Last month we reported on the fundamental performance during the pandemic of companies held within the funds managed under the Evenlode Global Income strategy. Since then we have had two big pieces of ‘macro’ news, one uncontrovertibly welcome in the form of promising results on vaccines for coronavirus, and one controversial (at least for the incumbent) in the conclusion of the US presidential race.

Both of these pieces of news flow have long term implications for individuals, economies, and the companies that operate within them. The equity market has bounced around as it has tried to digest and understand the ramifications, with the third quarter corporate reporting season thrown in to provide some business-level interest. As we often say, we can’t control market movements but can use them to our advantage. We can control the companies within the portfolio, biasing towards attractive qualities and deciding whether to pay the prices we are offered.

On the quality front, the third quarter results have given us another chance to assess how things are going on under the bonnet of the portfolio. The second quarter’s acid test in the depths of global lockdown resulted in an 8% revenue decline for the portfolio. In the third quarter revenue was flat . As with the second quarter, this performance was superior to the wider market, which turned in a revenue decline of 6% for the MSCI World according to data from Factset . Whilst we wouldn’t normally put too much store in only 90 or so days of a business’ operations, these are exceptional times. Firms are having to navigate their way through some particularly choppy waters, so it’s worth keeping an extra-keen eye on the direction of travel.

Naturally there are different stories being told by different companies. Examining the revenue performance, we see everything from the very positive such as eBay (quarterly revenue up 25%), and Quest Diagnostics (+43%), to the challenged like recruiter Adecco (-15%) and advertising agency Omnicom (-12%). Where we see very negative performance, we want to also see strength of financing to see things through, and as with the prior quarter those companies made up the smaller part of the portfolio. The majority of companies saw somewhat less exciting changes in their top line, in the single digits either side of zero.

Rotation dynamics

The news of positive vaccine trials was rightly cheered by market participants and prices have rallied, particularly in those companies that had been more impacted by lockdown. Travel and leisure companies soared, while those perceived to have benefitted from lockdown lagged, including eBay, in online retail, and Reckitt Benckiser in home hygiene.

With some quite large moves in share prices, we naturally ask ourselves if market valuations have deviated from those we might reasonably expect from an assessment of the fundamentals. Here we’ll dissect the price changes for clues and view them in the context of the Evenlode investment process. To pre-empt the conclusion, our assessment is that the Global Income portfolio is balancing the qualities and valuation appeal of individual companies, but first let us look at what’s happened in the market.

The recent market move has been dubbed a ‘great rotation’, partly because so-called ‘value’ stocks have not just lagged in the pandemic, but have lagged equity markets ever since the financial crisis. Value stocks are those that look cheap, perhaps on low price-earnings multiples, high yields or some other measure. The pandemic has provided a large number of value options as companies exposed to its effects have seen severe share price falls. Anything that acts as a positive catalyst for these out-of-favour companies has come to be referred to as a ‘value rotation’. Is this what we’re seeing now?

In our view the answer is an equivocal yes and no. Within the Evenlode investment process we have the twin pillars of quality (investing in businesses with attractive cash flows and economics…) and value (…when the price makes sense). What we’re buying matters as much as the price paid. Within the Global Income portfolios we have a spectrum of companies that range from more mature to faster growing, and in terms of the pandemic we have some that have been more exposed and those that have benefited.

Undoubtedly those companies that have fared worst through 2020 have seen the biggest gains since the vaccine announcements. In the three months to the time of writing (16th November 2020) the aforementioned Adecco and Omnicom both saw their share price appreciate by 14%. Event ticketing company CTS Eventim is up 41%. But these companies were the hardest hit beforehand.

