Back in the Loupe – Asymmetric Risk in France

Referring to political upheaval in France, we wrote in the recent Quarterly Report that ‘we do not think we would be credible or indeed it would be an effective use of time, if we produced a decision tree of probabilities attached to political outcomes, from which policy responses, from which company responses and made macro-based decisions this way’. Hence, we focus on stock specific opportunities.

One new holding thrown up by the recent political turmoil is Trigano, the European market leader in motorhomes. Trigano is an excellent case study of a successful family run business which has steadily grown and consolidated its leadership position in a sector which takes its investment case from an ageing population and the desire for both outdoor and more flexible holiday pursuits.

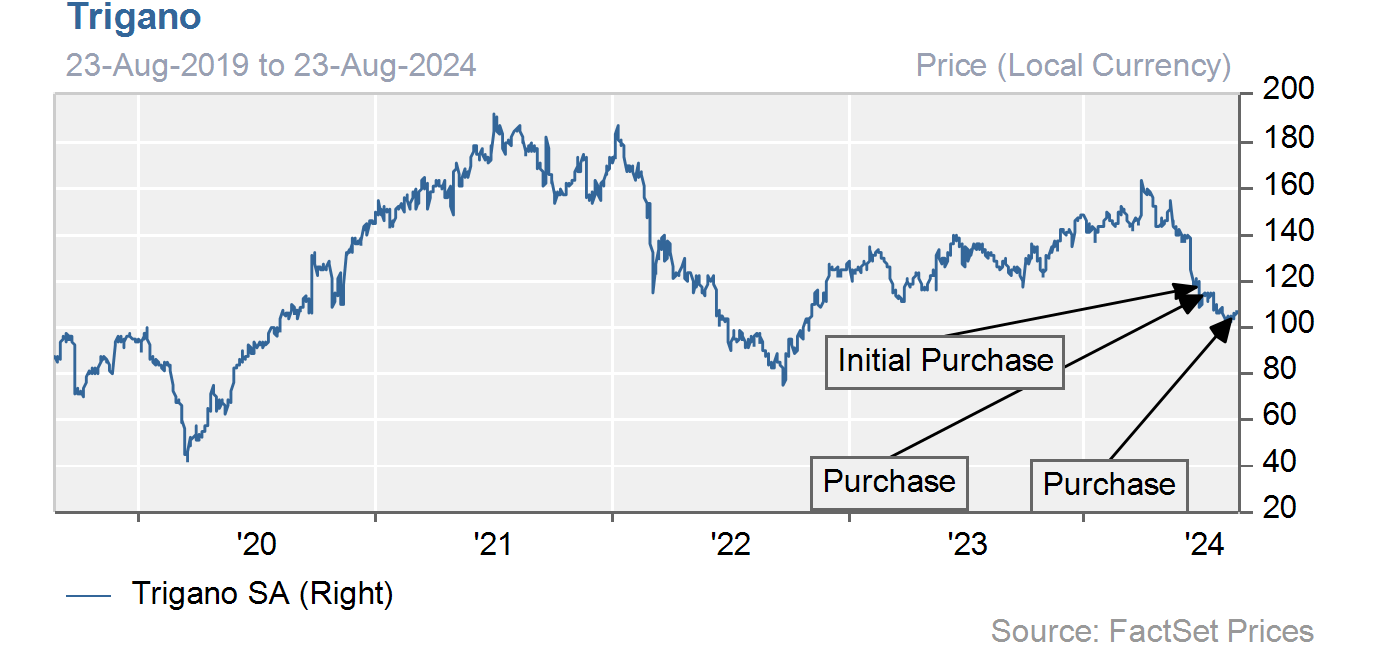

We have tracked the company for a while and the current political paralysis has thrown up what we consider a decent buying opportunity. Note that our inability to perfectly time means that tactically we average our way in over a period:

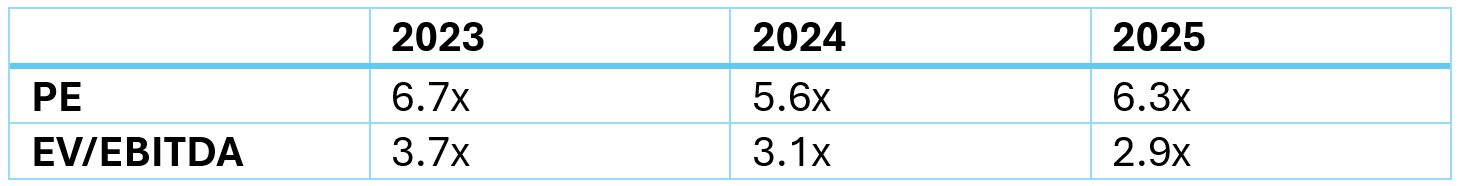

Shares discount a very gloomy future for the company as follows:

