly as we would have expected, perhaps hinting that the market’s attitude towards risk had changed.

As it turned out, any shift in risk appetite was short lived. Since the tariff pause the market has been off to the races, driven by those narratives around AI and certain cyclical sectors like defence, heavy industry and banks. Meanwhile the fund has essentially gone nowhere, despite the portfolio companies continuing to churn out revenue, profit and cash flow growth.

AI has been the dominant theme as it has moved from an exciting yet slightly intangible technology into massive real-life capital deployment, extending beyond just technology companies into capital goods, commodity markets, and macroeconomic data. This investment is driving US GDP directly and indirectly, including by a reduction in consumer savings rates encouraged by the strength of US stock markets, driven by AI narratives.

Now capital deployment has begun in earnest, the focus shifts to returns on that capital, who will pay for it and will it be enough? This is a critical but highly uncertain element. Artificial intelligence delivered through large language models is a great technology, and will be used to do great things, but this is a more old-fashioned but no less important question of return on investment.

We see the AI theme coming through as we look at the causes of the difference in performance between the fund and the comparator benchmark. Semiconductor & Semiconductor Equipment was the biggest drag on relative performance in the year, with NVIDIA a 1.5-point headwind on its own. Alphabet was a similar drag in a different sector, Media & Entertainment. The Commercial & Professional Services sub-sector has been out of favour despite solid performance. Wolters Kluwer and RELX have been caught on the other side of the AI trade, with concerns over disruption despite solid trading and the rollout of their own AI-enabled services. Paychex also detracted, its weakness perhaps due to concerns over the health of the US economy. Indeed, unemployment has risen, jobs growth has been poor and questions remain over the solidity of economic growth being reported. The business has proven resilient to previous downturns, notably the Great Financial Crisis. Nonetheless, we factor this cyclicality into a lower maximum position size, but think the valuation is good on a long-term basis (c5% free cash flow yield, c20x P/E, c4% dividend yield).

The improving valuations of these businesses, which have solid fundamentals and defendable competitive positions around them, represent an increasing opportunity in our view. In some cases, the valuations are at levels not seen since the aftermath of the Great Financial Crisis, which certainly surpassed the current time in terms of economic volatility and uncertainty.

Health Care is a sector that has found more favour in the market following some years in the doldrums. Pharmaceutical firms Roche and GSK in particular for us delivered total returns in 2025 of over 40% (GBP terms). These came from a base of lowly expectations, reflected in low valuation multiples. Certain parts of the Consumer Staples sector have also seen a change in sentiment, with health and hygiene firm Reckitt being the top contributor to performance in the year. This is quite a change from the pessimism reflected in the market after a post-covid-era decline in sales of hygiene products and a litigation case in the US. It goes to show that things can, and do, change where the market is concerned. A similar picture is seen at luxury goods giant LVMH, which was another top performer for the portfolio despite the slightly negative top line as noted above. In this case we had built into the position as the stock price weakened significantly in the first half of 2025, which then rallied toward the end of the year. There’s no particular reason why these moves should fit neatly into any twelve-month period, and we are willing to be more patient if the market decides to move over longer time periods as it often does.

Looking forward

To be clear we are making no predictions on what will happen in the short to medium term. However, on the long-term time scales over which equity returns develop, this time is not likely to be different to previous periods of valuation expansion. Ultimately corporate value is about free cash flow, free cash flow growth and the durability of that growth. If valuations have got very high, which we think they have in parts of the market, then history tells us future returns might not match the optimism implied by the price.

Managing risk through choosing companies with competitive advantages, considering their intrinsic value and constructing a diversified portfolio remains critical. An environment where such factors are not being prioritised by the market only makes them more important to the outcomes equity investors can expect. We do not dismiss the big themes of the market, and many portfolio companies are plugged into them. We also have other options in our investable universe that we will invest in when the price makes sense.

Whilst this time might not ultimately be different to previous episodes of high valuations, market structure has shifted and it is not clear what will cause a change in conditions, or when they will change. We will continue to invest where the quality of a company is high and the valuation attractive. It is not currently challenging to create a portfolio of great businesses that are reasonably priced and in fact we think conditions for doing this are highly unusual and bode well for the future. The challenge is sticking to these principles while the excitement flows elsewhere, something we continue to address through our investment process.

Ben Peters and Rob Hannaford

27 January 2026