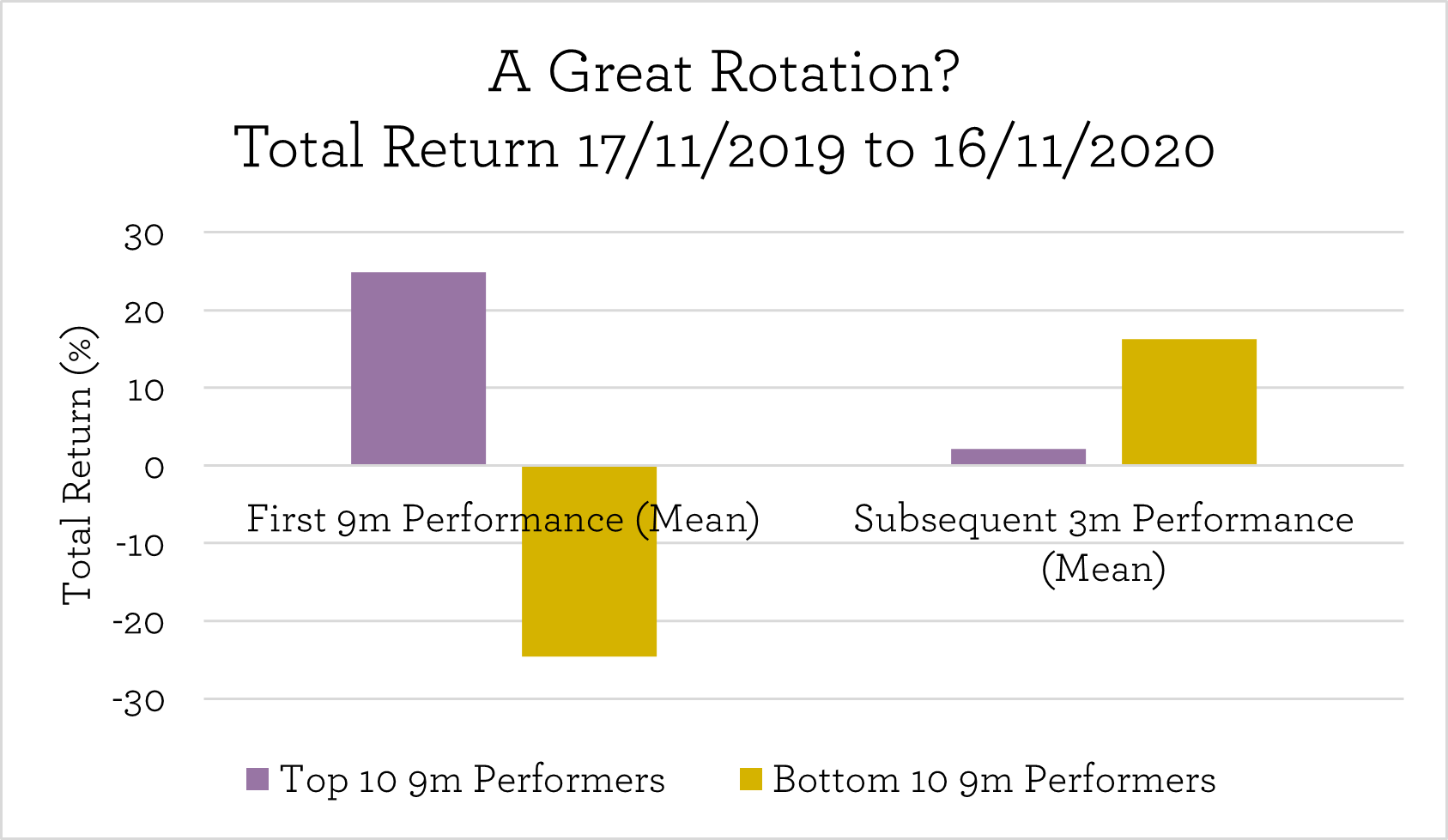

To get a handle on the dynamics of recent share price moves we have divided the prior year to the time of writing into the first nine months, and the last three months, and compared what has happened to share prices in those two periods. In the Evenlode Global Income portfolios the bottom ten performers during the first nine months were down -25% on average, and up +16% in the subsequent three. So yes, there’s been a rotation, but no, it hasn’t made up for the prior losses (not forgetting that these businesses would need to rally by +33% to make up the difference thanks to the maths of compounding).

We see a contrasting picture in the positive performers. The top ten returned +25% on average during the first nine months, and +2% subsequently. So the winners have kept on winning, albeit to a far lesser extent. For the record, eBay was down 14% in the last three months and Reckitt by 9%, but others like Hexagon and Accenture kept on rising. The performance of winning and losing groups is shown on the chart below.

Source: Factset, Evenlode Investment

The stats indicate a noteworthy point. For the portfolio, a hypothetical average company that saw zero return on its shares over the first nine months of the last year would have seen its price increase by over 6% in the last three months . For the MSCI World index this figure is over 9%, burnished by some particularly large winners continuing their upward trajectory like Tesla, Nvidia and Shopify.

What does that mean? In simple terms, the market (and portfolio) has gone up recently across both those companies that had underperformed during the pandemic and those that had performed ok. To put it another way, the stats indicate that the well-worn investment aphorism that ‘a rising tide lifts all boats’ is at play and that it is not only a rebound in ‘value’ stocks driving near term returns.

So, to valuation

All of that brings us on to our investment process ‘pillar’ of valuation. If the average company has been marked up by the market relative to its prospects then it has got more expensive. How have these price movements affected our view of the portfolio?

We look at the valuation of individual companies through a few different lenses at Evenlode, principally through a long-term assessment of the (discounted) free cash flow prospects of the company in question, but also at free cash flow yields in the near term.

Taking the free cash flow yield, looking backwards the fund as a whole yields 5.6%. This is clearly going to change when the final figures are totted up for 2020, and we’re looking at something around a 10% reduction in free cash flow this year, given everything we’ve seen so far. Not great, but relatively resilient and comfortably covering the dividend distribution, which we’re currently expecting to fall by around 13% for the current financial year. This free cash flow cushion is vital for companies as they emerge from this crisis, enabling them to plan, invest, and, ultimately for those who have reduced their payout, re-build dividend distributions to shareholders.

The prospective 5%-plus free cash flow yield compares favourably to the MSCI World’s figure of under 4% and is around the figure we’ve seen in the fund on average to date. We see a similar picture from our discounted cash flow modelling.

Resilient fundamental corporate performance, with decent valuation appeal, are evidence that our twin pillars of quality and value are in place within the portfolio, despite all the ebbing and flowing of the market described above. This is what we aim to achieve with the Evenlode investment strategies in any market, this choppy one included.

Looking back, and forward

As we approach the third anniversary of the Evenlode Global Income fund’s launch we’d like to thank all of our co-investors for your interest and support, particularly through the most unusual recent past. It is a privilege to be managing your and your clients’ capital, and please do get in touch if there’s anything you would like to discuss with us at any time – we look forward to hearing from you soon.

Ben Peters, Chris Elliott and the Evenlode Team

November 2020

Please note, these views represent the opinions of the Evenlode Team as of the 18th November 2020 and do not constitute investment advice.