Source: FactSet (consensus), Chelverton Asset Management as at 26/8/24

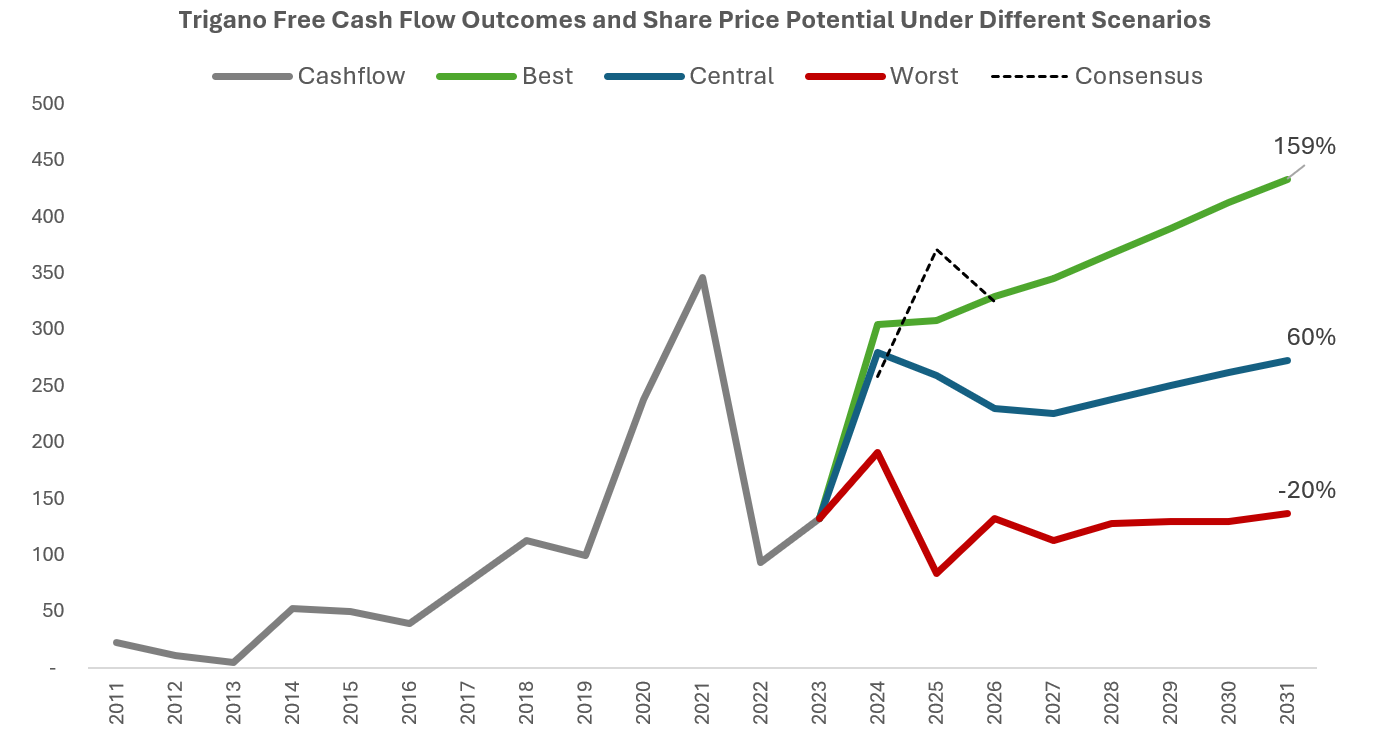

Our own in-depth work shows what we think to be an attractive, i.e. asymmetric, risk/reward profile:

Source: Chelverton Asset Management as at 26/8/24. For broader discussion of our use of these metrics please see In the Loupe entry from 15/1/2019

The perception of Trigano is as a consumer cyclical with violent swings in profitability and cash flow. We think both the sector and the company are better than this.

We have had a break from our regular diary posts as we figured out how best to communicate regularly with professional investors. We tried to ‘beef up’ the Quarterly Report with more analysis rather than just factual reporting on the quarter (all historical reports can be found on the left hand side of this page). Nonetheless, we think ‘little and often’ is the better strategy and so with this entry, we re-boot the diary, noting the re-branding from our marketing intermediary, Spring Capital, to ‘In the Loupe.’

Feedback on content is always welcome.